tax code 180 Expenditures By Farmers For Fertilizer Etc I R C 180 a In General A taxpayer engaged in the business of farming may elect to treat as expenses which are not

We re interested in statute IRC 180 expenditures by a farmer for fertilizer etc This code explains that a taxpayer engaged in the business of farming can annually choose to treat expenses such as the IRC 180 allows a taxpayer engaged in the trade or business of farming to annually elect by deducting the expense on the return the cost of fertilizer lime potash

tax code 180

tax code 180

https://assets-global.website-files.com/5e5e0a963f2bf9d0d9d31e01/617c1ff9b7f9c113e5bff755_Suretax-Tax-Codes---Explained.jpg

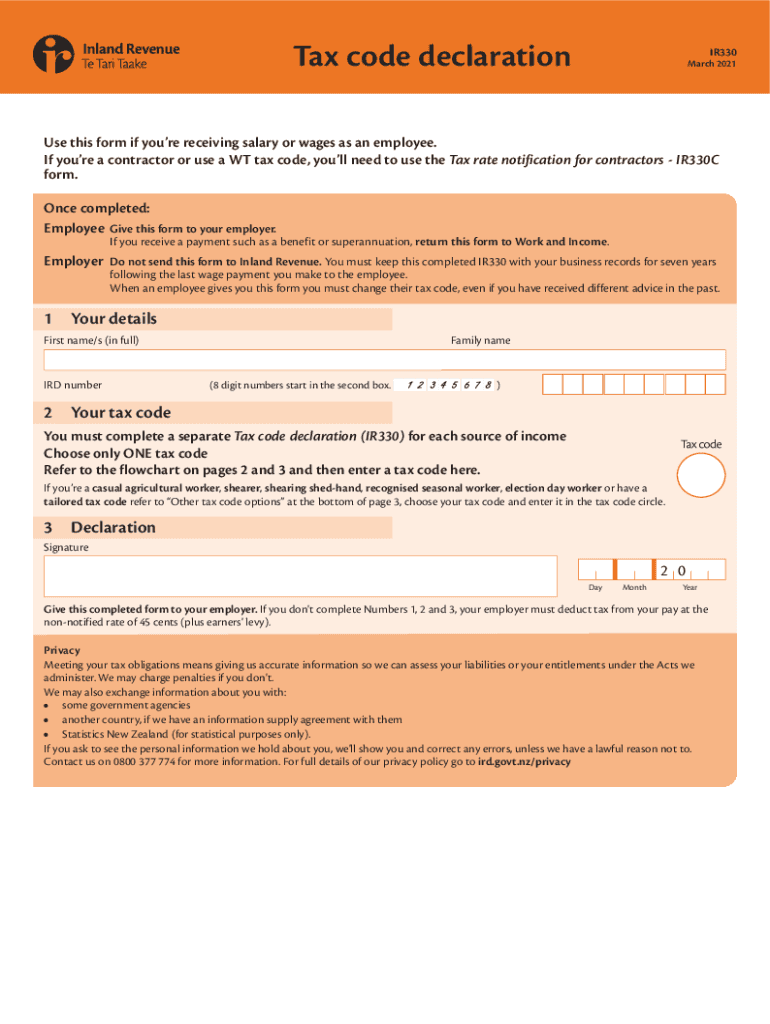

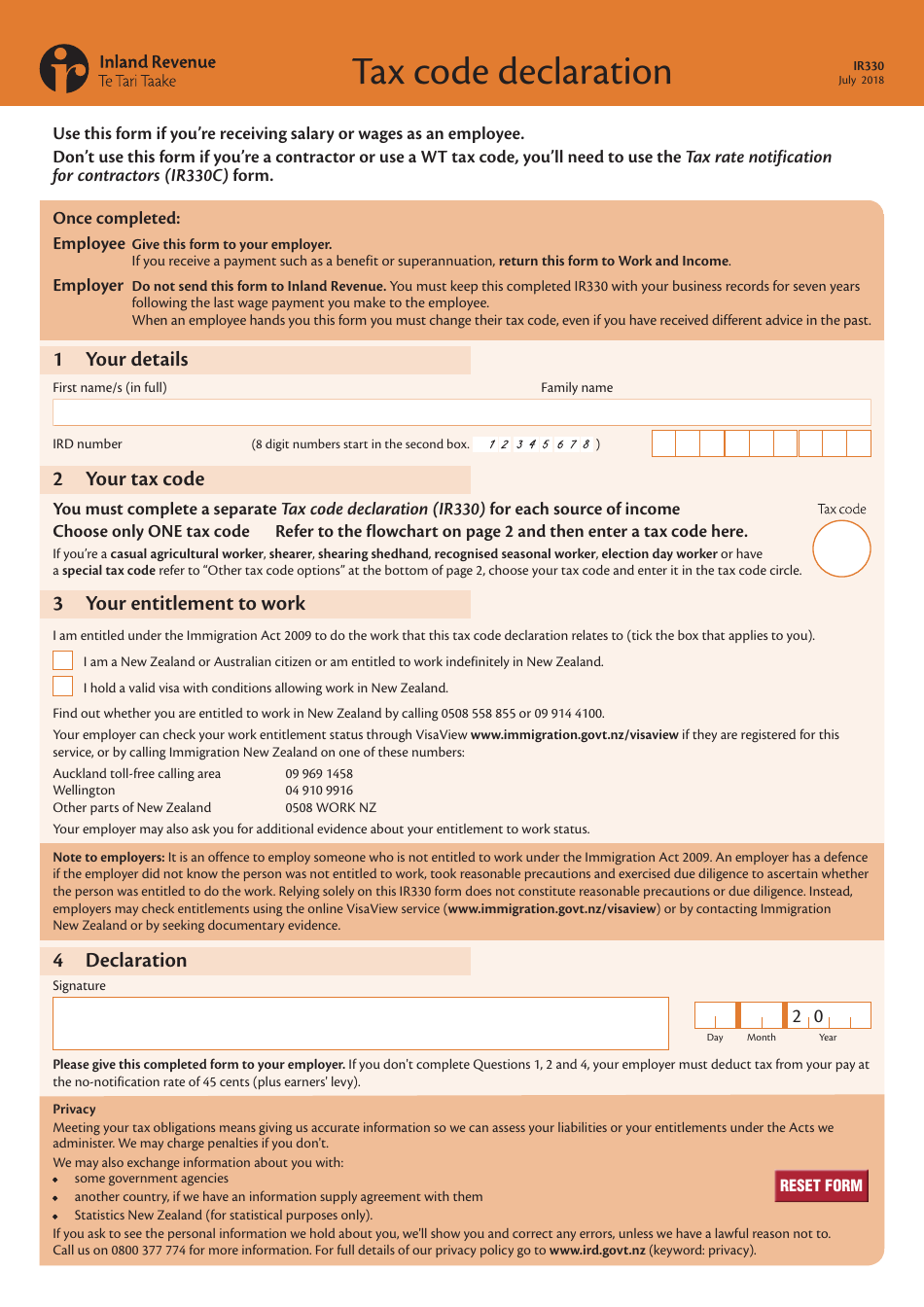

Ir330 Form Fill Out And Sign Printable PDF Template AirSlate SignNow

https://www.signnow.com/preview/572/207/572207136/large.png

What Is A BR Tax Code

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Tax-Code-BR.jpg

With recent land purchases some are asking questions to learn more about IRS Section 180 and how it may provide tax deductions in the year of purchase Let s The power to interpret the provisions of this Code and other tax laws shall be under the exclusive and original jurisdiction of the Commissioner subject to review by the

