basel 1 2 3 summary Basel I is a set of international banking regulations established by the Basel Committee on Banking Supervision BCBS It prescribes minimum capital requirements for financial institutions

The Basel III framework is a central element of the Basel Committee s response to the global financial crisis It addresses a number of shortcomings in the pre crisis regulatory framework and provides a foundation for a resilient banking system that will help avoid the build up of systemic vulnerabilities Basel Accords are a set of agreements that benchmarked banking regulations and credit policies followed by banks and financial institutions worldwide The Basel Committee on Banking Supervision was established in 1974 Consequently Basel accords I II and III were released in 1988 2004 and 2010 Each accord added

basel 1 2 3 summary

basel 1 2 3 summary

https://qph.fs.quoracdn.net/main-qimg-181ebb7d35da249d046dfbd68705dd70-c

Banking Regulation And The Benefits Of International Cooperation

https://theindustryspread.com/wp-content/uploads/2019/02/basel3_sum_1.png

Basel II And Basel III Norms All That You Need To Know BankExamsToday

https://3.bp.blogspot.com/-Gh7jeS_Bq0Y/VGByCiuz4_I/AAAAAAAAD7U/wTz6imSdcaI/s1600/Basel_norms_explained.jpg

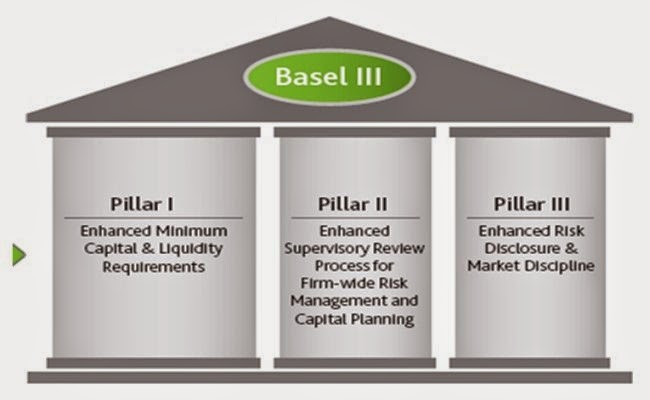

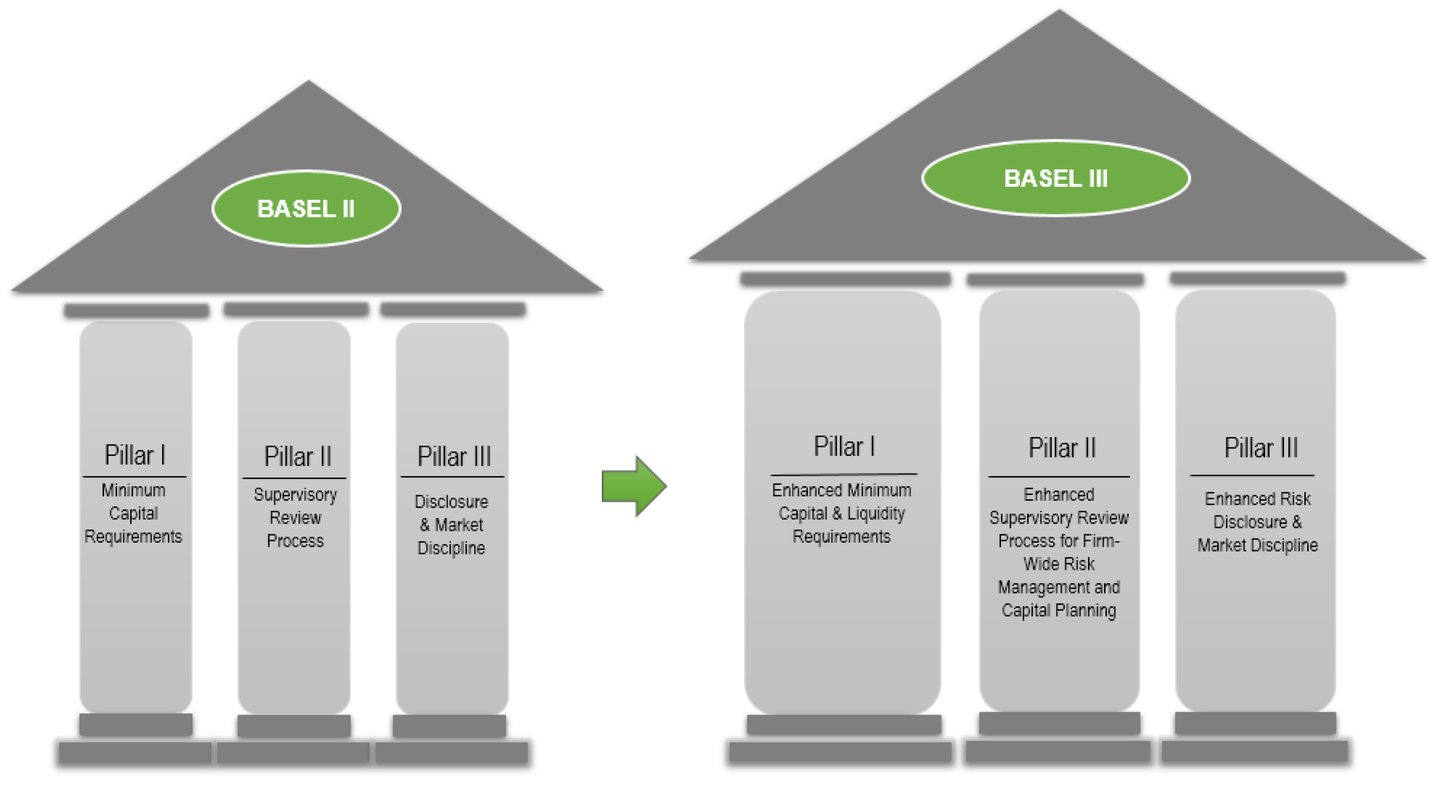

Here is a Basel III summary of the changes and Basel III capital requirements bringing a closer look at the difference between Basel 2 and Basel 3 namely higher standards overall for commercial banks The Basel Framework is the full set of standards of the Basel Committee on Banking Supervision BCBS which is the primary global standard setter for the prudential regulation of banks

