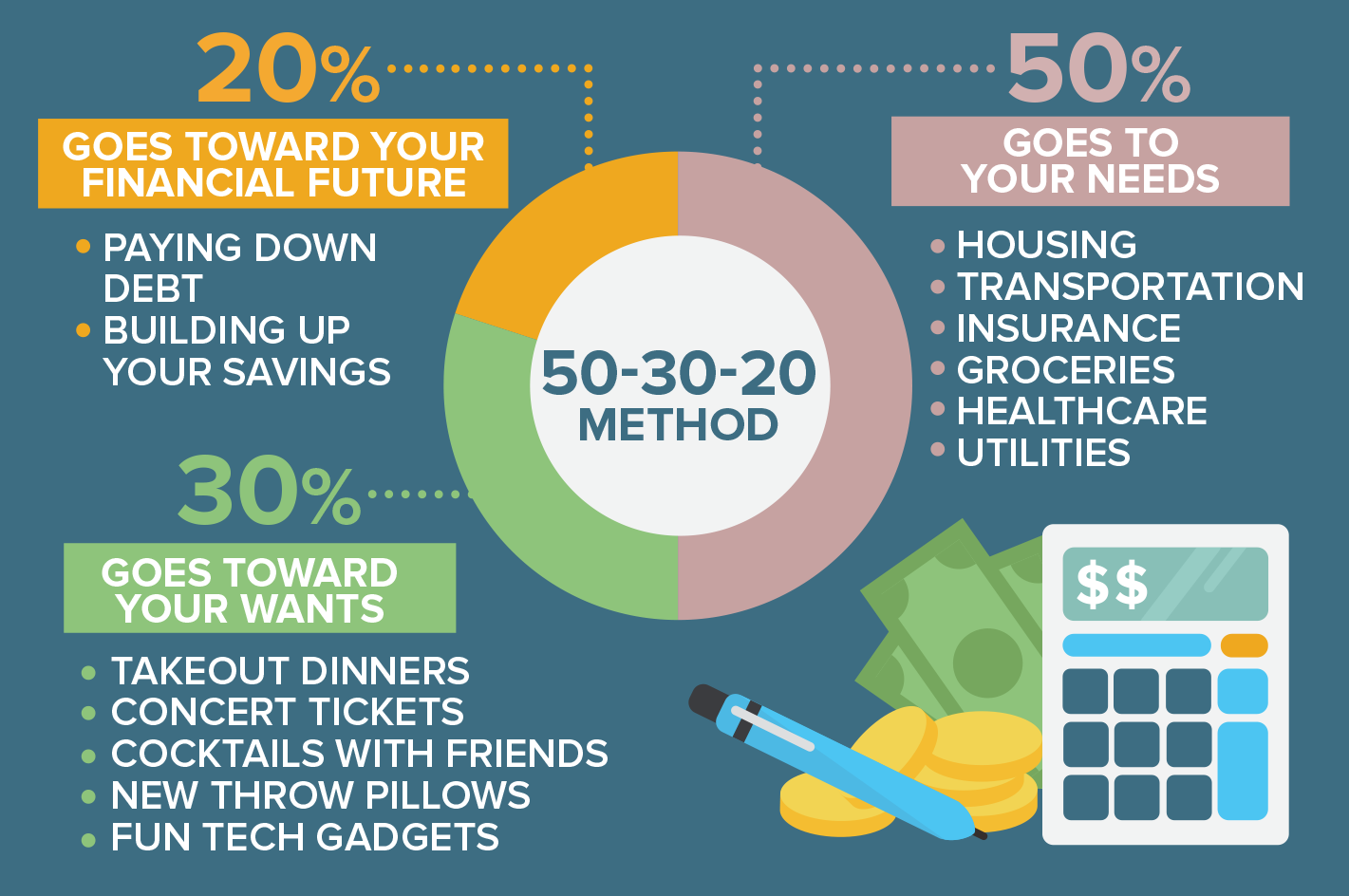

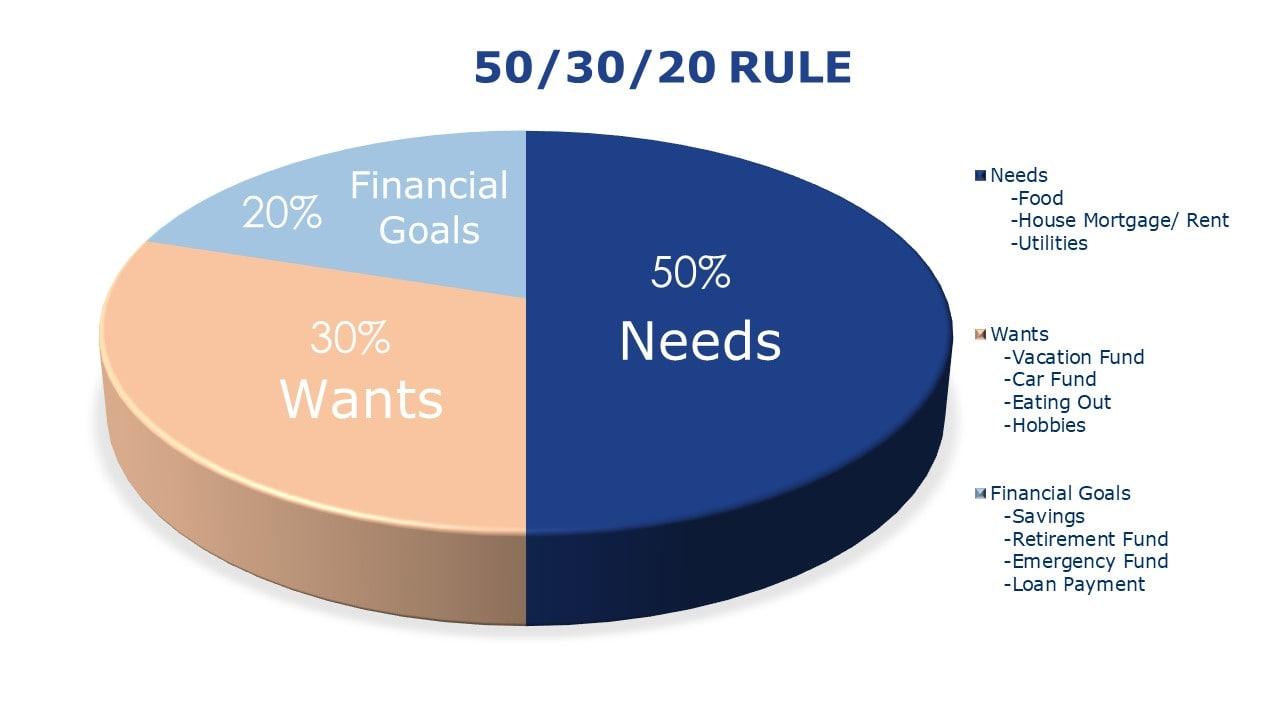

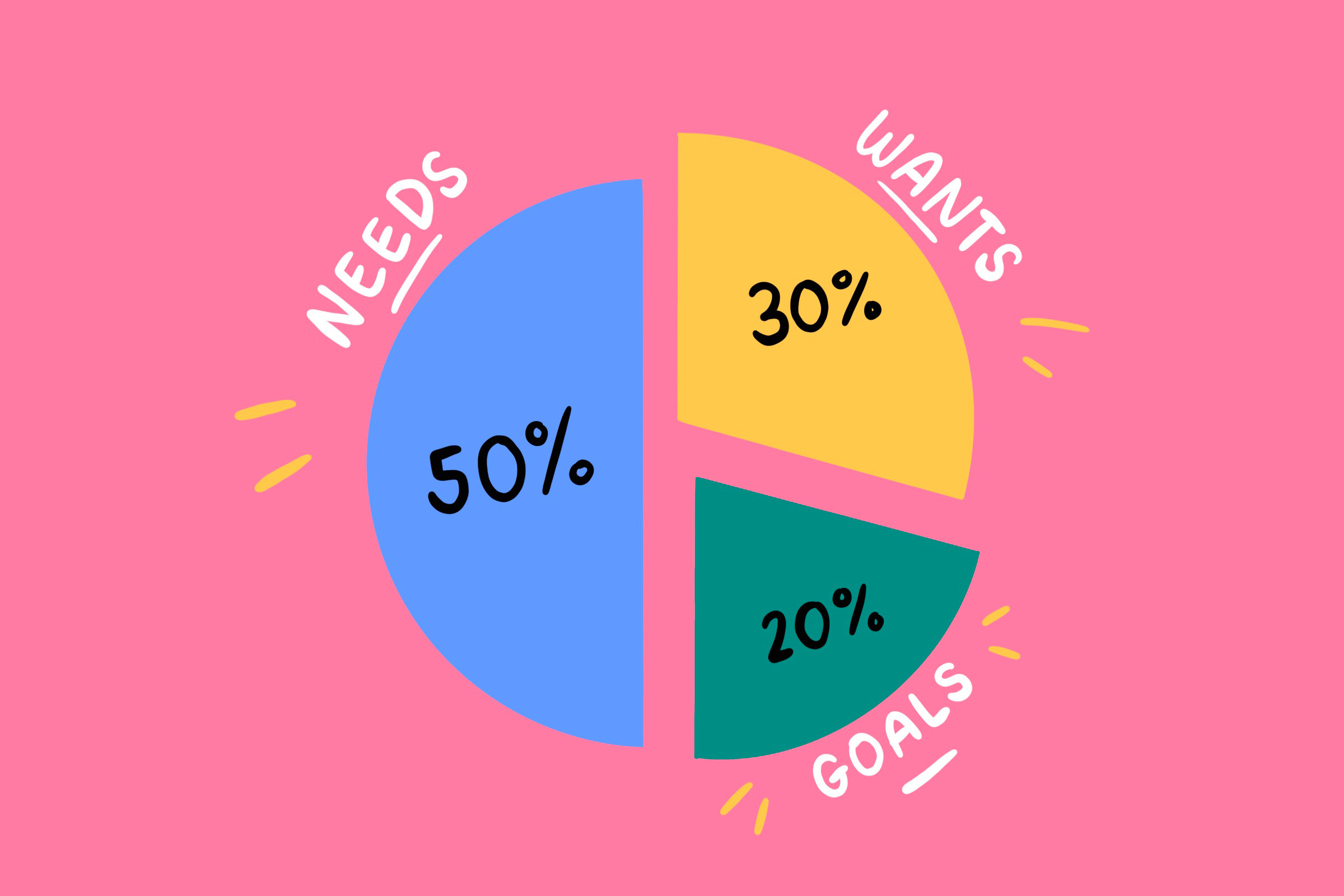

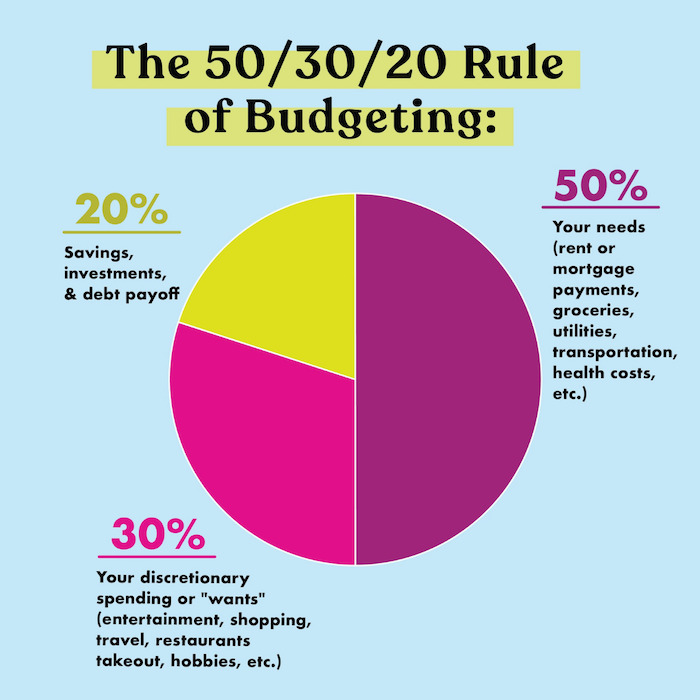

20 30 50 rule The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income i e your take home pay 50 to needs 30 to

Our 50 30 20 calculator divides your take home income into suggested spending in three categories 50 of net pay for needs 30 for wants and 20 for savings and debt repayment To make a budget for a month according to the 50 30 20 rule you need to allocate your after tax salary to the following three categories Spend 50 on necessities things that you need Spend 30 on wants entertainment shopping Allocate 20 of your income for saving or making a loan payment

20 30 50 rule

20 30 50 rule

https://bankonus.com/finance-expert/wp-content/uploads/2018/11/d4b56bad34702ffb869c6e9628f996f6-1.png

