What Is Notice U S 263 Of Income Tax - Worksheets have actually become important tools for numerous objectives, extending education and learning, service, and personal organization. From simple arithmetic workouts to complicated service analyses, worksheets act as organized frameworks that assist in knowing, preparation, and decision-making procedures.

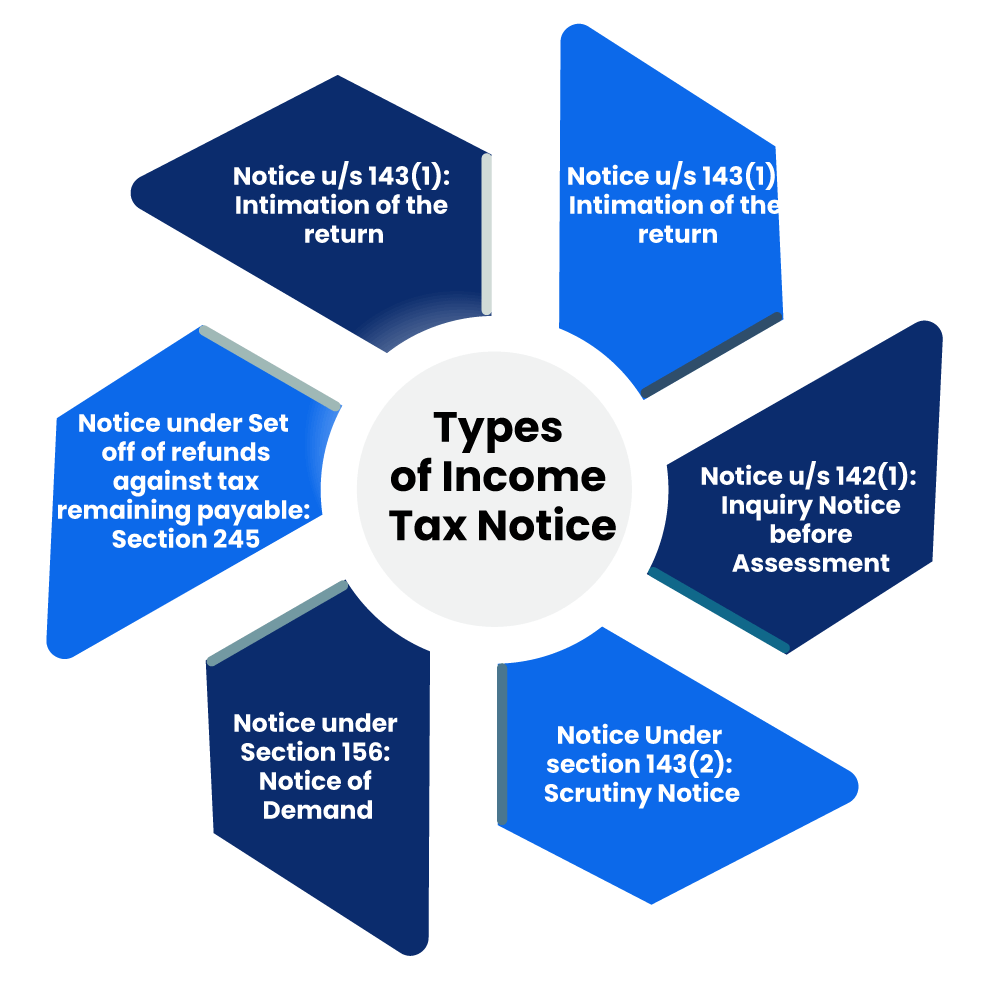

Types Of Income Tax Notice

Types Of Income Tax Notice

Worksheets are arranged documents that help systematically set up details or jobs. They offer a visual depiction of ideas, enabling users to input, take care of, and analyze information properly. Whether utilized in college, meetings, or personal settings, worksheets simplify operations and enhance performance.

Varieties of Worksheets

Educational Worksheets

Worksheets play a critical duty in education, serving as valuable devices for both instructors and pupils. They encompass a range of activities such as mathematics problems and language jobs, permitting method, reinforcement, and examination.

Job Coupons

In the business globe, worksheets serve multiple features, consisting of budgeting, project planning, and information evaluation. From financial declarations to SWOT evaluations, worksheets assist services make educated choices and track progression towards goals.

Private Activity Sheets

Personal worksheets can be a beneficial device for accomplishing success in different elements of life. They can aid individuals established and work in the direction of objectives, manage their time efficiently, and check their development in areas such as physical fitness and financing. By supplying a clear structure and sense of responsibility, worksheets can assist people remain on track and attain their purposes.

Making best use of Discovering: The Advantages of Worksheets

Worksheets use various advantages. They promote involved discovering, boost understanding, and support logical reasoning capacities. Moreover, worksheets support structure, rise performance and make it possible for team effort in team circumstances.

INCOME TAX ITR 3 Copy

Know About Section 43B In Income Tax Act 1961

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Income Tax Filing Online File Your Income Tax Services At Flickr

CBDT Decided To Further Extend The Due Dates For Filing Of Income Tax

Income Tax Notice How To Authenticate Notice Order Issued By Income

Reply To Scrutiny Assessment Notice U s 143 3 Ebizfiling

Sec 263 Revision Can Be Exercised If Appeal Was Filed Against Order Of

Outstanding 26as Of Income Tax Act Balance Sheet A Level Business

No Revision Order Can Be Passed U s 263 Of Income Tax Act Against