what is us 87a Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

Income tax rebate u s 87A is the same for the FY 2021 22 AY 2022 23 FY 2020 21 AY 2021 22 As per section 87A if a resident individual s total taxable income is up to Rs 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

what is us 87a

what is us 87a

https://i.ytimg.com/vi/GxhuAMGX5sU/maxresdefault.jpg

What Is Tax Exemption Under Section 87A With Automated Income Tax

https://1.bp.blogspot.com/-QwbPPuIJkqE/YQ8hxWt3tWI/AAAAAAAARd4/sOkojJa-6Jk150E9-TVE2yd2ILJswOw_QCNcBGAsYHQ/w1200-h630-p-k-no-nu/87%2BA%2BPicture.jpg

WHAT IS IT Mystery Tools 87a Question Tubalcain MRPETE YouTube

https://i.ytimg.com/vi/W_FE2Y-3Evg/maxresdefault.jpg

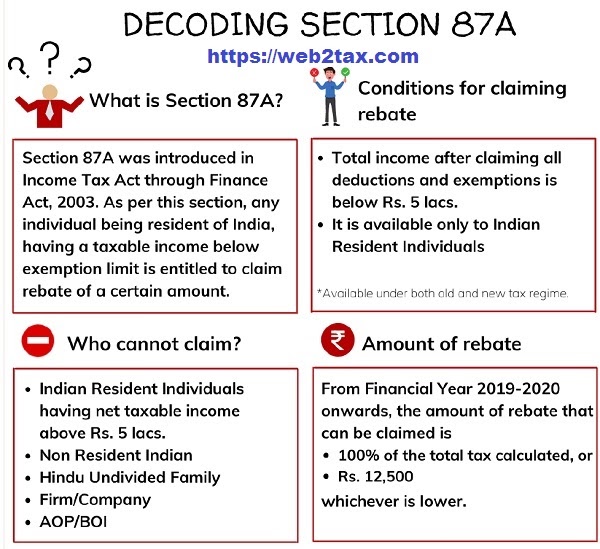

Income Tax Rebate u s 87A Of Income Tax Act 1961 Section 87A of the Income Tax Act was introduced in 2013 to provide relief to taxpayers The Budget 2023 introduces tax rebate under new tax The rebate u s 87A allows taxpayers to claim rebates against their tax liabilities providing relief and reducing the burden of taxation Tax Expert Rebate u s 87A for Previous Years

Eligible amount of rebate u s 87A The eligible amount of rebate u s 87A would be lower of the two The amount of tax payable or INR 12 500 By applying the amount of tax Rebate under Section 87A on income explained Section 87A of the Income Tax I T Act helps you lower your taxes Taxpayers can claim rebate us 87A if their

More picture related to what is us 87a

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

https://i.ytimg.com/vi/c8x9R1Q-cVQ/maxresdefault.jpg

Springfield 87A

https://dygtyjqp7pi0m.cloudfront.net/i/9910/10820065_2.jpg?v=8CE15FE0E6FC0E0

Rebate U s 87A Questions Answers YouTube

https://i.ytimg.com/vi/qcr-ZCYZS9Q/maxresdefault.jpg

Rebate under section 87A of the Income Tax Act helps taxpayers to reduce their tax liability Resident individuals with a net taxable income less than or equal to INR The threshold limit us 87A is Rs 12 500 for FY 2020 21 AY 2021 22 This means that if the total tax payable is lower than Rs 12 500 then that amount will be the rebate under section 87A This rebate is

Income Tax Rebate 87A The income tax rebate under Section 87a provides some relief to the taxpayers who fall under the tax category of 10 Any individual whose annual net Rebate u s 87A is one of the best ways to reduce our income tax liability further Let us have a look at the eligibility criteria that help us claim an income tax

Lot SPRINGFIELD MODEL 87A 22LR SEMI AUTO RIFLE

https://image.invaluable.com/housePhotos/bradfordsauction/42/688942/H22021-L233450348_original.jpg

SPRINGFIELD MODEL 87A Trigger Assembly Safety 28 00 PicClick

https://www.picclickimg.com/posAAOSwVo9iM4qX/Springfield-Model-87A-Trigger-Assembly-Safety.webp

what is us 87a - Section 87A is a provision under the IT Act for those whose annual income is below a certain limit In the old regime Section 87A allowed individuals with income up to INR 5