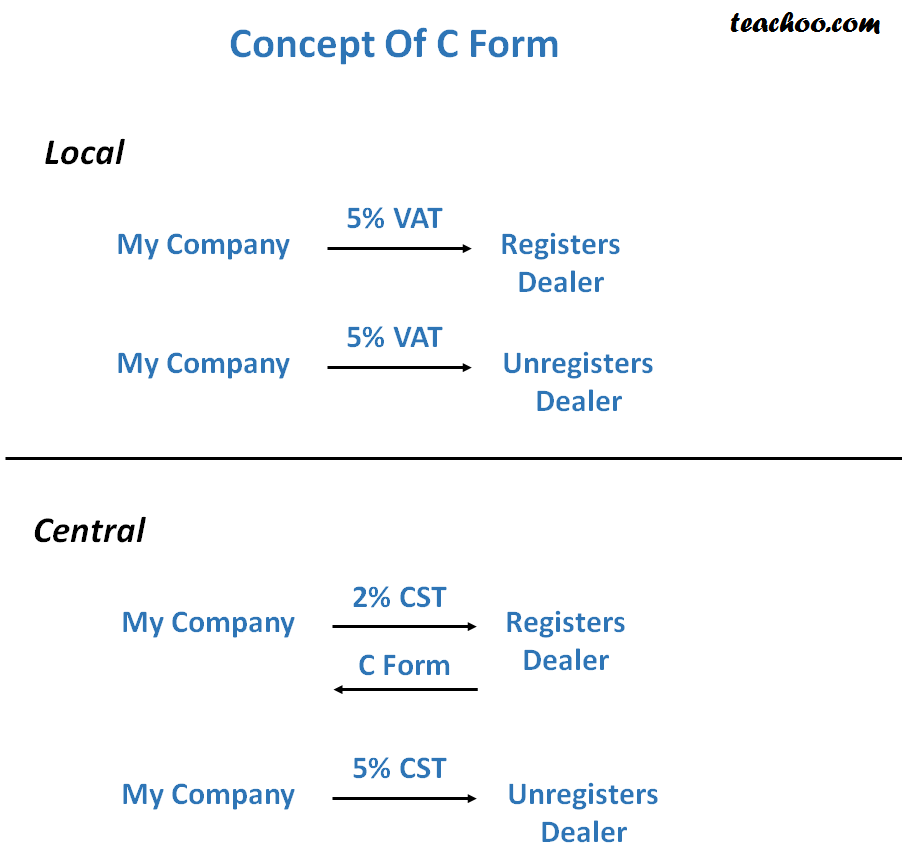

what is c form Levy of Penalty for non submission of C form First of all it should be noted that availing of concessional rate of CST depends upon filing of the C form Section 8 4 of CST Act which provides for furnishing of C form for concessional rate of CST runs as under Section 8 4 The provisions of sub section 1 shall not apply to any sale

What is C Form And what are its implications in current scenario Provision of C Forms is in Central Sales Tax Act 1956 As the name suggest it is to be controlled by Central Government as all revenue goes to Central Govt But in reality it is controlled by individual states and creating a lot of problem In maharashtra 15 1 25 pm is applicable 1 Like Sheela Manager Accounts 51 Points Replied 31 January 2016 In my opinion for non receipt of C Forms though higher rate is levied one need not pay any interest provided it is proved through invoices the sale took place originally against the declaration form

what is c form

what is c form

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/62c19987-c545-48af-9fb6-6798c20be2b6/c-form.png

How To File Self Employed Taxes Online For 100 Or Less Careful Cents

http://www.carefulcents.com/wp-content/uploads/2017/03/Schedule-C-form-1024x687.png

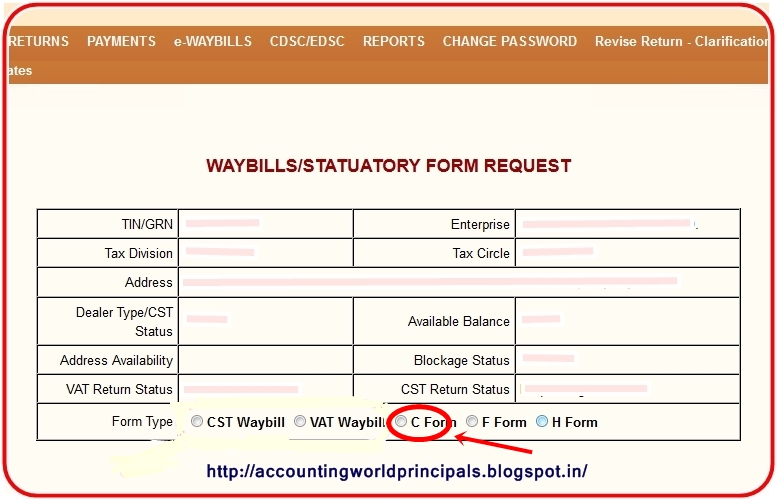

How To Apply Upload C Form NEW In Andhrapradesh Sales Tax Website

http://2.bp.blogspot.com/-k7nCWhQO-R4/UU25dpZEUcI/AAAAAAAABrY/AbEx3PhMrew/s1600/Andhrapradesh+Commercial+sales+tax+-+C-Form2+.jpg