The 50 30 20 Rule On Budgeting Peso Wise Mom

https://pesowisemom.com/wp-content/uploads/2022/06/50-30-20-rule-on-budgeting.jpg

How The 50 30 20 Budgeting Rule Works

https://img.buzzfeed.com/buzzfeed-static/static/2021-04/17/1/asset/21e91fced15a/sub-buzz-16544-1618621303-8.jpg

What is the 50 30 20 rule The idea is you d aim to spend 50 of your income on needs essential living expenses such as rent mortgage bills food and transport to work 30 on wants discretionary spending such as eating out shopping trips and subscriptions In its simplest form the 50 30 20 budget rule divides your after tax income into three distinct buckets which are 50 to needs 30 to wants 20 to savings A plan like this helps simplify finances and is also easy to follow Who invented the 50 30 20 budget U S Senator Elizabeth Warren came up with the 50 30 20 budget

What is the 50 30 20 rule The 50 30 20 rule is a budgeting strategy that allocates 50 percent of your income to must haves 30 percent to wants and 20 percent to savings As the 50 30 20 rule dictates 20 percent of your post tax income must be saved and then utilized through investments Please note unlike needs and wants savings should be non negotiable and need to be a top priority

More picture related to 20 30 50 rule

50 30 20 Template Excel

https://thefinancialdiet.com/wp-content/uploads/2021/05/50-30-20-1.jpg

The 20 30 50 Budgeting Rule

https://spotmoney.com/wp-content/uploads/2022/12/20-30-40-infographic-mobile-768x891.jpg

Understanding The 50 30 20 Rule To Help You Save MagnifyMoney

https://www.magnifymoney.com/wp-content/uploads/2019/06/Graphic-1.png

The 50 30 20 rule of thumb is a way to allocate your budget according to three categories needs wants and financial goals It s not a hard and fast rule but rather a rough guideline to help you build a financially sound budget The 50 30 20 rule recommends putting 50 of your money toward needs 30 toward wants and 20 toward savings The savings category also includes money you will need to realize your future goals Let s take a closer look at each category Needs 50 About half of your budget should go toward needs

[desc-10] [desc-11]

How The 20 30 50 Rule Works Queen City Money Management

https://qcmm.files.wordpress.com/2019/03/20.30.50-chart1-1.png?w=1200

The 50 30 20 Budget Rule And How To Apply It Estradinglife

https://estradinglife.com/wp-content/uploads/2022/02/50-30-20-budget-rule-1024x542.png

20 30 50 rule - What is the 50 30 20 rule The 50 30 20 rule is a budgeting strategy that allocates 50 percent of your income to must haves 30 percent to wants and 20 percent to savings