what is 3 401k A 401 k is a staple for many people s retirement planning so it s important to understand how they work Browse Investopedia s expert written library to learn more

This powerful defined contribution plan can help you save and invest for retirement You decide how much to contribute to your account and which investments to choose The unintuitive name comes Key Takeaways Your traditional 401 k contributions reduce your taxable income in the year that you make them A 401 k employer match can help you grow your nest egg even faster In

what is 3 401k

what is 3 401k

https://slavic401k.com/wp-content/uploads/2022/02/Employer-Matching-Table.png

How Companies Can Improve Their 401 k Plans

https://www.gannett-cdn.com/-mm-/4f1aaefb83599761e560c64d1397c3e4146411c7/c=0-104-3453-2055/local/-/media/USATODAY/None/2014/10/30/635502730928573425-177287438.jpg?width=3200&height=1680&fit=crop

What Is A 401 k Match OnPlane Financial Advisors

https://images.squarespace-cdn.com/content/v1/5c101a4e7c9327fdf174b93b/1564583290453-TT3LQ1RAEZYYLHF083DP/30years_3%25.jpg

A 401 k plan is a tax advantaged retirement account employers offer to help their employees save for retirement The two most common types of 401 k plans are traditional and Roth A 401 k is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made Because of

A 401 k plan is an employer sponsored retirement plan with substantial growth potential Your 401 k plans can be funded with pre tax dollars or after tax dollars It s If you have access to a 401 k plan through your job learn more about employer matching and saving on taxes plus how it can help you save and invest for retirement

More picture related to what is 3 401k

Brief About 401 k Plan In US Payroll Using The OpenHRMS

https://www.openhrms.com/blogs/Uploads/BlogImage/brief-about-401k-plan-in-us-payroll-using-the-openhrms.jpg

How Much Should I Have In My 401k During My 20 s 30 s 40 s And 50 s

https://i.pinimg.com/originals/85/e7/d7/85e7d72a77022a550d629482263dba23.png

Roth IRA Vs 401 k Which Is Better For You Ira Investment Roth

https://i.pinimg.com/originals/8c/00/18/8c0018f99bf15a1a564f15b326716600.png

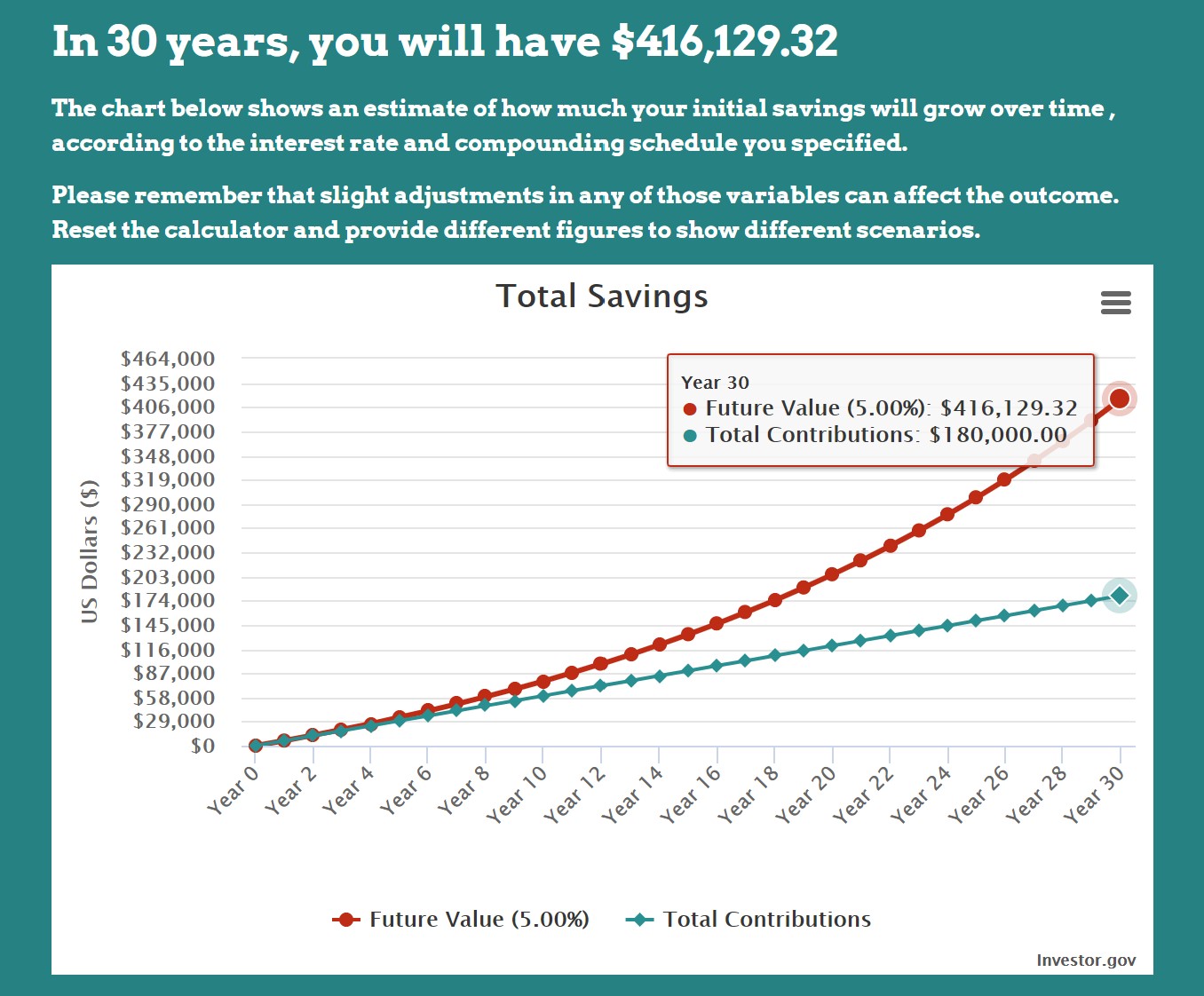

Your 401 k balance at retirement is based on the values you plug into the calculator your total planned annual contribution your current age and retirement age and the rate of return The 401 There are three types of fiduciaries of 401 k plans with different duties and liabilities 3 16 3 21 and 3 38

401 k retirement calculator A traditional 401 k can be one of your best tools for creating a secure retirement It provides you with two important advantages First all contributions and A 401 k plan is a tax advantaged retirement savings tool offered by employers that allows eligible employees to contribute a portion of their salary up to a set amount each year

Pension Vs 401K Plan Find The Key Differences One Should Know

https://www.compareclosing.com/blog/wp-content/uploads/2021/08/Pension-vs-401K-Plan-Find-The-Key-Differences-One-Should-Know.jpg

How To Choose Your 401k Provider

http://www.vision-hr.com/wp-content/uploads/2018/10/401k-benefits.jpg

what is 3 401k - What Is a 401 k Most for profit companies offer 401 k s which help their employees build tax advantaged retirement savings Depending on whether you choose a