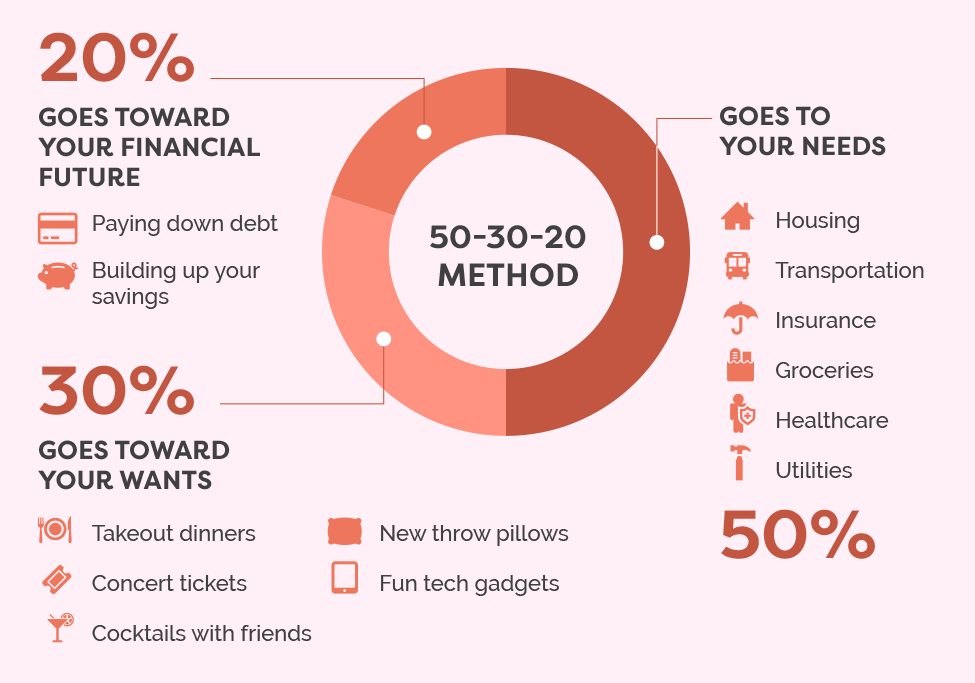

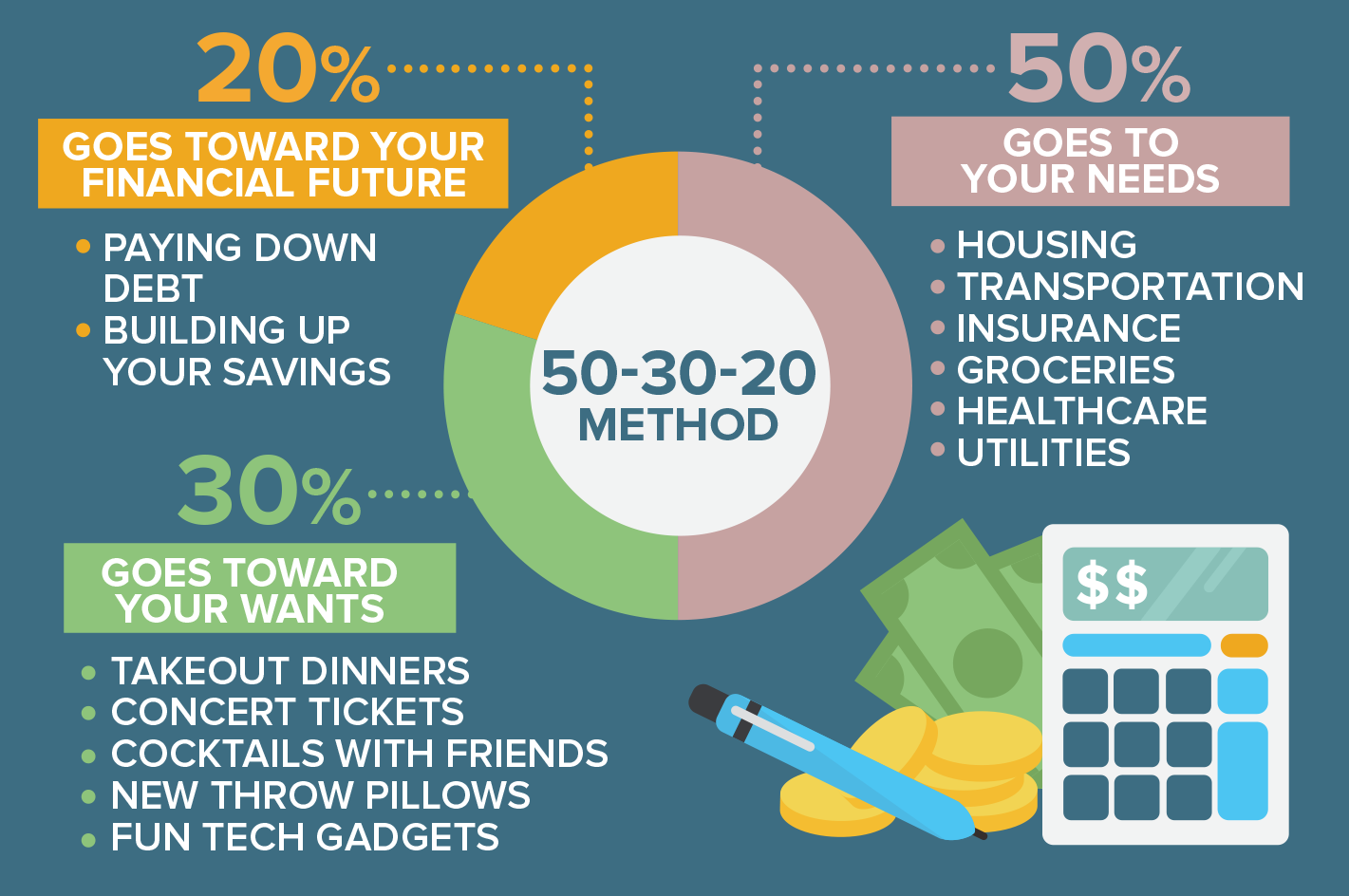

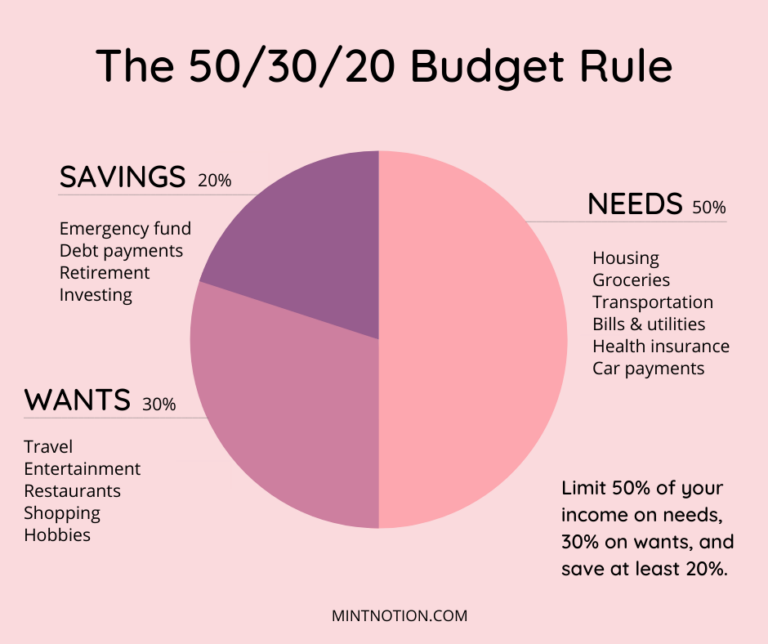

30 20 50 rule To make a budget for a month according to the 50 30 20 rule you need to allocate your after tax salary to the following three categories Spend 50 on necessities things that you need Spend 30 on wants entertainment shopping Allocate 20 of your income for saving or making a loan payment

The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income i e your take home pay 50 to needs 30 Our 50 30 20 calculator divides your take home income into suggested spending in three categories 50 of net pay for needs 30 for wants and 20 for savings and debt repayment

30 20 50 rule

30 20 50 rule

https://images.squarespace-cdn.com/content/v1/5e07c91e66be9216ac7e3646/1579401173259-NVXJ9074HW57HOGQQQ3W/50-30-20+Budget+Rule.png

50 30 20 Principle To Save Your Money

https://media.licdn.com/dms/image/D5612AQFnKSDGWVToSg/article-cover_image-shrink_720_1280/0/1677487751467?e=2147483647&v=beta&t=RYx97hLBnR61-F4uL0vp-HjdcYSkn3M0R6AsevG4DbI

The Ultimate Guide To Saving Money Info

https://i.pinimg.com/736x/ae/fc/95/aefc951d372ee70a2866042551632356.jpg

The 50 30 20 budget rule is a simple and effective method for managing personal finances This rule allocates after tax income into three main categories 50 for needs 30 for wants and 20 for savings and debt repayment Budgeting is crucial for achieving financial stability and success Want to know if the 50 30 20 rule will work for your finances Learn the basics of this budgeting method including examples

The 50 30 20 rule of thumb is a guideline for allocating your budget accordingly 50 to needs 30 to wants and 20 to your financial goals The rule was popularized in a book by U S Senator Elizabeth What is the 50 30 20 rule The 50 30 20 rule is a budgeting strategy that allocates 50 percent of your income to must haves 30 percent to wants and 20 percent to savings

