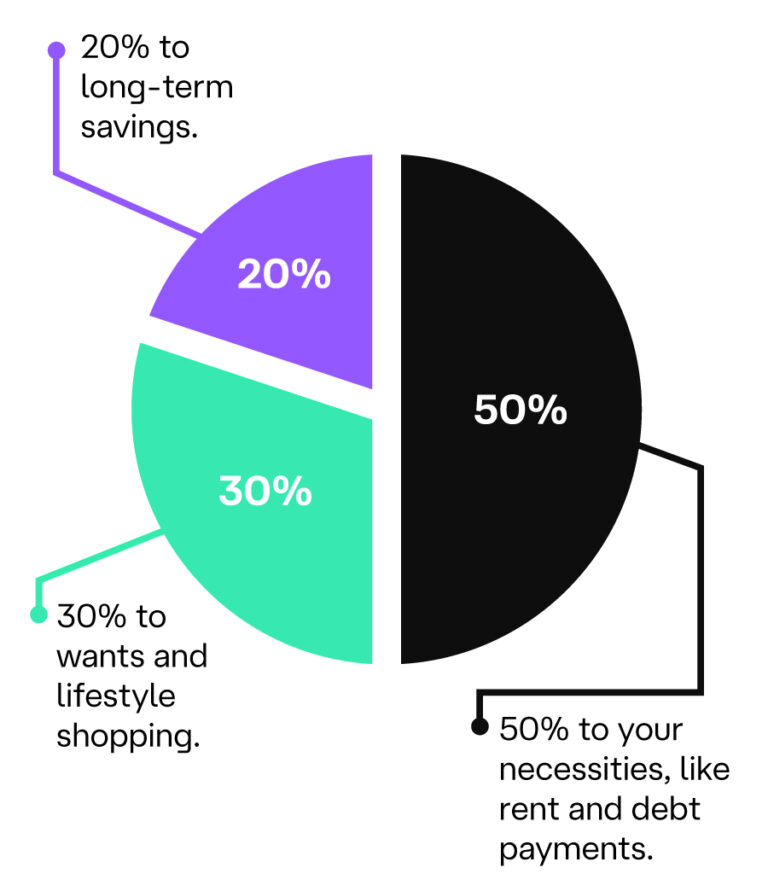

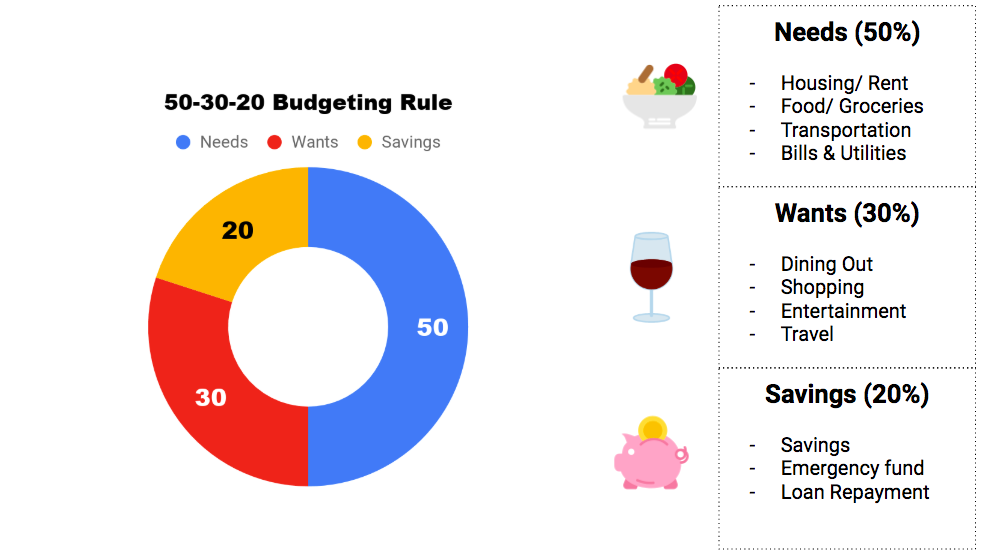

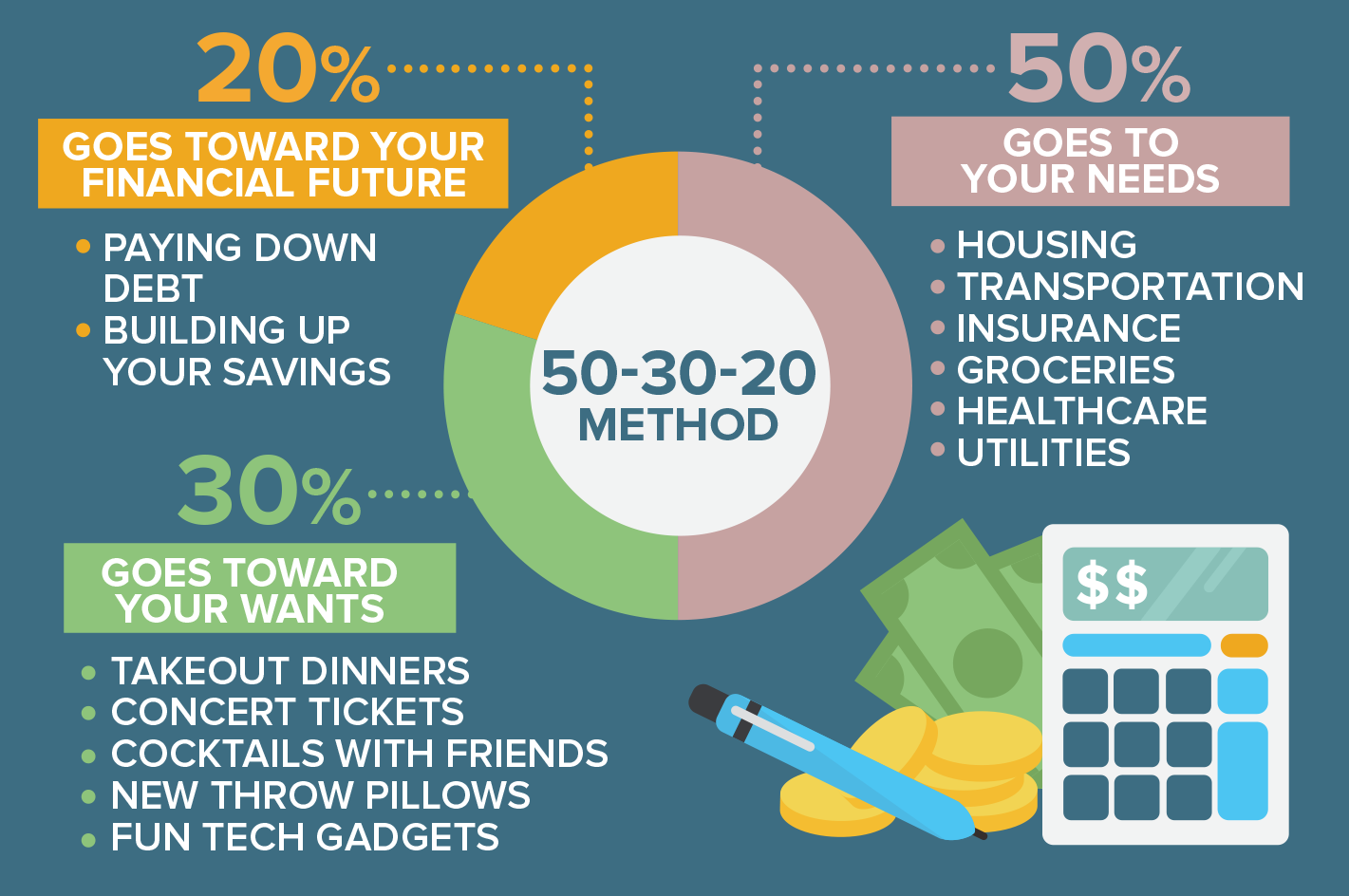

20 30 50 savings rule Our 50 30 20 calculator divides your take home income into suggested spending in three categories 50 of net pay for needs 30 for wants and 20 for savings and debt repayment

The 50 30 20 budget rule is a budgeting framework that recommends allocating 50 of income to needs 30 to wants and 20 to savings and debt repayment What are considered needs under the The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income i e your take home pay 50 to needs 30

20 30 50 savings rule

20 30 50 savings rule

https://spotmoney.com/wp-content/uploads/2022/12/20-30-40-infographic-mobile-768x891.jpg

Using The 20 20 60 Savings Rule To Optimize Your Finances

https://static.fmgsuite.com/media/images/876638c9-4192-4fc9-b864-3cdf9d60e9eb.png

The 50 30 20 Rule For Saving Money Saving Money Budget Money

https://i.pinimg.com/originals/29/a3/e8/29a3e87f500784d56fd75fff42536f0b.jpg

Spending is broken up into 50 for needs 30 for wants and 20 for savings and debt Groceries would be in the needs group makeup would be a want and student loan bills would be a debt payment Here s an example The 50 30 20 rule of thumb is a guideline for allocating your budget accordingly 50 to needs 30 to wants and 20 to your financial goals The rule was popularized in a book by U S Senator Elizabeth Warren and her

What is the 50 30 20 rule The 50 30 20 rule is a budgeting strategy that allocates 50 percent of your income to must haves 30 percent to wants and 20 percent to savings The 50 30 20 rule simplifies budgeting by dividing your after tax income into just three spending categories needs wants and savings or debts Knowing exactly how much to spend on each category will make it easier to stick to your

