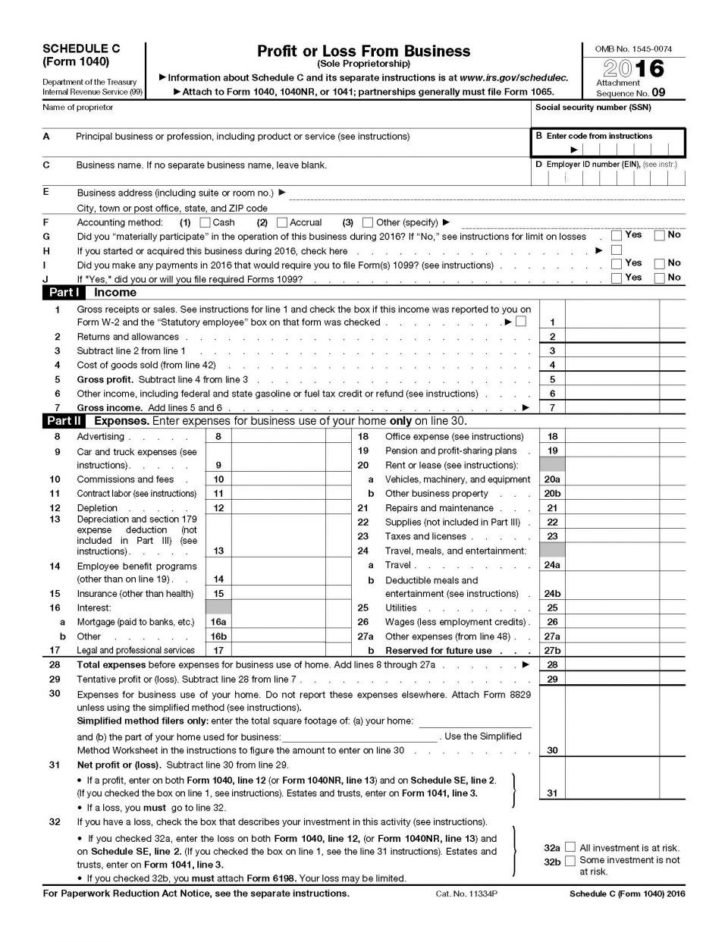

what is the 28 rate gain worksheet used for What is a 28 rate gain Two categories of capital gains are subject to the 28 percent rate small business stock and collectibles If you realized a gain from

A sale or other disposition of an interest in a partnership may result in ordinary income collectibles gain 28 rate gain or unrecaptured section 1250 gain For Subscribe to our YouTube channel youtube channel UCPQFIx80N8 a3MC6Gx9If2g sub confirmation 1

what is the 28 rate gain worksheet used for

what is the 28 rate gain worksheet used for

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2020/03/capital-gain-tax-worksheet-pdf.jpg

28 Rate Gain Worksheet

https://i2.wp.com/www.thetaxadviser.com/content/dam/tta/issues/2014/oct/clinic-4-exhibit.png

