what is 25 plus tax How Much is 25 Plus Tax 25 plus tax is equal to 27 06 assuming a local tax rate of 8 25 The local sales tax calculator is used to calculate the total costs of an item after tax is taken into account How Much is 25 Plus Tax Costs Tax Rate What is 25 Plus Tax 25 Plus Tax Table

How to calculate sales tax with our online sales tax calculator Find out the sales tax rate In our example let us make it 4 Find out the net price of a product Let s use 45 Multiply your net price by 4 so by 0 04 Sales Tax Calculator Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due

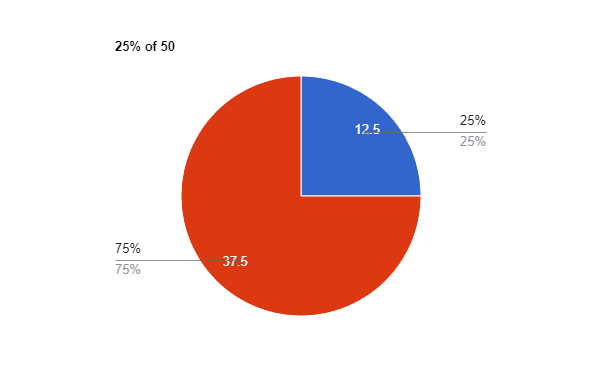

what is 25 plus tax

what is 25 plus tax

https://i.ytimg.com/vi/jEIoRXMBeuw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLBES_cNQPCebjOkniVTV9o-_c3IBQ

One Size Leggings 25 Plus Tax Women Fashion Women s Top

https://i.pinimg.com/originals/fb/6f/7a/fb6f7ab64981253b25f9214760452c96.jpg

Safety Sign The Prices Of All Taxable Items Include Sales Tax

https://media.compliancesigns.com/media/catalog/product/p/a/payment-policies-sign-nhe-33994_1000.gif

A sales tax is a consumption tax paid to a government on the sale of certain goods and services Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase In most countries the sales tax is called value added tax VAT or goods and services tax GST which is a different form of consumption tax Sales tax 5 00 Cost Price before ST 100 00 Total Cost Price including ST 105 00 In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return these results Sales tax 7 33 Cost Price before ST 104 67 Total Cost Price including ST 112 00 Sales tax definition and rates

This free online Sales Tax Calculator will calculate the sales taxes on the price of a product or service given a sales tax percentage price plus tax and if you want will also tell you the number of hours you will need to allocate The sales tax or VAT doesn t really matter in this case is 25 The gross price would be 40 25 40 40 10 50 Net price is 40 gross price is 50 and the tax is 25 You perform a job and your gross pay is 50 The income tax is 20 so your net income is 50 20 50 10 40

More picture related to what is 25 plus tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

25 Percentage Formula Online AbbigaelBain

https://www.storyofmathematics.com/wp-content/uploads/2022/09/of-.png

Buying A First Home At 60 No It s Not A Sin World Today News

https://m1.quebecormedia.com/emp/emp/Cropscc56afde-7cff-4718-83a0-3b1670d878a5_ORIGINAL.jpg?impolicy=crop-resize&x=0&y=293&w=1586&h=653&width=1200

Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage Partner with ConvertIt New Online Book Handbook of Mathematical Functions AMS55 Conversion Calculation Home Calculators Financial Sales Tax Calculator Enter Cost Price Net Amount excluding tax 100 00 Tax 8 875 8 88 Gross Amount including tax 108 88 Share Results Our sales tax calculator will calculate the amount of tax due on a transaction The calculator can also find the amount

Input the Final Price Including Tax price plus tax added on Input the Tax Rate Please check the value of Sales Tax in other sources to ensure that it is the correct value We can not guarantee its accuracy See also the Sales Tax Calculator Add Tax on Our free online Sales Tax Calculator allows you to calculate the sales tax for any state that is inside of the United States GoodCalculators A collection of really good online calculators for use in every day domestic and commercial use

Solved Relationship Between Tax Revenues Deadweight Loss And

https://www.coursehero.com/qa/attachment/17129554/

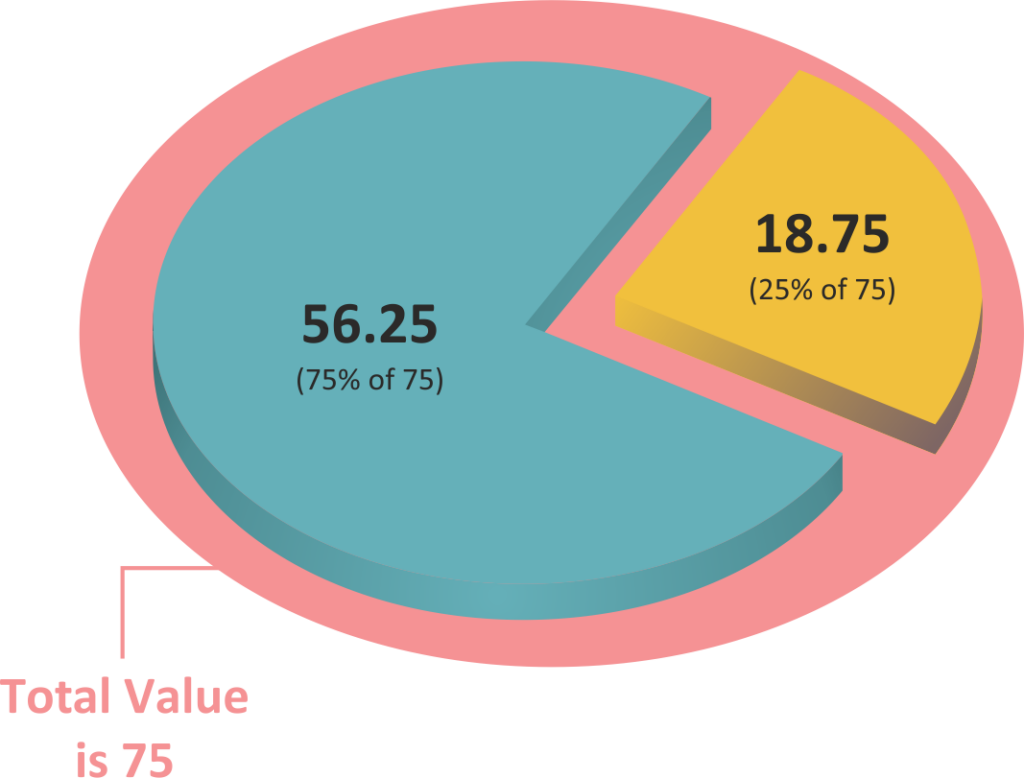

What Is 25 Of 75 Solved In 10 Seconds

https://moonpreneur.com/math-corner/wp-content/uploads/2023/03/part_II-1-1024x778.png

what is 25 plus tax - A sales tax is a consumption tax paid to a government on the sale of certain goods and services Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase In most countries the sales tax is called value added tax VAT or goods and services tax GST which is a different form of consumption tax