A taxpayer engaged in the business of farming may elect to treat as expenses which are not chargeable to capital account expenditures otherwise chargeable to capital account Section 180 Expenditures by farmers for fertilizer etc a In general A taxpayer engaged in the business of farming may elect to treat as expenses which are

More picture related to tax code 180

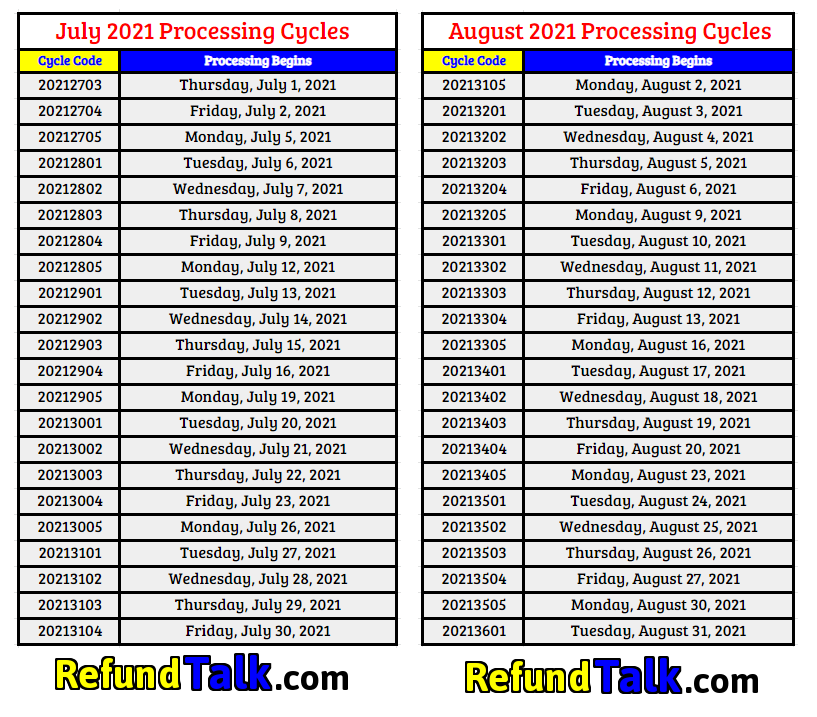

Tax Chart 2021 Irs Latest News Update

https://refundtalk.com/wp-content/uploads/2021/01/july.august-21-1.png

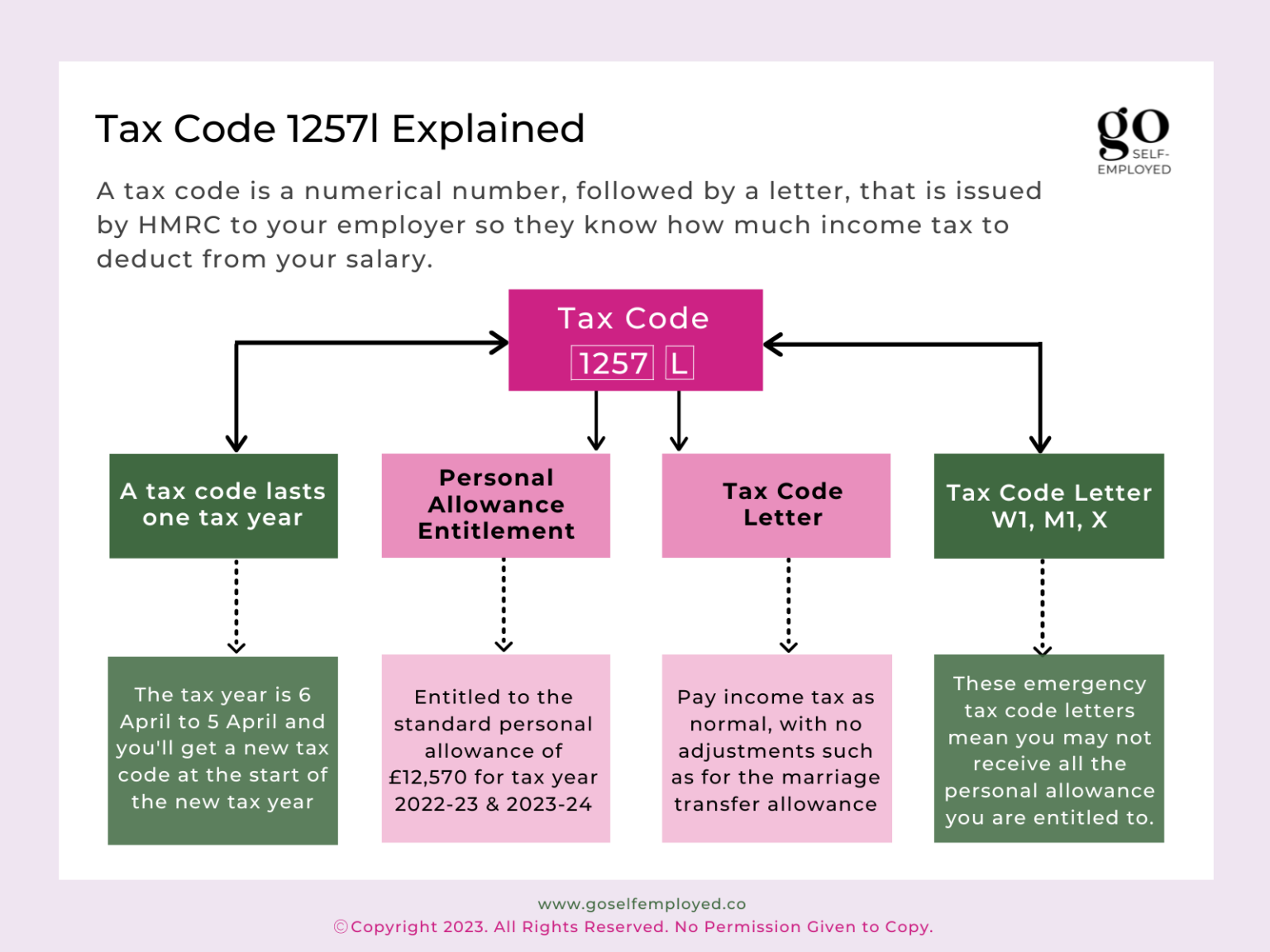

1257l Tax Code Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/01/1257l-Tax-Code-1536x1152.png

Understanding The New Tax Code

https://static.fmgsuite.com/media/images/5bb910d4-47f9-4772-99b2-e2ceb93c0bff.jpg?v=1

Sec 180 Expenditures by farmers for fertilizer etc Internal Revenue Code of 1986 SUBTITLE A INCOME TAXES Chapter 1 Normal Taxes and Surtaxes Subchapter Internal Revenue Code 180 Expenditures by farmers for fertilizer etc Current as of January 01 2024 Updated by FindLaw Staff a In general

This article examines IRS tax code 180 and the ways that landowners can use it to claim depreciation on their soil Learn more here IRS Code Section 180 is an opportunity to realize the value of fertilizer nutrients in the soil at time of acquisition by purchase or inheritance This residual fertilizer supply can be

Form IR330 Fill Out Sign Online And Download Fillable PDF New

https://data.templateroller.com/pdf_docs_html/1728/17289/1728951/form-ir-330-tax-code-declaration_print_big.png

Political Calculations 2011 The Number Of Pages In The U S Tax Code

https://4.bp.blogspot.com/-vefjI5r2lt4/Tg3TjmFeNXI/AAAAAAAAENQ/ndZQecRf9vY/s1600/2011-cch-std-fed-tax-reporter-number-of-pages-us-tax-code.png

tax code 180 - Section 180 Expenditures by farmers for fertilizer etc a In general A taxpayer engaged in the business of farming may elect to treat as expenses which are