what is schedule c on 1099 k form Here s who should file IRS Schedule C how to fill it out and a few things to remember plus tips and tricks that could save you money and time

Business income If you re a sole proprietor like an independent contractor you ll report the income on Schedule C Form 1040 line 1 and any returns or allowances on Schedule C line 2 Additionally you should calculate the cost Something happens to make you unable to attend the event so you resell the tickets online for 100 more than what you paid

what is schedule c on 1099 k form

what is schedule c on 1099 k form

https://fundsnetservices.com/wp-content/uploads/Lost-your-1099-Form.png

IRS Reintroduces Form 1099 NEC For Non Employees Wendroff

https://lh4.googleusercontent.com/Yqn5aOoQW5V6DMCy7QTGXTwpCLjJp40-KdNljm2hP3_1N1OQdMbyWkFsr-cyHCnApS_IOnFuwQPanmObDUp2v7z4wkB41dcn001c7GNDjbd6jocAd1Jr4wDteaQxkk-ZLydd1oTY

1099 K form 1400x897 Maine SBDC

https://www.mainesbdc.org/wp-content/uploads/2022/09/1099-K-form-1400x897-1.png

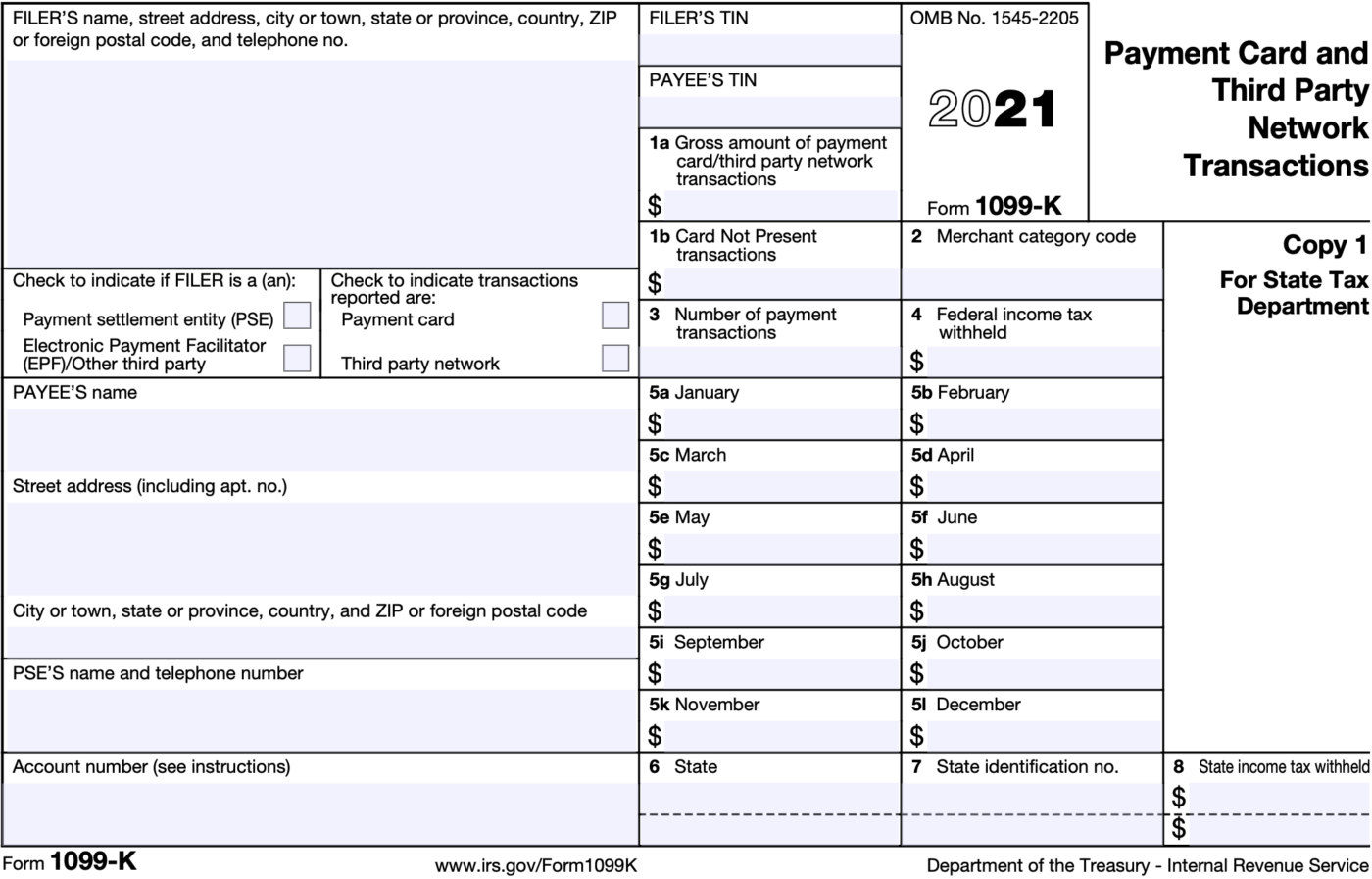

Schedule C is used to report self employment income and business expenses like supplies and software costs Anyone earning income outside of a W 2 such as freelancers gig workers and sole proprietors TPSOs which include popular payment apps and online marketplaces must file with the IRS and provide taxpayers a Form 1099 K that reports payments for goods or services where

This article will help you learn why your client received 1099 K forms and where to report them on a tax return Like the 1099 NEC forms 1099 K are information returns that Information about Form 1099 K Payment Card and Third Party Network Transactions including recent updates related forms and instructions on how to file A payment settlement entity

More picture related to what is schedule c on 1099 k form

2023 Tax Documents From TD Ameritrade And Charles Schwab EKS Associates

https://eksassociates.com/wp-content/uploads/2024/01/form-1099-scaled.jpeg

Irs 1099 Nec Printable Form

https://free-printable-az.com/wp-content/uploads/2019/07/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

1099 A Fillable Form Printable Forms Free Online

http://www.contrapositionmagazine.com/wp-content/uploads/2020/12/form-1099-fillable.jpg

A copy of a 1099 usually goes to both the payee and the IRS Because you received a 1099 K this is considered a Business and filing a Schedule C is required The good news is that you can claim Expenses against the income

The objective is to ensure people report their business income on their taxes Review your business records to check the gross receipts reported on your Form 1099 K are accurate and your tax information is correct

File Form 1099 K Online What Is Form 1099 K

https://d2rcescxleu4fx.cloudfront.net/images/1099-K.webp

What Is A 1099 K Form

https://assets-global.website-files.com/6253f6e60f27498e7d4a1e46/62d6bb5e137f9c23f4dae64a_Example of a 1099-K IRS form.png

what is schedule c on 1099 k form - If you received any 1099 NEC 1099 MISC or 1099 K tax forms reporting money you earned working as a contractor or selling stuff you ll have to report that as income on Line