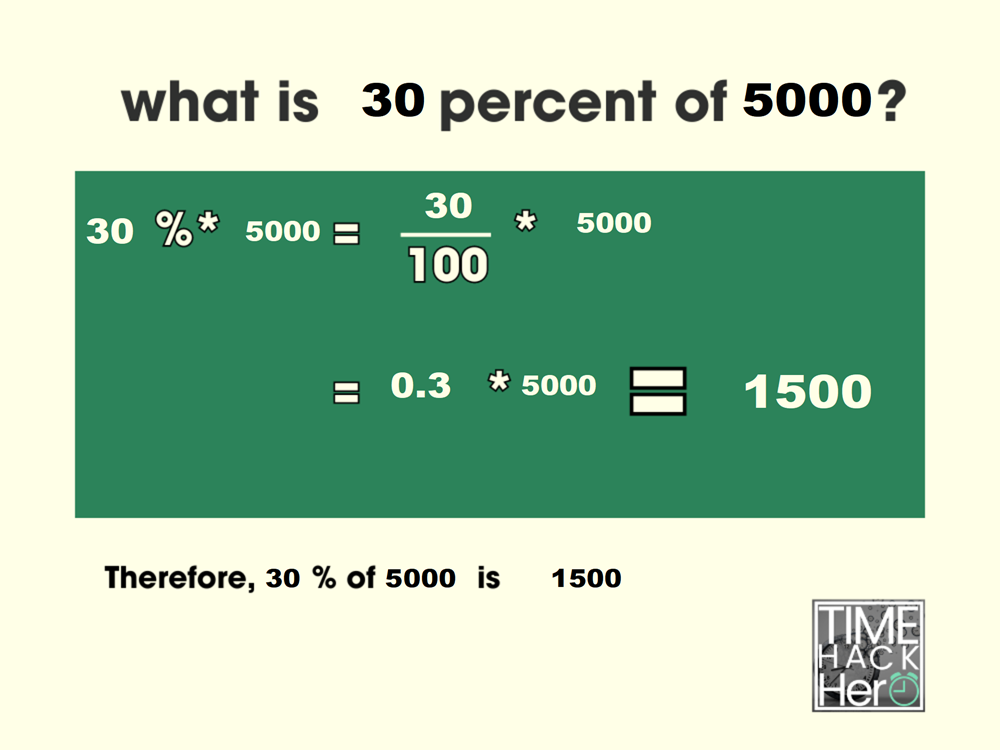

30 percent of 2500 credit limit Your credit utilization comprises about 30 of your total credit score This credit utilization ratio calculator will tell you how much you re using

Your credit utilization ratio is how much you owe on all your revolving accounts such as credit cards compared with your total available You can best manage your credit utilization by keeping your credit card balances below 30 of the credit limit But the lower the better According to Experian one of the three major credit bureaus the average credit utilization

30 percent of 2500 credit limit

30 percent of 2500 credit limit

https://timehackhero.com/wp-content/uploads/2024/01/What-is-30-Percent-of-5000-1500-With-2-Solutions.png

