what is form b malaysia This Explanatory Notes is provided to assist an individual who is resident in Malaysia in accordance with the provision of section 7 of Income Tax Act 1967 ITA 1967 or deemed to

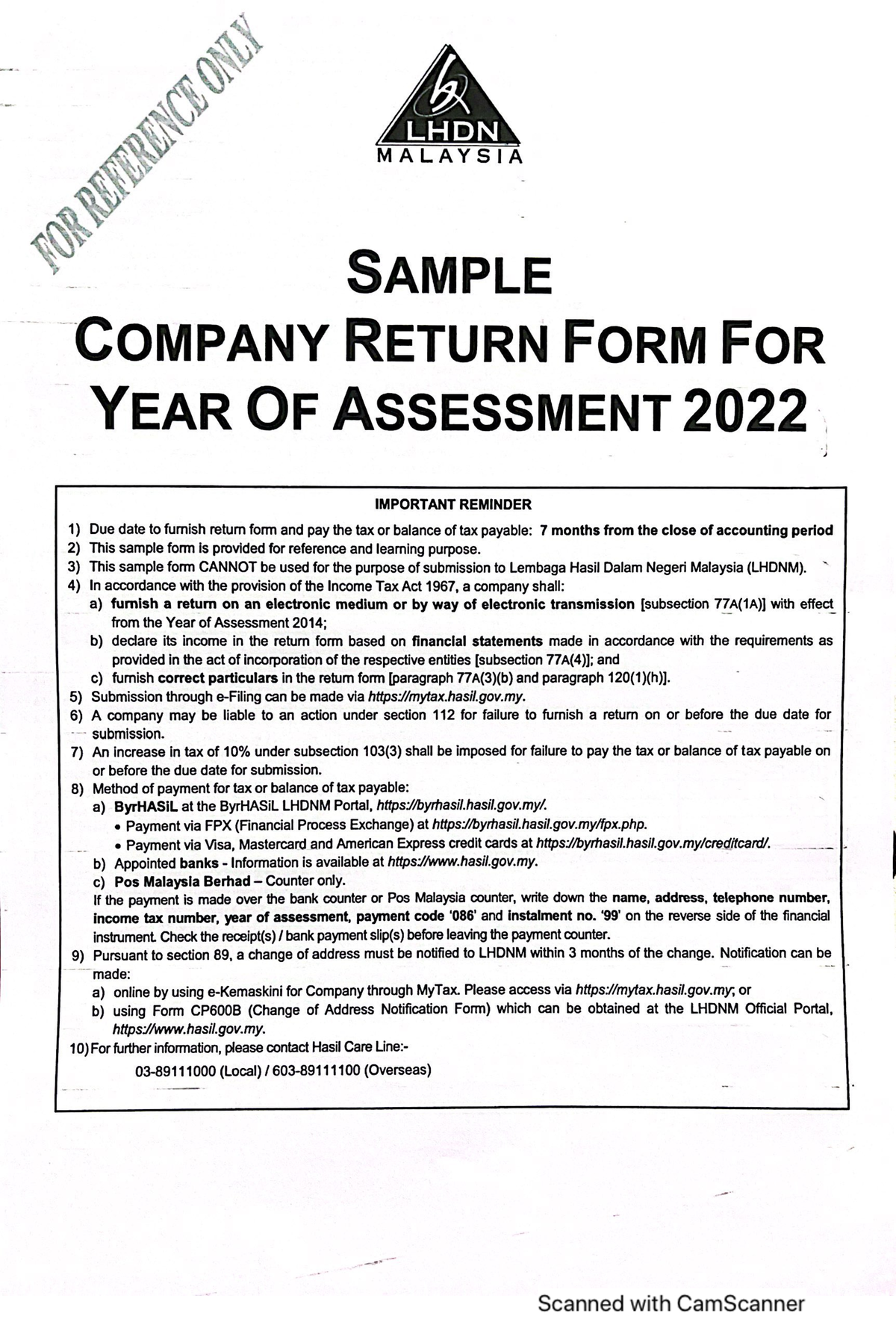

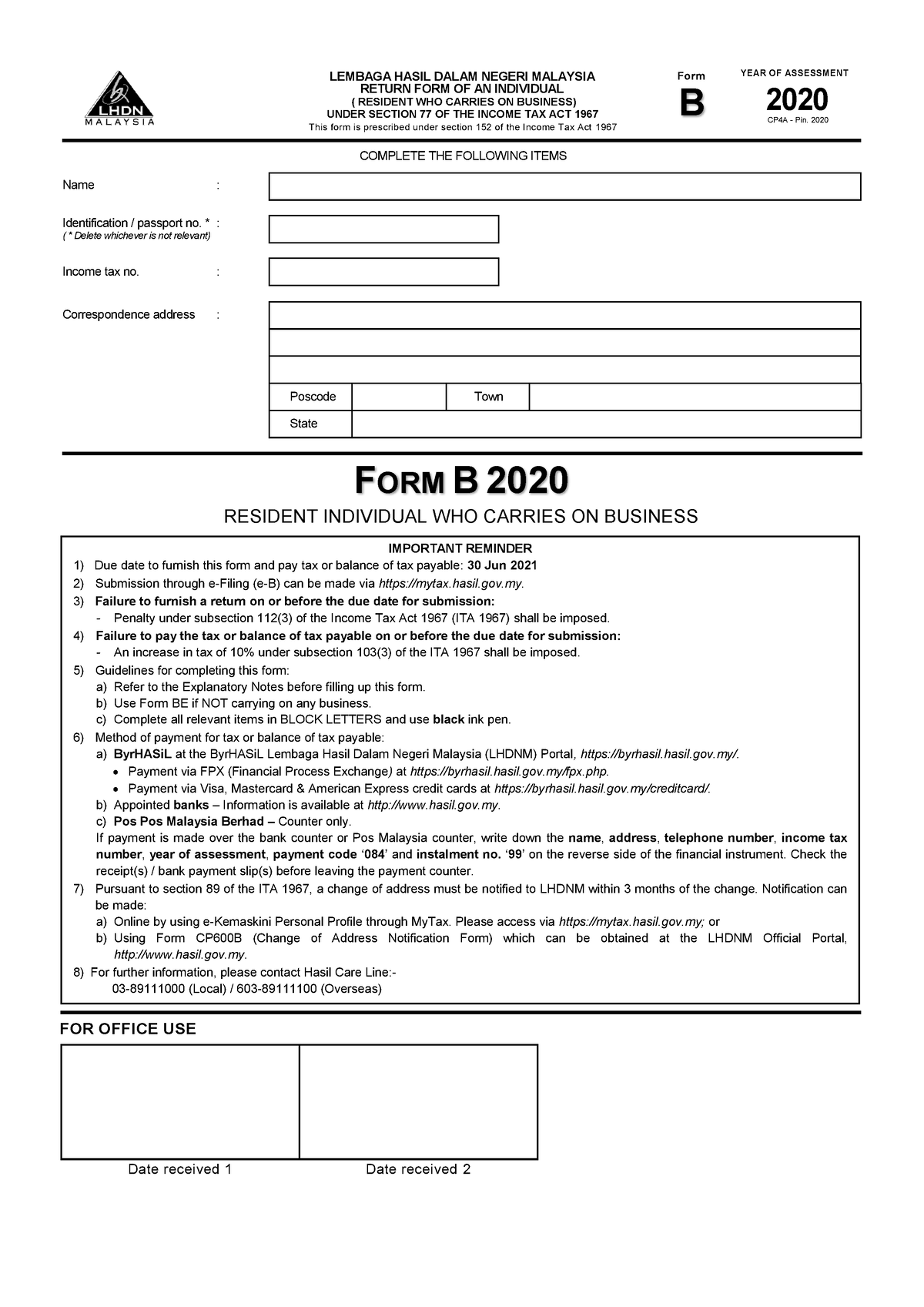

B Using Form CP600B Change of Address Notification Form which can be obtained at the LHDNM Official Portal hasil gov my 8 For further information please contact FORM B 2023 RESIDENT INDIVIDUAL WHO CARRIES ON BUSINESS IMPORTANT REMINDER Due date to furnish this form and pay tax or balance of tax payable 30 Jun