Basel I the Basel Capital Accord Basel II the new capital framework Basel III responding to the 2007 09 financial crisis At a glance 1 Adoption of Banking Standards among Non Basel Committee Members 13 2 Comparison of Basel II and Basel III Capital Requirements 15 3 Possible Priority for Implementation of Basel Prudential Standards 33 Boxes 1

More picture related to basel 1 2 3 summary

Basel Norms Basel 1 Basel 2 Basel 3 JAIIB 2020 PPB Adda247

https://i.ytimg.com/vi/YdA5tn83g4c/maxresdefault.jpg

.png)

Temps Subjectif Fracture Rwa Bale 2 Sant Merveille Sp cificit

http://www.gtrisk.com/Basel_III_files/net cash outflows).png

Basel II What Is It Pillars Vs Basel III Objectives

https://www.wallstreetmojo.com/wp-content/uploads/2020/06/Basel-II.jpg

The Basel I Accord was the outcome of a round of consultations and deliberations by central bankers from around the world which resulted in the publishing by the BCBS of a set of minimum capital requirements for banks This is also known as the 1988 Basel Accord and was enforced by law in the Group of Ten G 10 countries in 1992 Basel 1 was created by the International Basel Committee on Bank Supervision BCBS in 1988 in Basel Switzerland as a series of guidelines to regulate the banking sector in a country that specified particular measures to reduce credit risk exposed by any institution

[desc-10] [desc-11]

III

https://pic3.zhimg.com/v2-80cc30be20e3aa96dd8e540c2de149b3_1440w.jpg?source=172ae18b

What Are BASEL 1 2 And 3 Norms What Are The Basic Differences Between

https://qph.fs.quoracdn.net/main-qimg-3637a36233e76f26b626f20667863d30

basel 1 2 3 summary - Basel I the Basel Capital Accord Basel II the new capital framework Basel III responding to the 2007 09 financial crisis At a glance