what is a 1098 e student loan statement Information about Form 1098 E Student Loan Interest Statement Info Copy Only including recent updates related forms and instructions on how to file File this form if

The 1098 E tax form reports the amount of interest you paid on student loans in a calendar year Loan servicers send a 1098 E to anyone who pays at least 600 in student loan interest The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some federal

what is a 1098 e student loan statement

![]()

what is a 1098 e student loan statement

https://collegeaftermath.com/wp-content/uploads/2022/07/icons8-team-FcLyt7lW5wg-unsplash-768x1152.jpg

Form 1098 E American Tax Training

https://americantaxtraining.com/wp-content/uploads/2022/06/form-1098-E.png

1098 T FAQs UT Southwestern Dallas Texas

https://www.utsouthwestern.edu/education/students/assets/1098.jpg

1098 E Form student loan interest statement is a tax form used to report student loan interest Learn more about this tax form with the help of H R Block The 1098 E form is a student loan interest statement It states how much interest you paid on student loans within a year and you may find out you are eligible for deductions

Your loan servicer issues a 1098 E statement which reports the amount of loan interest paid on a student loan during the year for borrowers in repayment Some borrowers may be eligible to use this amount that appears in Box 1 or a If you paid interest on a qualified student loan you may be able to deduct it on your federal income tax return using IRS Form 1098 E This form reports the amount of interest paid and is

More picture related to what is a 1098 e student loan statement

What Is A 1098 E Form What You Need To Know About The Student Loan

https://s.yimg.com/ny/api/res/1.2/6cMowBRaxpaYaVe_haTMPA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02Nzk-/https://media.zenfs.com/en/usa_today_money_325/009c6ac47159f7f2267e42574f14d0ca

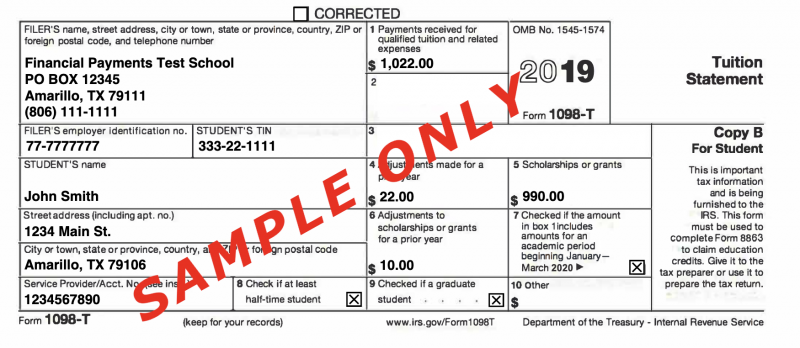

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

1098 T Software To Create Print And E File IRS Form 1098 T Student

https://i.pinimg.com/736x/7b/60/e5/7b60e5c162ada12b82686b6e50418967.jpg

Form 1098 E is a Student Loan Interest Statement we issue to clients who ve paid eligible student loan interest during the calendar year You may be able to deduct some or even all of The 1098 E is almost certainly correct FedLoan might not have had great management of everything it did but financial institutions don t mess around with tax forms You can rely on

Any interest that you paid on qualifying student loans is generally reported to you on Form 1098 E Student Loan Interest Statement by the financial institution to which you made the Box 1 Shows the interest received by the lender during the year on one or more student loans made to you For loans made on or after September 1 2004 box 1 must include loan

What Is A 1098 E Form Student Loan Interest Statement H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2019/11/college-student-graduate-loans-768x505.jpg

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Form 1098 Mortgage Interest Statement And How To File

https://www.investopedia.com/thmb/I2hSqiwM-Z4WyzK-zDK4noFs5Zg=/1428x928/filters:fill(auto,1)/Form1098-5c57730f46e0fb00013a2bee.jpg

what is a 1098 e student loan statement - Your loan servicer issues a 1098 E statement which reports the amount of loan interest paid on a student loan during the year for borrowers in repayment Some borrowers may be eligible to use this amount that appears in Box 1 or a