1098 e student loan interest deduction Information about Form 1098 E Student Loan Interest Statement Info Copy Only including recent updates related forms and instructions on how to file File this form if

You can use Form 1098 E to find out how much student loan interest you paid during the tax year You can deduct up to 2 500 of student loan interest from your taxable income if you meet certain conditions If you paid at least 600 in student loan interest during the year your loan servicer should send a Form 1098 E showing how much you paid If you don t receive a 1098 E you can still

1098 e student loan interest deduction

1098 e student loan interest deduction

https://americantaxtraining.com/wp-content/uploads/2022/06/form-1098-E.png

Student Loan Interest Deduction And Tuition Fees Deduction Offer Tax

https://www.myfederalretirement.com/wp-content/uploads/2021/03/student-loans-chalkboard.jpg

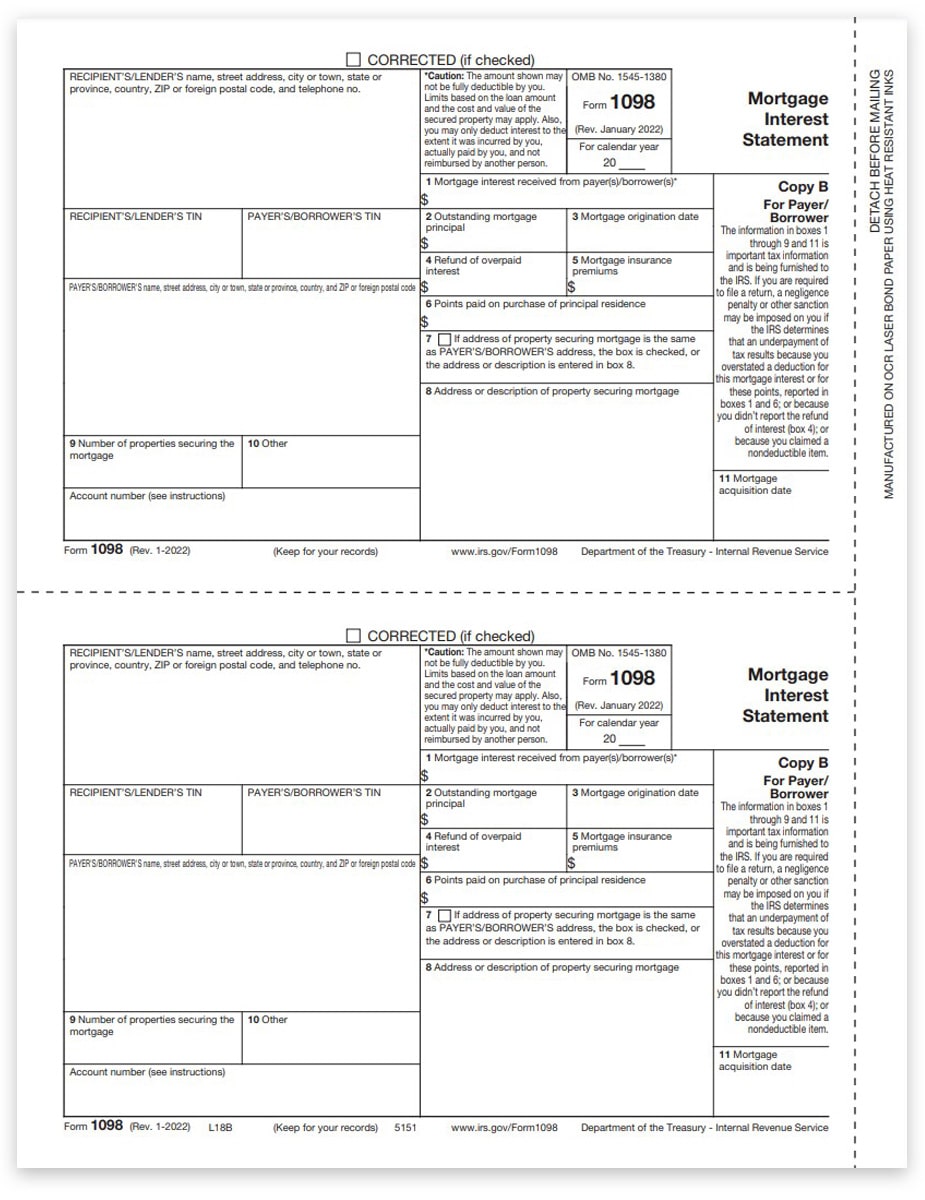

1098 Tax Form For Mortgage Interest Payer Copy B DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

You may be able to deduct student loan interest that you actually paid in 2023 on your income tax return However you may not be able to deduct the full amount of interest reported on Eligibility for Student Loan Interest Deduction To be eligible for the maximum student loan interest deduction of 2 500 for tax year 2023 your modified adjusted gross

A deduction of up to 2 500 is allowed for interest paid by the taxpayer during the year on qualified student loans Deductible interest includes voluntary payments made during a period The maximum student loan interest deduction allowed is 2 500 To claim a tuition and fees deduction Form 8917 use Screen 38 Education Credits Tuition Deduction instead

More picture related to 1098 e student loan interest deduction

E file 1098 E Form For Student Loan Interest Statement

https://d2rcescxleu4fx.cloudfront.net/images/1098-E.webp

Understanding The 1098 E And Student Loan Interest Deduction YouTube

https://i.ytimg.com/vi/TnephyUvrXI/maxresdefault.jpg

![]()

What Is The 1098 E Student Loan Statement

https://collegeaftermath.com/wp-content/uploads/2022/07/icons8-team-FcLyt7lW5wg-unsplash-768x1152.jpg

Form 1098 E is used to determine your student loan interest tax deduction while Form 1098 T can be used to determine any education credits you may qualify for as well as additional deductions for education expenses Use the 1098 E Form to figure your student loan interest deduction You can deduct up to 2 500 worth of student loan interest from your taxable income if you meet the following requirements You are legally obligated to pay interest on

How to deduct student loan interest on your tax return Deducting student loan interest from your federal tax return is fairly straightforward Student loan interest is considered A person including a financial institution a governmental unit and an educational institution that receives interest payments of 600 or more during the year on one or more qualified student

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Home Mortgage Interest Deduction Second Home Home Sweet Home

https://www.investopedia.com/thmb/I2hSqiwM-Z4WyzK-zDK4noFs5Zg=/1428x928/filters:fill(auto,1)/Form1098-5c57730f46e0fb00013a2bee.jpg

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

1098 e student loan interest deduction - You may be able to deduct student loan interest that you actually paid in 2023 on your income tax return However you may not be able to deduct the full amount of interest reported on