More picture related to 20 30 50 savings rule

Budget With The 50 30 20 Rule Versa

https://versa.com.my/wp-content/uploads/2022/10/Versa-50-30-20-1536x864.png

The 50 30 20 Budget Rule Explained Ultimate Guide Arrest Your Debt

https://arrestyourdebt.com/wp-content/uploads/2020/08/50-30-20-Budget-JPG-scaled.jpg

What Is The 50 30 20 Budget Rule

https://gladstonellc.com/wp-content/uploads/2023/05/50-30-20.jpg

20 Savings The savings category in the 50 30 20 rule covers some super important parts of your budget Retirement investments Emergency fund savings Any extra debt payments above those minimum payments Discover how the 50 30 20 budgeting rule can streamline your finances Learn to balance needs wants and savings for a more secure financial future

The 50 30 20 budgeting method suggests you spend 50 of your income on necessities 30 on wants and 20 on savings It can be a helpful framework if you re new to What is the 50 30 20 rule The idea is you d aim to spend 50 of your income on needs essential living expenses such as rent mortgage bills food and transport to work

Money Lover Spending Manager App Understand 50 30 20 A Simple

http://note.moneylover.me/content/images/2018/08/Screen-Shot-2018-08-25-at-11.46.26-PM.png

How 50 20 30 Rule Will Change Your Life Finance Expert

https://bankonus.com/finance-expert/wp-content/uploads/2018/11/d4b56bad34702ffb869c6e9628f996f6-1.png

20 30 50 savings rule - What is the 50 30 20 rule The 50 30 20 budgeting rule states that 50 of your monthly after tax income should go to needs 30 to wants and 20 for savings Here s what