More picture related to 30 20 50 rule

50 30 20 Rule Of Money Saving Money Budget Money Management Advice

https://i.pinimg.com/originals/ba/ec/49/baec4963c8cc70b86f50107efba931a1.jpg

How 50 20 30 Rule Will Change Your Life Finance Expert

https://bankonus.com/finance-expert/wp-content/uploads/2018/11/d4b56bad34702ffb869c6e9628f996f6-1.png

50 30 20 Budget Rule How To Make A Realistic Budget Mint Notion

https://www.mintnotion.com/wp-content/uploads/2020/10/The-50_30_20-Budget-Rule-768x644.png

The 50 30 20 rule is a budgeting method that can help guide your monthly saving and spending To follow the 50 30 20 budgeting rule put your after tax income into three categories 50 for The 50 30 20 rule recommends putting 50 of your money toward needs 30 toward wants and 20 toward savings The savings category also includes money you will need to realize your future goals Let s take a closer look at each category Needs 50 About half of your budget should go toward needs

The 50 30 20 system was designed to make budgeting more accessible to people who get overwhelmed by complicated spreadsheets and budgeting apps It was popularized by Senator Elizabeth Warren in her book All The 50 30 20 budgeting rule is one of the best known ways to start a solid money management journey It does not matter how much you earn You can easily apply this rule and develop

The 50 30 20 Budget Rule And How To Apply It Estradinglife

https://estradinglife.com/wp-content/uploads/2022/02/50-30-20-budget-rule-1024x542.png

How To Use The 50 30 20 Rule For Budgeting Your Money

https://www.kindafrugal.com/wp-content/uploads/50-30-20-rule-021-730x548.png

30 20 50 rule - What Is The 50 30 20 Rule The 50 30 20 rule is a simple budgeting method used to break down your after tax income into three spending categories needs wants and savings