basel 1 2 3 4 summary Here we explain their history capital requirements and the three main basel accords

The Basel Framework is the full set of standards of the Basel Committee on Banking Supervision BCBS which is the primary global standard setter for the The Basel Accords were formed with the goal of creating an international regulatory framework for managing credit risk and market risk Their key function is to ensure that banks hold enough cash reserves to meet their

basel 1 2 3 4 summary

basel 1 2 3 4 summary

https://ebrary.net/imag/bef/faur_bankint/image032.jpg

A Recap Of The Basel IV Regulation And It s Timeline

https://morssoftware.com/wp-content/uploads/2022/07/Basel-Timeline-1024x508.png

Figure I From From Basel I To Basel II To Basel III Semantic Scholar

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/2502f4a9e7be6f6446d380a1c8a959200d0207d1/5-FigureI-1.png

Basel I is a set of international bank regulations that established minimum capital reserve requirements for financial institutions Short term exposures

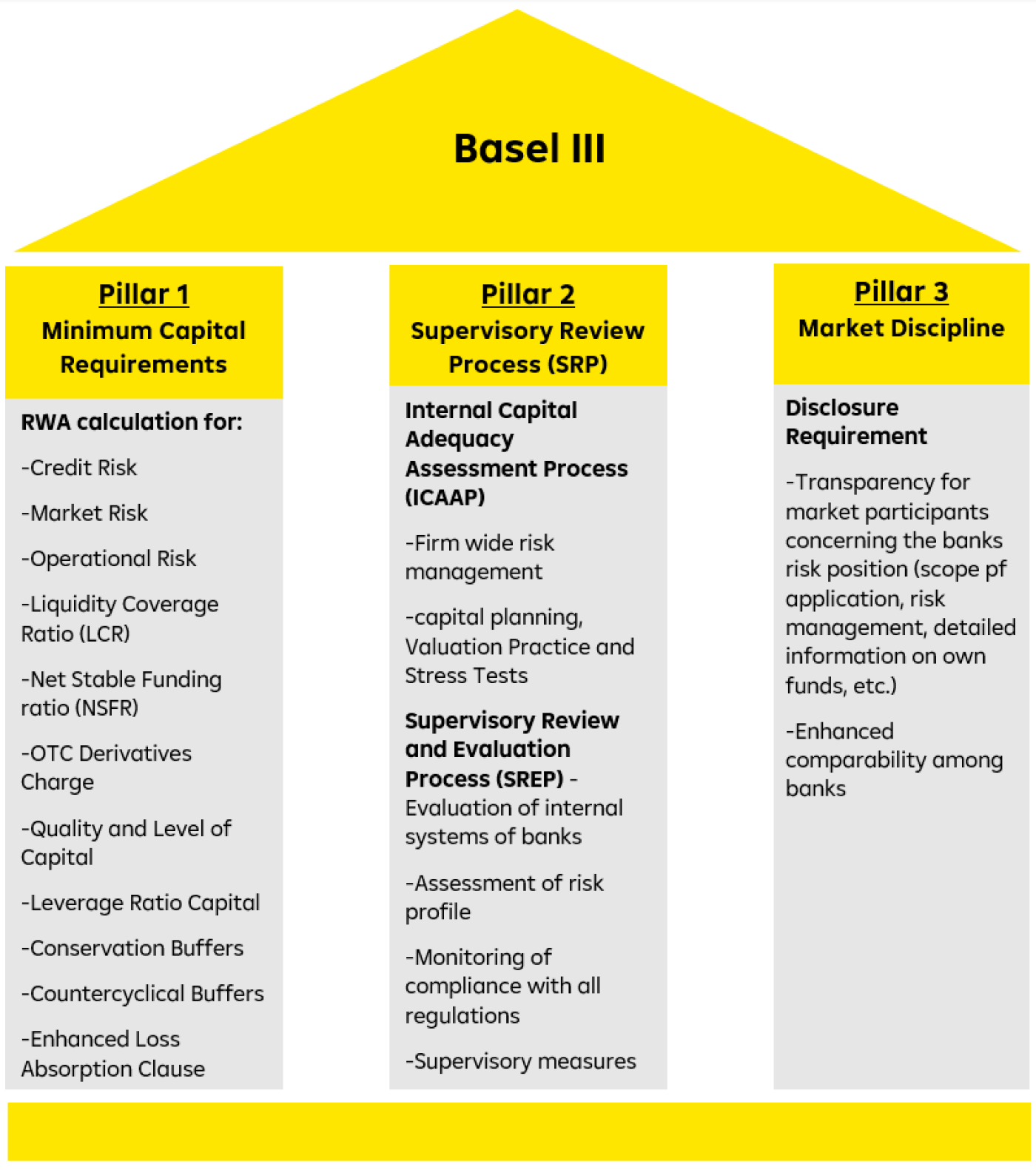

Introduction Richard Barfield 1 1 Overview 1 2 For whom is the Guide intended 1 3 Overview of the reform agenda 1 4 The players 1 5 A brief history of Basel 1 6 Basel III in a nutshell 1 7 While Basel II focused primarily on the amount of capital the banks held and how they managed risk Basel III included new rules on liquidity leverage and systemic risk factors

More picture related to basel 1 2 3 4 summary

BASEL Norms Explained In Hindi Basel 1 Basel 2 Basel 3 Difference

https://i.ytimg.com/vi/dvghsvk7QjU/maxresdefault.jpg

Basel II What Is It Pillars Vs Basel III Objectives

https://www.wallstreetmojo.com/wp-content/uploads/2020/06/Basel-II.jpg

Basel III Basel IV Eigenkapitalvorschriften F r Banken GeVestor

https://static.gevestor.de/wp-content/uploads/2021/11/basel-i-ii.png

The implementation date for the final Basel III reforms was extended by six months to 1 July 2025 while the transitional period was reduced by six months to 4 5 years in order not to delay the full implementation The Basel Committee on Banking Supervision BCBS officially unveiled the new recommendations for setting the capital requirements for the banking sector commonly dubbed Basel IV in December last year

In 2017 the Basel Committee agreed on changes to the global capital requirements as part of finalising Basel III The changes are so comprehensive that they are increasingly seen as an Under Basel 3 banks would be mandated to maintain healthier amounts of true capital

What Are BASEL 1 2 And 3 Norms What Are The Basic Differences Between

https://qph.fs.quoracdn.net/main-qimg-181ebb7d35da249d046dfbd68705dd70-c

Basel III

https://bank.rbinternational.com/content/dam/rbi/marketing/ww/regulatory-fastlane/images/Basel 3.png.transform.rbifw.png

basel 1 2 3 4 summary - Basel I was primarily focused on Credit Risk and Risk Weighted Assets RWA In order to offset risk banks with an international presence were required to hold capital which was classified