A seller has not received the C FORM from his buyer since 2 yrs He had earlier made a sale at concessional rate 2 If the sale were not made against C FORM then the same goods would have suffered tax 4 Now notice is sent by sales tax dept asking for payment of difference of tax amount Also buyer is of no intention to give that C Replied 28 January 2012 Hi anjali you should include excise duty while issuing form C Form c is issued at the amount on which cst is calculated suppose if the basic value is rs 100 excise duty 10 rs cst 2 rs than you need to issue c for m on 110 rs only vaibhav student 253 Points Replied 28 January 2012

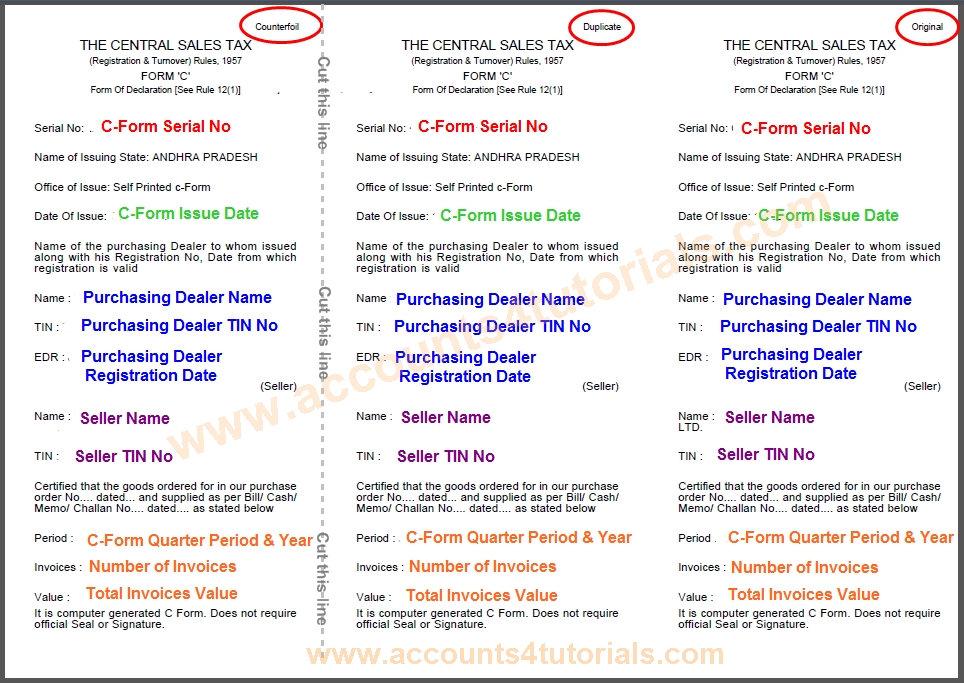

Rules show that even when the Original C Form is lost the Assessing Authority on the basis of indemnity bond may proceed with the assessment for giving the benefit of exemption under Sub section 4 of the Section 8 of the Central Sales Tax Act 1956 When to submit the C form with the authorities by the selling Dealer The prescribed form for claiming concessional rate of CST u s 8 1 is C form which is obtained by the purchaser from the sales tax authorities in his state and is given to the seller for the goods purchased at concessional rate C form obtained from the purchaser needs to be furnished by the seller to the prescribed authority within 3

More picture related to what is c form

What Is C Form In Hotel CaresClub

https://caresclub.com/wp-content/uploads/2023/12/homealtafguestpostcartGuestPostCartmediatempd78f4494-ae29-4f69-8d46-e1164f1b6578-scaled.jpg

What Is C Form

https://tnexams.in/wp-content/uploads/2023/07/What-Is-C-Form.jpg

How To Report K1 On 1040 TAXW

https://sharedeconomycpa.com/wp-content/uploads/2020/01/schedule-c-instructions.png

C form correction jayesh accountant 361 Points 24 November 2011 Dear Sir Madam we have issue one c form to our party by mistake party bill no wrongly mantion in c form which process to correct c form bill no 19 Replies CA Ratan kandare Expert Follow 12 August 2010 Dear sir following are the procedure to be followed by a suppplier if he lost the C form issued by the purchaser 1 Intimate your sales tax office for the lost of C form 2 intimet your purchaser and give the following document for issueing Duplicate C form

[desc-10] [desc-11]

What Is C Form Accounting Taxation

http://1.bp.blogspot.com/-Honyp_bVKxg/UhEKvD1b1iI/AAAAAAAACzU/kpl5uKtFOPU/s1600/AP+Commercial+Tax+C-Form+Generate+.jpg

What Is C Form And Use Of C Form In CST

https://1.bp.blogspot.com/-50euipt_7OU/VoTZIXgC68I/AAAAAAAAAtk/jv0MZoQ_eos/s1600/what-is-c-form.jpg

what is c form - [desc-14]