what is form b malaysia

what is form b malaysia

https://landco.my/wp-content/uploads/2022/06/1-13.png

Form B L Co

https://landco.my/wp-content/uploads/2022/06/3-9.png

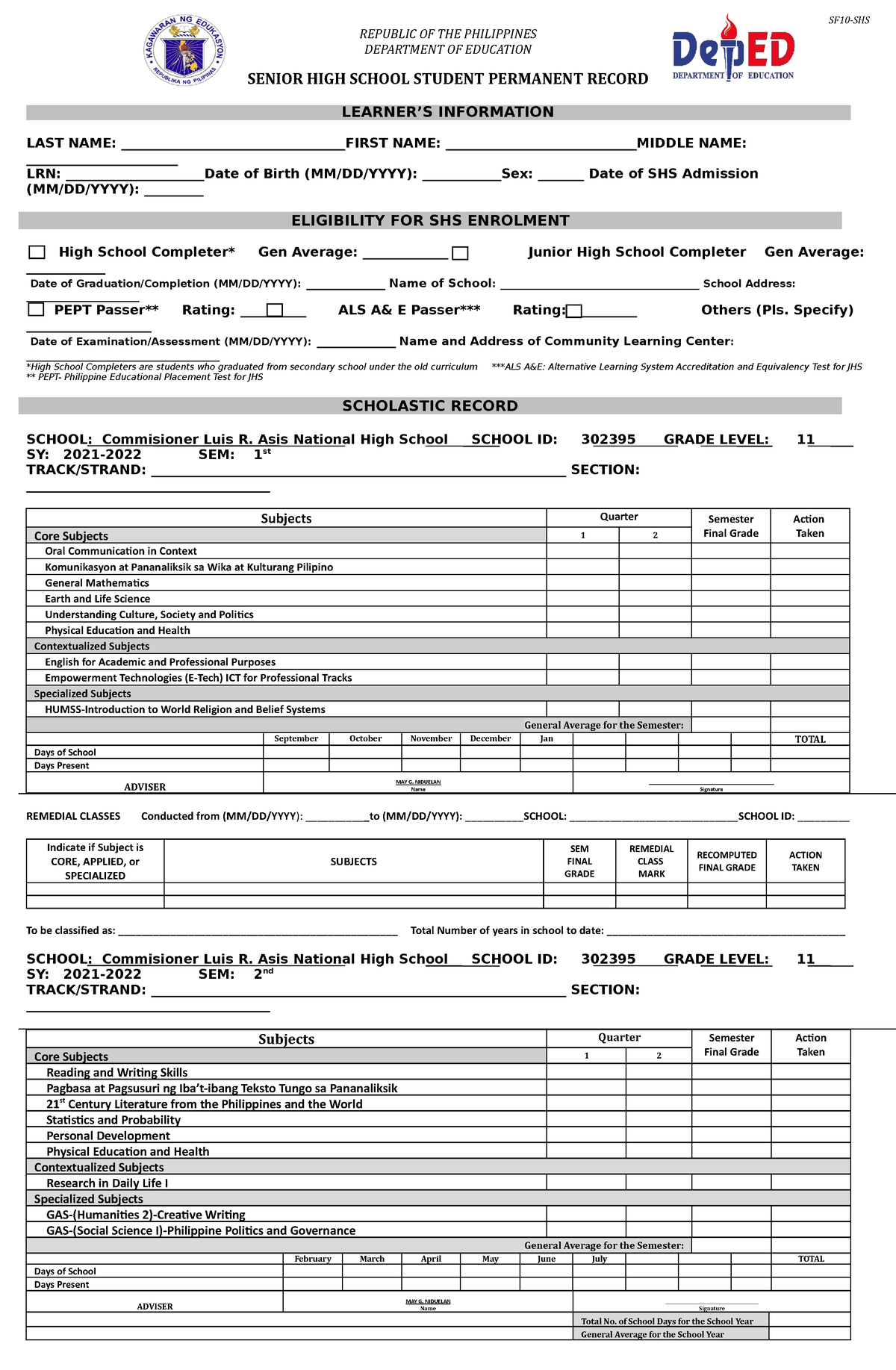

Form 137 A Humssb A4 Useful SF10 SHS REPUBLIC OF THE PHILIPPINES

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2743b6d4068719127973b89de9b769f7/thumb_1200_1835.png

Sole proprietors must annually file Form B before 30 June which is a document specific for residents in Malaysia with business income Here s a link to the 2022 Form B in English and 2022 Form B in Bahasa Melayu What is the difference between Form BE and Form B Form BE income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual

Assuming that you are registered with the SSM as a sole proprietor business you will need to use B form when filing your taxes This is because you are now carrying on a business enterprise rather than the occasional freelancing If you ve not registered your freelance work as a business then you will still be using the BE form which is intended for individuals who do not own a business On the other hand if you have registered your work as a

More picture related to what is form b malaysia

Form C Tax517 ASIGNMENT Taxation Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/19835fcf662cef1dc600c992e7adcb6b/thumb_1200_1770.png

Form E B 2020 Example Of Form E b FORM B 2020 RESIDENT INDIVIDUAL

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8de0f7bf993cbcd82ece722d2ab05095/thumb_1200_1697.png

Company Annual Filing Requirements In Malaysia

https://wecorporate.com.my/wp-content/uploads/2021/12/Company-Annual-Filing-Requirements-in-Malaysia-Infographic-scaled.jpg

Form B or Form e B for electronic filing is the form that you will need to submit if you are a resident individual who runs your own business including a freelancer For you the deadline for submitting your tax returns Simplified forms with explanations and guides on how to fill out those forms and compute the chargeable income and income tax have been prepared to assist taxpayers What is Form B

The income tax return for individuals with business income is known as Form B income other than employment income Who needs to submit Form B Individuals who pay taxes in Simplified forms with explanations and guides on how to fill out those forms and compute the chargeable income and income tax have been prepared to assist taxpayers What is Form B

Form B L Co

https://landco.my/wp-content/uploads/2022/06/8-9.png

Form B L Co

https://landco.my/wp-content/uploads/2022/06/1-5.png

what is form b malaysia - It is time to submit Form B For individuals with business income income other than employment income you will need to file the Form B