Understanding The Qualified Dividends And Capital Gains Worksheet 2020

https://i.pinimg.com/736x/ae/e0/c1/aee0c124b354b5d72825eda9e7b58fbf.jpg

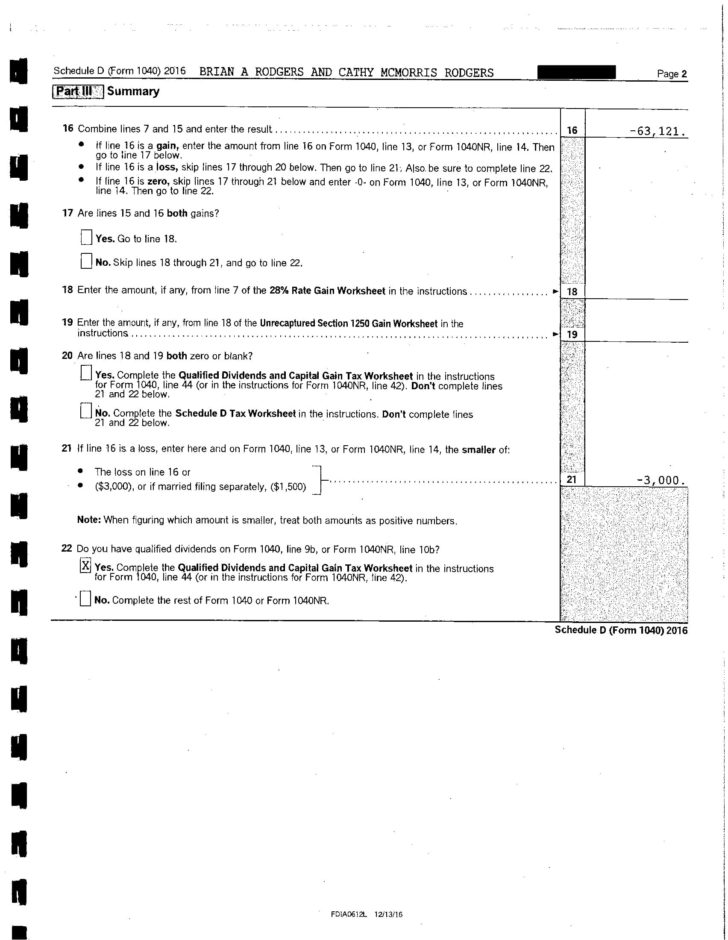

28 Rate Gain Worksheet Line 18 Keep for Your Records 1 Enter the total of all collectibles gain or loss from items you reported on Form 8949 Part II 1 2 Enter 28 Rate Gain Worksheet If the sum of short term capital gains or losses plus long term capital gains or losses is a gain the 28 Rate Gain Worksheet will be produced

For tax year 2023 the 20 maximum capital gain rate applies to estates and trusts with income above 14 650 The 0 and 15 rates continue to apply to certain threshold Part I Short Term Capital Gains and Losses Generally Assets Held One Year or Less Part II Long Term Capital Gains and Losses Generally Assets Held

More picture related to what is the 28 rate gain worksheet used for

Irs 28 Percent Rate Gain Worksheet

https://db-excel.com/wp-content/uploads/2019/09/us-unrecaptured-sec-28-rate-gain-worksheet-2016-for-one-step-728x940.jpg

Unit Rates Worksheet 6th Grade

https://worksheets.myify.net/wp-content/uploads/2020/10/understanding_unit_rate_worksheet_3.png

Irs 28 Rate Gain Worksheet 2021

https://db-excel.com/wp-content/uploads/2019/09/federal-income-tax-rates-for-28-rate-gain-worksheet-2016-728x942.jpg

Capital Gains and Losses Capital Gains Collectibles 28 Rate Gain 1 Collectibles include works of art rugs antiques metals such as gold silver and platinum bullion gems Oct 30 2023 These instructions explain how to complete Schedule D Form 1040 Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Use

Short term gains and losses The initial section of Schedule D is used to report your total short term gains and losses Any asset you hold for one year or less at 28 Rate Gain Worksheet see instructions enter the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040 SR line 12a or in the

Irs 28 Percent Rate Gain Worksheet Studying Worksheets

https://proconnect.intuit.com/community/image/serverpage/image-id/1162i74A3F6C9FC41C7C7?v=v2

10 28 Rate Gain Worksheet

https://i2.wp.com/briefencounters.ca/wp-content/uploads/2018/11/28-rate-gain-worksheet-2016-with-i1040-instruction-pages-201-206-text-version-of-28-rate-gain-worksheet-2016.jpg

what is the 28 rate gain worksheet used for - Part I Short Term Capital Gains and Losses Generally Assets Held One Year or Less Part II Long Term Capital Gains and Losses Generally Assets Held