what is 30 of 2500 credit limit Your credit utilization ratio is the amount you owe across your credit cards and other revolving credit lines compared to your total available credit expressed as

We advise using no more than 30 of your limit overall and on each individual card to maintain healthy credit Lenders will likely consider those who have too much credit utilization as You can best manage your credit utilization by keeping your credit card balances below 30 of the credit limit But the lower the better According to Experian one of the three major credit bureaus the

what is 30 of 2500 credit limit

what is 30 of 2500 credit limit

https://www.lexingtonlaw.com/blog/wp-content/uploads/2017/10/CreditCardLimit.jpg

How To Set A Credit Limit Commercial Domestic Investigations

http://www.commercialdomesticinvestigations.co.uk/wp-content/uploads/2017/10/credit-limit.jpg

2 500 Credit Limit GUARANTEED Ava Review YouTube

https://i.ytimg.com/vi/MqG5JiIJb8w/maxresdefault.jpg

Your credit utilization ratio is how much you owe on all your revolving accounts such as credit cards compared with your total available credit expressed as a percentage It s important How much of your credit should you use Experts advise using no more than 30 of your credit card limits to keep your credit utilization down and lower is better

To obtain a solid credit score you should keep your credit utilization ratio under 30 For example let s say your credit limit is 1 000 and you have a current balance of 600 You should use less than 30 percent of your credit card s credit limit especially if you want to avoid any damage to your credit score The lower your credit utilization ratio is the better off your credit score

More picture related to what is 30 of 2500 credit limit

Credit Limit Finance Image

http://www.picpedia.org/finance/images/credit-limit.jpg

How Much Of A 4000 Credit Limit Should I Use Leia Aqui How Much

https://scrn-cdn.omnicalculator.com/finance/[email protected]

30 Percent Of 200 YouTube

https://i.ytimg.com/vi/pz42oOtNS9U/maxresdefault.jpg

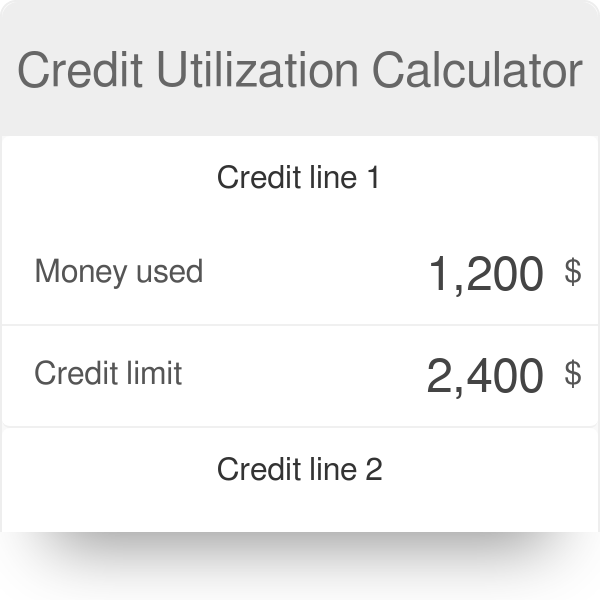

Our credit utilization ratio calculator can tell you whether your credit utilization is helping or hurting your credit Just plug in details for up to five of your credit lines including balances and credit limits and you ll have What is my credit utilization ratio Your credit utilization ratio is the percentage of your available credit that you actually use This ratio accounts for 30 of

A single credit card can have a credit limit of anywhere from 500 to 10 000 depending on various factors like the type of card your credit score and more According to A credit limit is the maximum amount that you can spend with a credit card or line of credit Having high limits lets you spend more and can be good for your credit

What Is 30 Percent Of 600 In Depth Explanation The Next Gen Business

https://thenextgenbusiness.com/wp-content/uploads/2021/09/30-Percent-of-600.webp

Credit Limit Free Of Charge Creative Commons Highway Sign Image

https://www.picpedia.org/highway-signs/images/credit-limit.jpg

what is 30 of 2500 credit limit - How much of your credit should you use Experts advise using no more than 30 of your credit card limits to keep your credit utilization down and lower is better