what is excise tax Summary Excise tax refers to a tax on the sale of an individual unit of a good or service The vast majority of tax revenue in the United States is generated from excise taxes The incidence of an excise tax depends on the price elasticity of demand and the price elasticity of

Excise tax in Ethiopia is imposed and payable on selected goods and services which are demand inelastic This page outlines the major issues covered under the new Excise Tax Proclamation No 1186 2020 Excise Tax Proclamation No An excise tax is an indirect toll placed on goods services or activities as a way to either offset the cost of public usage or discourage use of certain items In most situations you may

what is excise tax

what is excise tax

https://support.treez.io/hc/article_attachments/360012228512/excise_graphic_2.png

What Is A Regressive Tax 2023

https://files.taxfoundation.org/20190731110329/TF_AverageExciseTaxbyIncome.jpg

Excise Tax Meaning YouTube

https://i.ytimg.com/vi/-l4vGZCKiOA/maxresdefault.jpg

Excise tax is an indirect tax imposed on the manufacturing selling or license of particular products and services This includes tobacco alcohol highways fuel etc The seller or producer pays excise duty that is later embedded in the market price paid by the consumer It can be filed both online and offline An excise tax is similar to a sales tax but it s levied only on certain products or services The most common excise taxes are imposed on tobacco alcohol and gasoline The Affordable Care Act also provides for an excise tax on some health related services and products

Excise Tax Definition Federal state or local taxing authorities impose excise taxes Generally speaking in the United States these taxes are levied at the time of production or when the service is performed For this reason the tax is not generally seen as separate by consumers but simply baked into the cost of the good or service An excise tax is a tax imposed on a specific good or activity Excise taxes are commonly levied on cigarettes alcoholic beverages soda gasoline insurance premiums amusement activities and betting and typically make up a relatively small and volatile portion of state and local and to a lesser extent federal tax collections

More picture related to what is excise tax

Excise Tax Examples What Is It Top 3 Practical Examples

https://wallstreetmojo.com/wp-content/uploads/2019/10/Excise-Tax-Examples.jpg

What Is Excise Tax And How Does It Differ From Sales Tax

https://www.accuratetax.com/wp-content/uploads/2015/09/excise-tax.jpg

Excise Tax Definition Types And Examples TheStreet

http://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/9c4ab4cb-56e2-11e9-a65a-d37e40182361.png

An excise tax is a tax a government levies on specific goods and services often with the goal of discouraging their consumption or to make up for their associated social costs Unlike traditional sales taxes which apply to broad swaths of commerce excise taxes target items such as fuel tobacco and firearms An excise tax is a tax charged for items that are frequently seen either as socially harmful or as a luxury good or service Luxury vehicles are subject to excise tax as are alcohol

[desc-10] [desc-11]

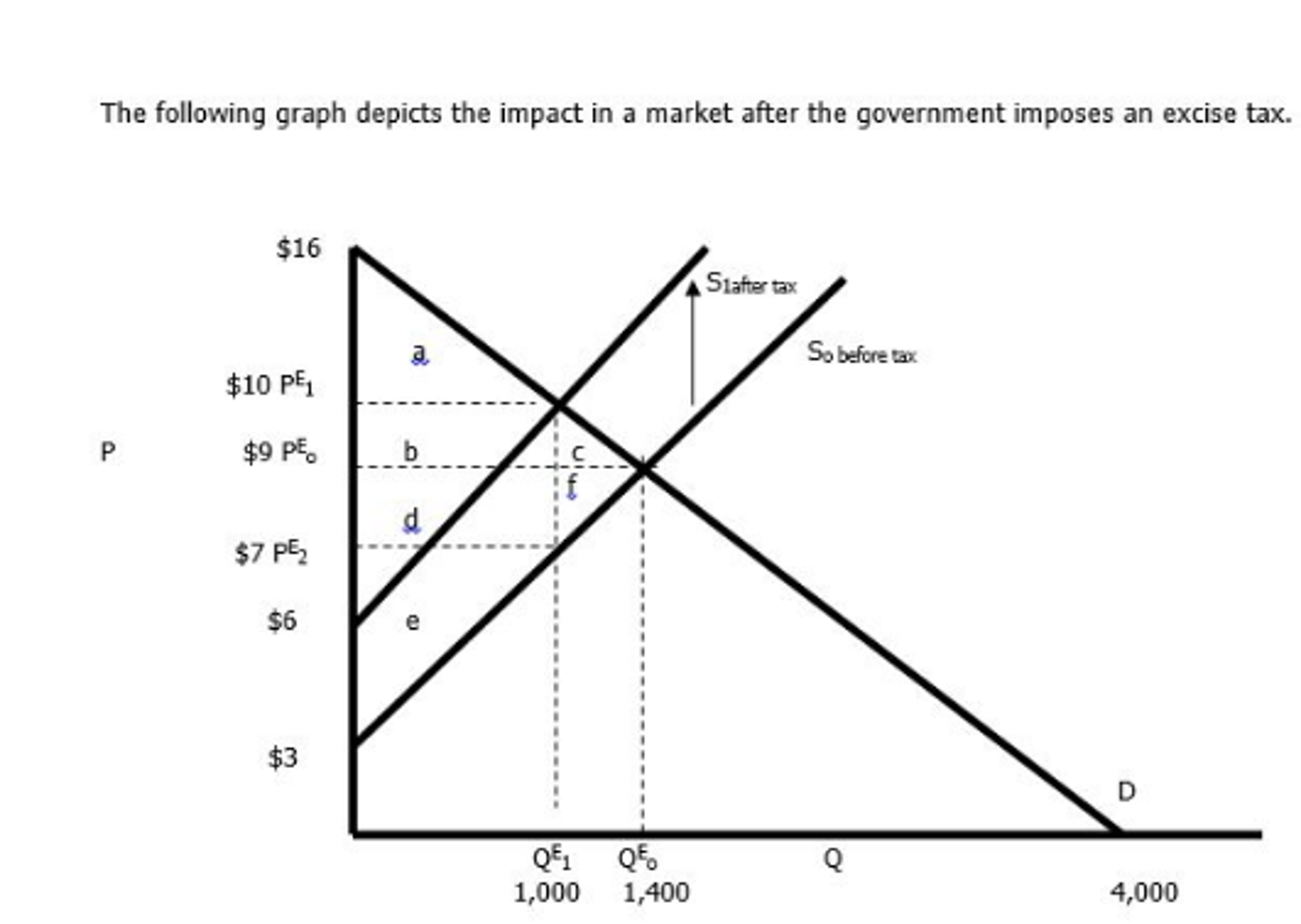

Solved What Is The Dollar Amount Of The Excise Tax 1 1 Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/f19/f19b4f1a-6f92-46fe-ad1e-6dbaf93aa6c3/phphZJo5N.png

How Much Does Your State Collect In Excise Taxes Tax Foundation

https://files.taxfoundation.org/20180607085056/ExcisePerCapita-01-1024x902.png

what is excise tax - [desc-12]