Capital One QUICKSILVER Credit Limit Increase How To Request And Get

https://i.ytimg.com/vi/DbKcD46op0M/maxresdefault.jpg

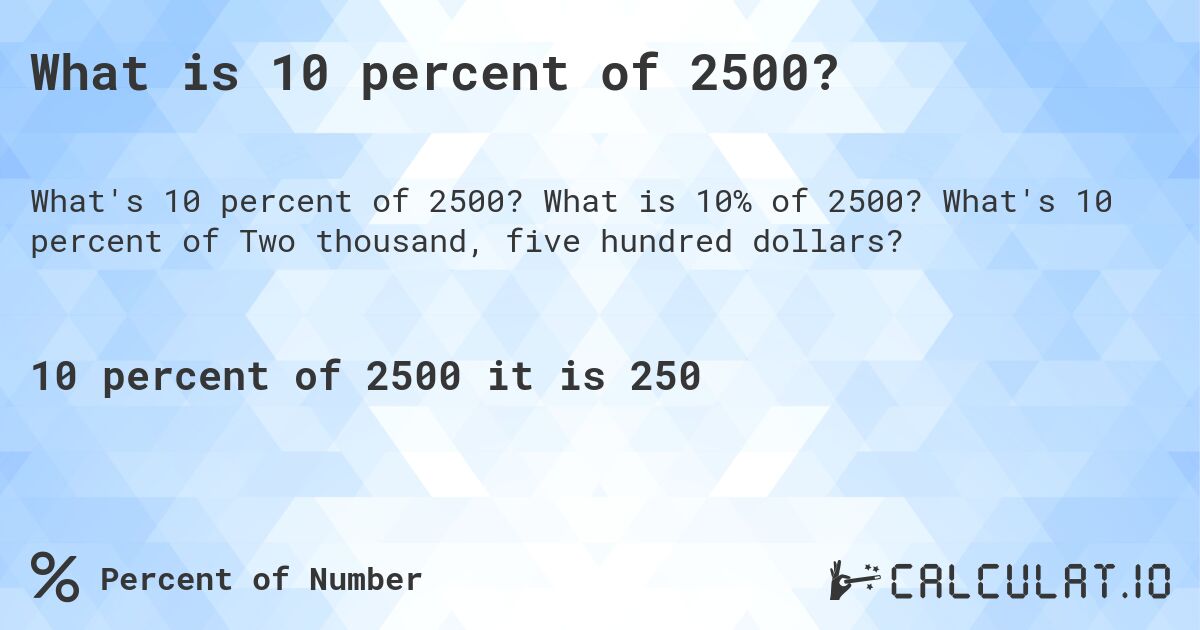

What Is 10 Percent Of 2500 Calculatio

https://calculat.io/en/number/percent-of/10--2500/generated.jpg

Learn how to calculate your credit utilization ratio a key factor in your credit score and how to keep it below 30 percent to maintain good credit Find out how to lower your utilization by How much of your credit should you use Experts advise using no more than 30 of your credit card limits to keep your credit utilization down and lower is better

Calculate your credit utilization ratio the percentage of your available credit you re using and learn how to improve it Find out how credit utilization affects your credit score and what you Learn what credit utilization ratio is how it affects your credit score and how to lower it A good credit utilization ratio is under 30 of your total available credit

