tax code 18t Tax code 0T means your allowances have been used up or reduced to nil and your income is taxed at the relevant tax rates what does that mean o I have 1

Tax codes are used in the UK to identify how much income tax an employee should be paying The code tells the employer how much tax to deduct A tax code is a code issued to you by HMRC that tells your employer or pension provider the correct amount of tax to deduct from your income The tax code is

tax code 18t

tax code 18t

https://assets-global.website-files.com/5e5e0a963f2bf9d0d9d31e01/617c1ff9b7f9c113e5bff755_Suretax-Tax-Codes---Explained.jpg

Obama s Budget Shows That The U S Tax Code Is A Travesty The New Yorker

https://media.newyorker.com/photos/5909667a2179605b11ad62e9/16:9/w_1280,c_limit/Cassidy-Tax-Code.jpg

Political Calculations 2011 The Number Of Pages In The U S Tax Code

https://4.bp.blogspot.com/-vefjI5r2lt4/Tg3TjmFeNXI/AAAAAAAAENQ/ndZQecRf9vY/s1600/2011-cch-std-fed-tax-reporter-number-of-pages-us-tax-code.png

In the UK we have a list of tax codes that determine how much money you have to hand back to the taxman each year Here s how to check you re paying the right TIN Tax Identification Number is a code number that identifies the taxpayer Finnish taxpayers do not have a TIN Instead the personal identity code is the

Depending on which box the employee ticked HMRC s rules dictate which tax code should be used in each case The Payroll Site will choose the correct tax code when you use L You re entitled to a tax free personal allowance For those earning under 100 000 with no taxable perks such as a company car this should be 12 570 for

More picture related to tax code 18t

K Tax Code Explained What To Do If It s Wrong

https://goselfemployed.co/wp-content/uploads/2021/04/tax-code-k.png

Tax Code Changes May Be On The Horizon Kennan Law Offices Cape Cod

https://www.estateplanningcapecod.com/wp-content/uploads/2021/03/18124-Tax.jpg

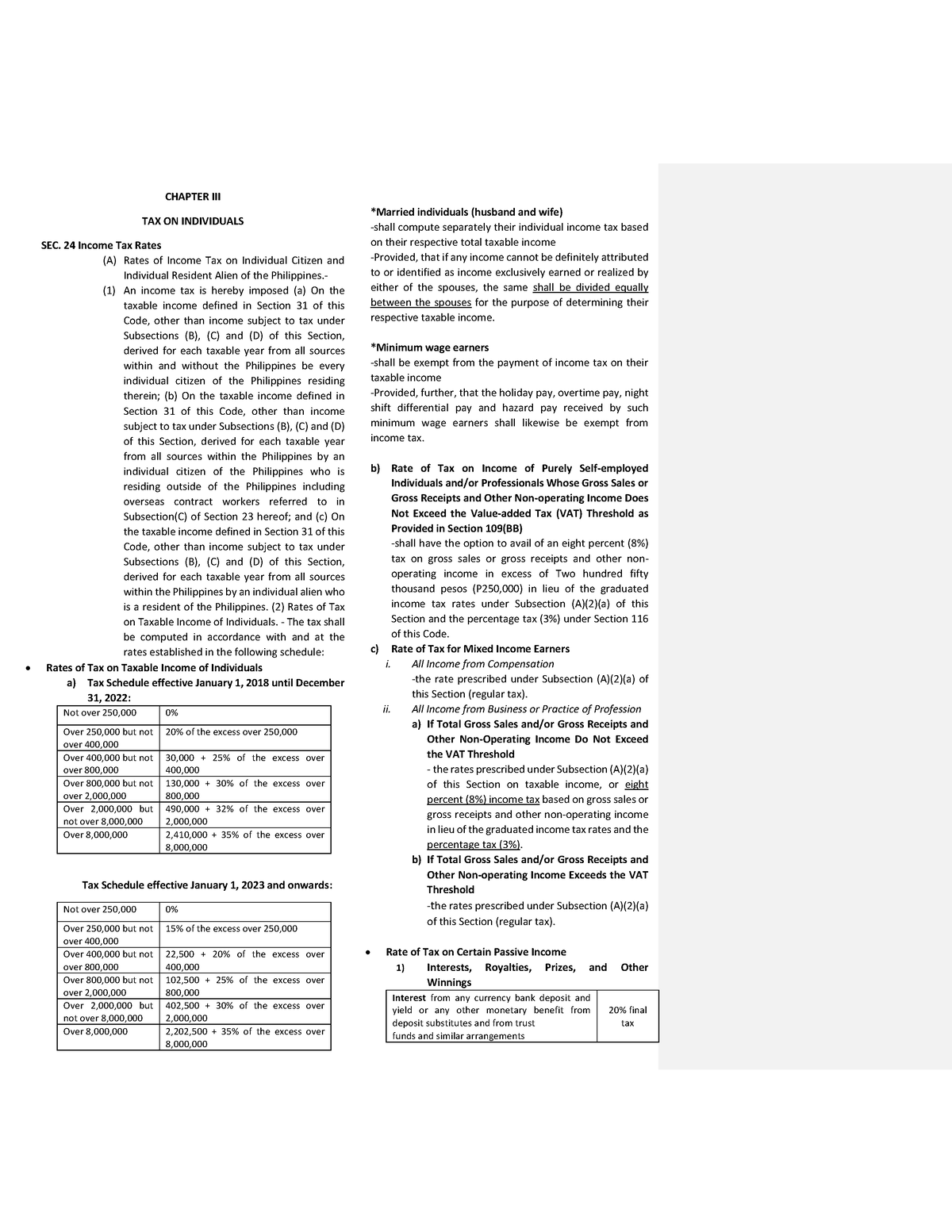

TAX CODE Summary CHAPTER III TAX ON INDIVIDUALS SEC 24 Income Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/931f688ab519b9279df08bda96cd3450/thumb_1200_1553.png

182T is equivalent to a personal allowance of 1829 and is generally appropriate to a second job or source of income with the remainder of the allowances Tax liabilities Income tax VAT Obligations of a foreign employer Foreign leasing corporations Tax at source on trade income Tax at source on dividend interest and

All PAYE tax codes are comprised of numbers and a letter for instance 1257L This particular code is the most common in the UK and is used when has one Each income you have jobs private pensions will have a different tax code Remember to check them all Here are the best places to look for your tax code s

Broken Tax Code Legalities

https://image.cnbcfm.com/api/v1/image/103537941-2ED1-PL-US-TAX-REFORM-041116.jpg?v=1529471211&w=1920&h=1080

USE THE TAX CODE TO MAKE BUSINESS LOSS LESS PAINFUL Aldridge Borden

https://www.aldridgeborden.com/wp-content/uploads/2023/05/tax-code-copy-scaled.jpg

tax code 18t - What the letters mean Changes during the tax year Updating for the new tax year What the letters mean Letters in an employee s tax code refer to their situation and how it