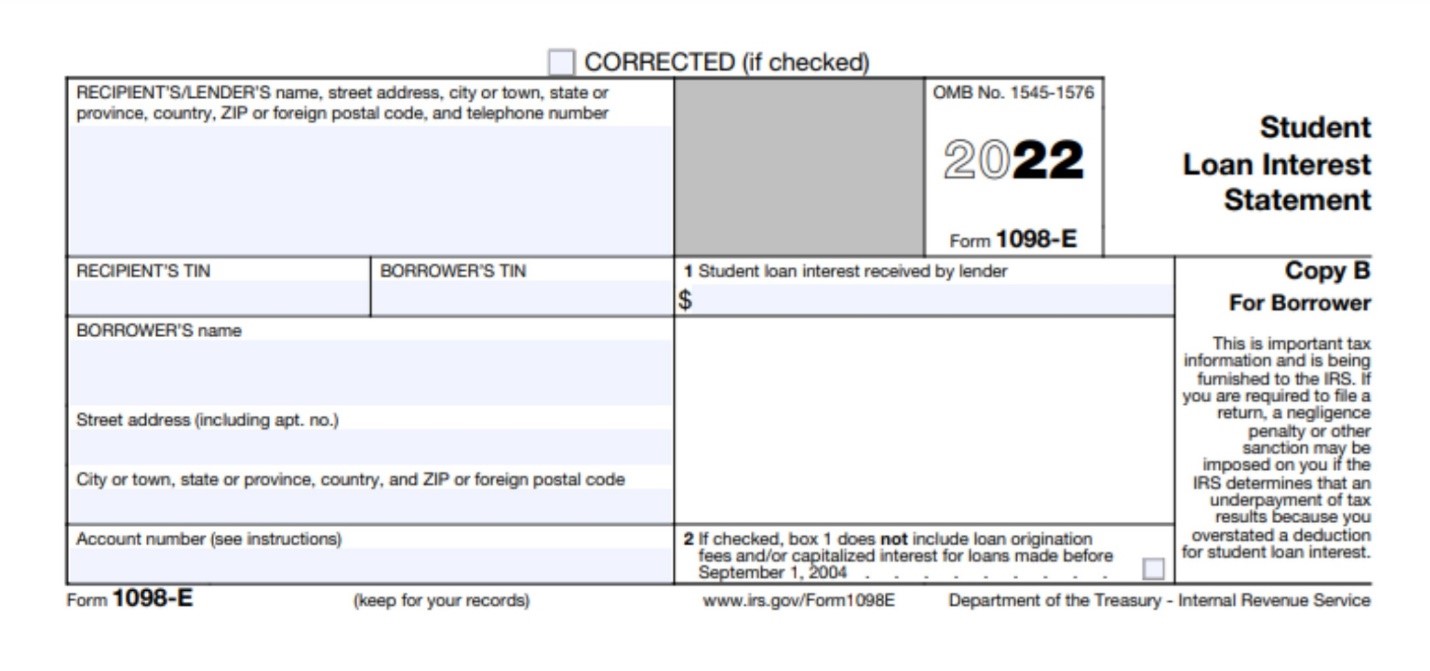

student loan interest deduction form 1098 e 1098 E Student Loan Interest Statement If you made federal student loan payments in 2022 you may be eligible to deduct a portion of the interest you paid on your 2022

You use the 1098 E to figure your student loan interest deduction You can deduct up to 2 500 worth of student loan interest from your taxable income as Form 1098 E reports to you and the IRS how much you paid in student loan interest during the tax year This could mean a tax deduction if you qualify

student loan interest deduction form 1098 e

student loan interest deduction form 1098 e

https://i.ytimg.com/vi/QJNY02cZlCs/maxresdefault.jpg

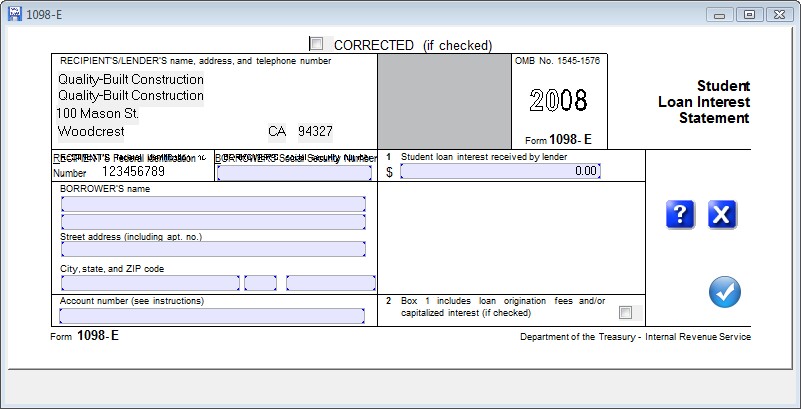

How To Enter Form 1098 E Student Loan Interest Statement In A Tax Return

https://kb.erosupport.com/assets/img_60be4d74e3bf2.png

How To Get A Copy Of IRS Form 1098 E

https://www.taxdefensenetwork.com/wp-content/uploads/2022/02/form-1098-e-instructions.jpg

Use the 1098 E Form to figure your student loan interest deduction You can deduct up to 2 500 worth of student loan interest from your taxable income if you meet the following requirements You are legally obligated If you paid at least 600 in student loan interest during the year your loan servicer should send a Form 1098 E showing how much you paid If you don t receive a

You should use your Form 1098 E to help determine if you qualify for a student loan interest deduction and how much you might be able to deduct To determine what portion of the interest you paid is What is Form 1098 E Form 1098 E is an informational form used to report student loan interest that you paid during the year It is issued by the government

More picture related to student loan interest deduction form 1098 e

Entering Editing Data Form 1098 E

http://www.magtax.com/help/form1098e.jpg

Form 1098 E Student Loan Interest Statement Sign On The Page Editorial

https://thumbs.dreamstime.com/z/form-e-student-loan-interest-statement-sign-page-209661780.jpg

Form 1098 E Student Loan Interest Statement IRS Copy A

https://www.phoenixphive.com/images/products/detail/b98efed05.2.png

The 1098 E tax form reports the amount of interest you paid on student loans in a calendar year Loan servicers send a 1098 E to anyone who pays at least 600 in How to deduct student loan interest If you paid at least 600 in interest on your student loan your servicer should send you IRS Form 1098 E which will contain

To claim the student loan interest deduction you need a 1098 E form showing 600 or more in interest payments to a lender within a year But if you paid less or don t receive When should I receive my Form 1098 E Taxpayers should expect to receive their Form 1098 E student loan interest statement from their student loan servicer or

Form 1098 E Student Loan Interest Statement IRS Copy A

http://www.phoenixphive.com/ProductImages/1098EFeda.gif

Form 1098 E Student Loan Interest Statement IRS Copy A

http://www.phoenixphive.com/images/products/detail/1098ECOPYA.1.jpg

student loan interest deduction form 1098 e - Form 1098 E is your Student Loan Interest Statement It will include information about your student loan lender name and address and the amount of