More picture related to 30 percent of 2500 credit limit

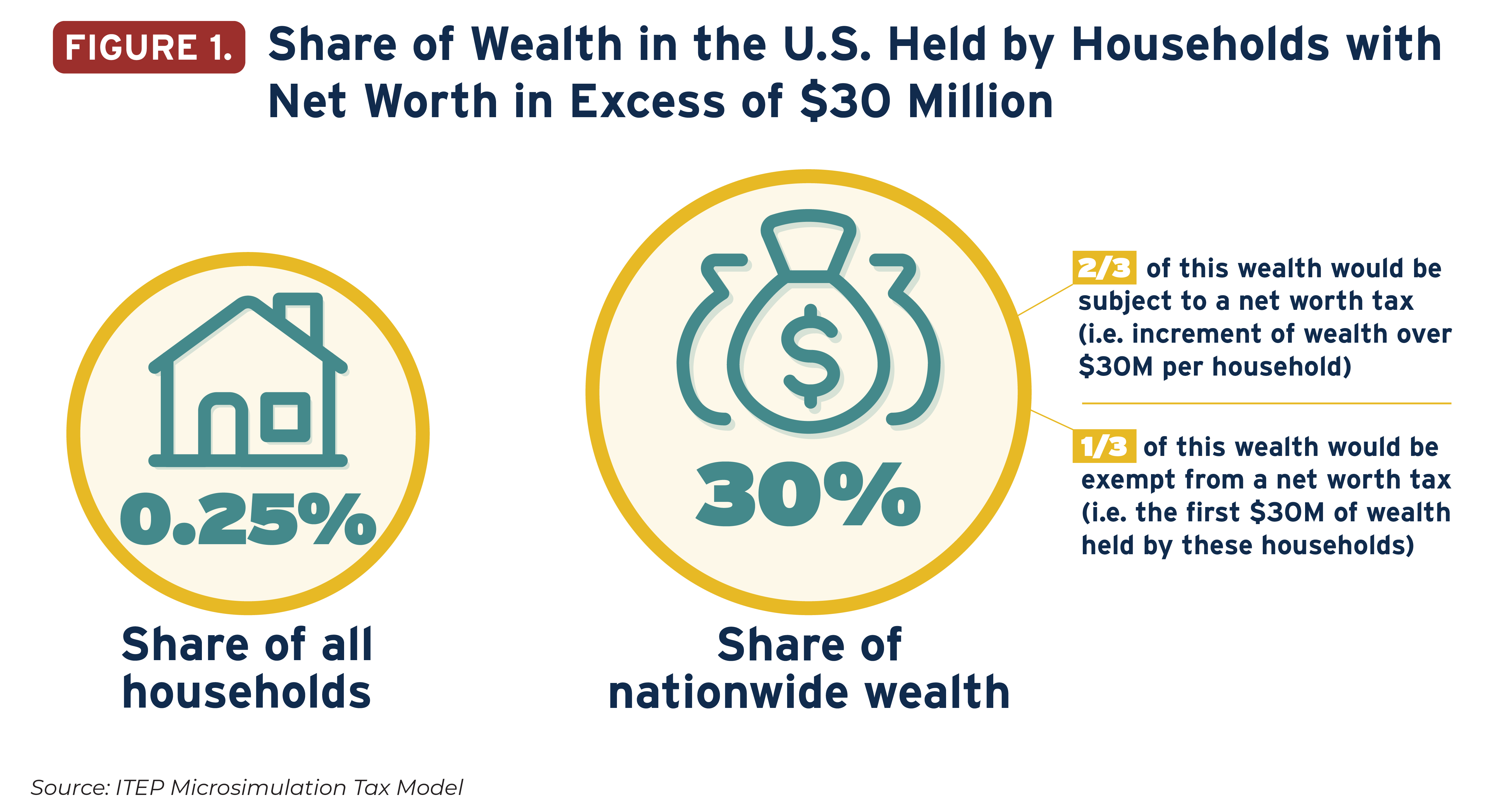

The Geographic Distribution Of Extreme Wealth In The U S 2023

https://itep.sfo2.digitaloceanspaces.com/Figure-1-Share-of-Wealth-in-the-U.S.-Held-by-Households-with-Net-Worth-in-Excess-of-30-Million.png

