what is section 87a Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate

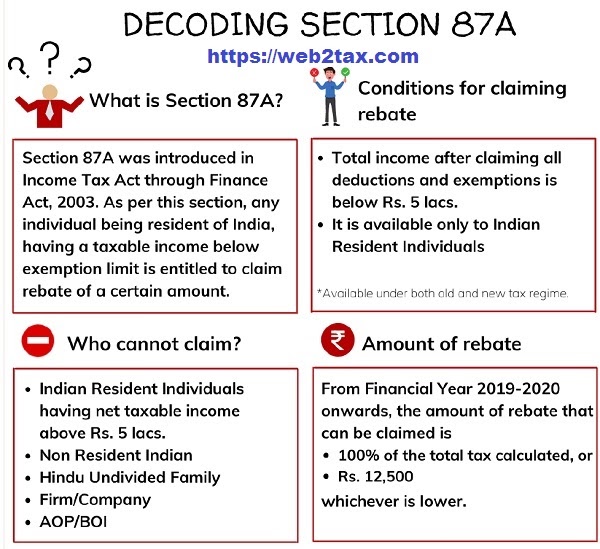

Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax Explore the benefits of Section 87A of the Income Tax Act 1961 and learn how eligible resident individuals can reduce their tax liability with this rebate This guide

what is section 87a

what is section 87a

https://i.pinimg.com/originals/b3/57/9d/b3579d46d1a28f2b1180211b6e7a9b92.png

What Is Section 87A Refund Under Section 87A Section 87A Deduction In

https://i.ytimg.com/vi/GxhuAMGX5sU/maxresdefault.jpg

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old To claim a tax rebate under Section 87A follow these steps Calculate your gross total income for the financial year Reduce your tax deductions for tax savings investments etc Determine your total income after deducting

Section 87A is a provision under the IT Act for those whose annual income is below a certain limit In the old regime Section 87A allowed individuals with income Claiming a rebate under Section 87A provides significant tax relief to eligible individuals with an annual income up to 5 lakhs Section 87 A s rebate is a valuable provision

More picture related to what is section 87a

What Is Section 87A And Why It s Suddenly Everywhere

https://bfsi.eletsonline.com/wp-content/uploads/2015/12/TAX.jpg

Section 87A Of Income Tax Act Tax Relief For Low Income Earners

https://margcompusoft.com/m/wp-content/uploads/2023/03/6-10-1024x576.jpg

What Is Tax Exemption Under Section 87A With Automated Income Tax

https://1.bp.blogspot.com/-QwbPPuIJkqE/YQ8hxWt3tWI/AAAAAAAARd4/sOkojJa-6Jk150E9-TVE2yd2ILJswOw_QCNcBGAsYHQ/w1200-h630-p-k-no-nu/87%2BA%2BPicture.jpg

What is Section 87A of the Income Tax Act of 1961 Introduced as part of the Finance Bill in 2013 section 87A of the Income Tax Act 1961 is a provision that provides a rebate to Section 87A of the Income Tax Act provides a rebate to resident individuals with low taxable income The rebate amount depends on the tax regime and the

If your total income doesn t exceed Rs 5 lakh you can claim a tax rebate under section 87A It s important to keep in mind that the maximum rebate under section 87A for the Assessment Year 2022 23 As per Bombay Chartered Accountants Society the new ITR filing utilities are not allowing the rebate under section 87A for various special rate incomes

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

what is section 87a - Section 87A is a provision under the IT Act for those whose annual income is below a certain limit In the old regime Section 87A allowed individuals with income