What Is 10 Percent Of 2500 Calculatio

https://calculat.io/en/number/percent-of/10--2500/generated-og.png

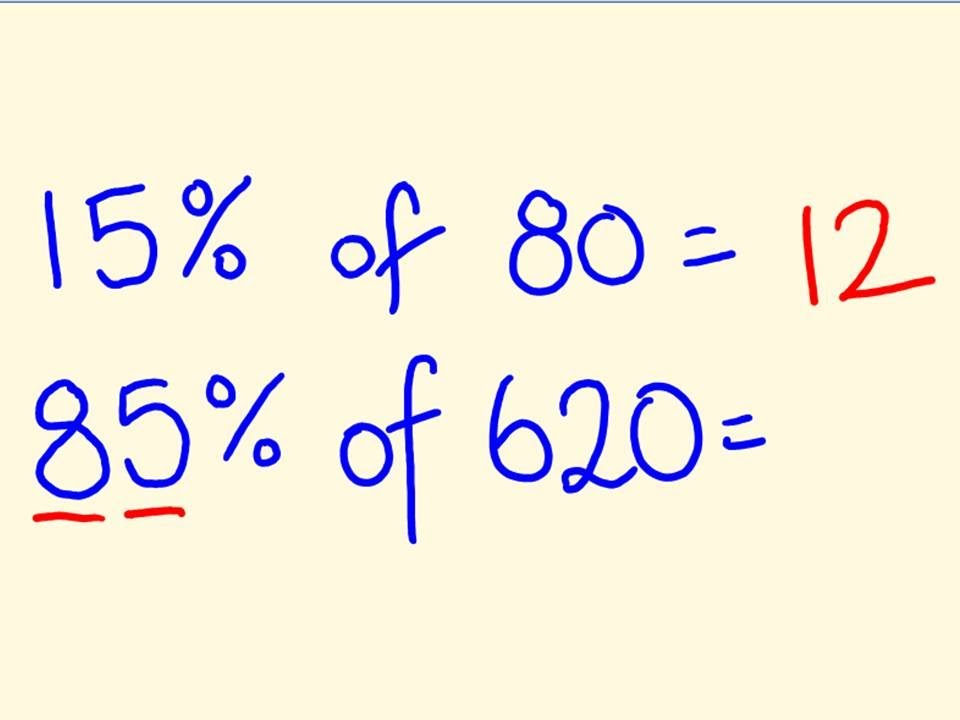

How To Calculate Percentage Quickly In Mind Haiper

http://i.ytimg.com/vi/YWHx0RsRNzI/maxresdefault.jpg

Your credit utilization ratio is the percentage of your available credit that you actually use This ratio accounts for 30 of your credit score calculation and tells your future Your credit utilization ratio is a measure of how much credit you ve used versus how much credit you have typically expressed as a percentage In general having a lower credit utilization ratio is better for your credit scores

You should aim to use no more than 30 of your credit limit at any given time Allowing your credit utilization ratio to rise above this may result in a temporary dip in your score Keeping your credit utilization below 30 protects your credit score But if you want to boost your score as much as you can keep your ratio under 10 FICO scores range from

RBI Issued Draft Circular On Declaration Of Dividend By NBFCs

https://www.gkseries.com/blog/wp-content/uploads/2020/12/RBI-issued-draft-circular-on-declaration-of-dividend-by-NBFCs-2048x1528.jpg

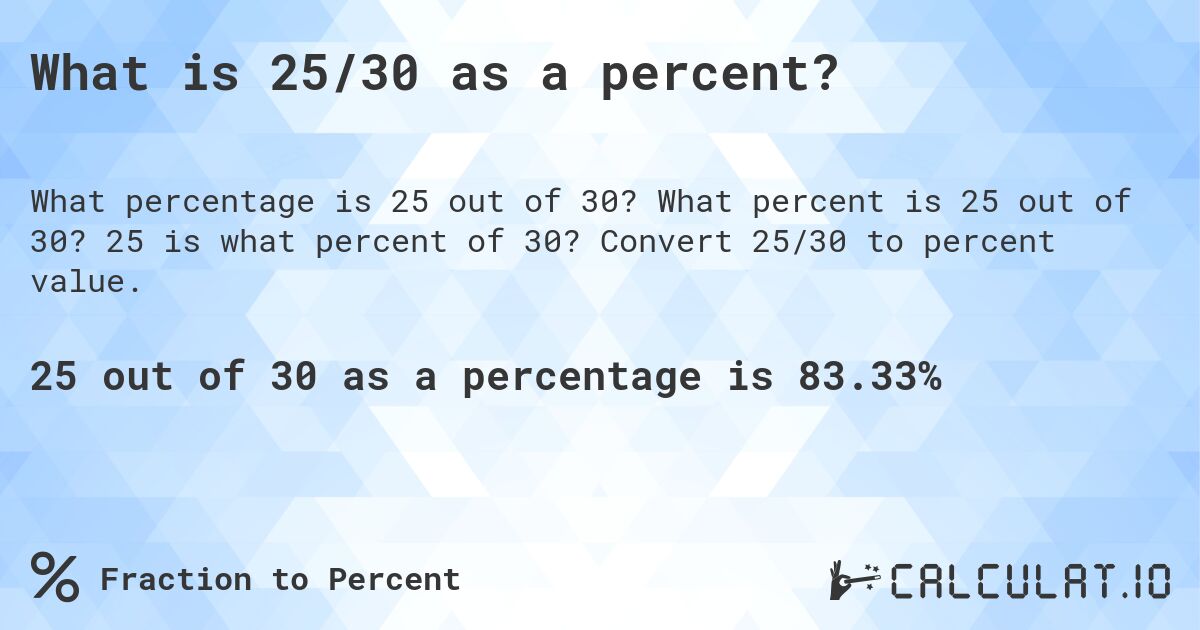

What Is 25 30 As A Percent Calculatio

https://calculat.io/en/number/percentage/25--30/generated.jpg

30 percent of 2500 credit limit - Learn what credit utilization ratio is how it affects your credit score and how to lower it A good credit utilization ratio is under 30 of your total available credit