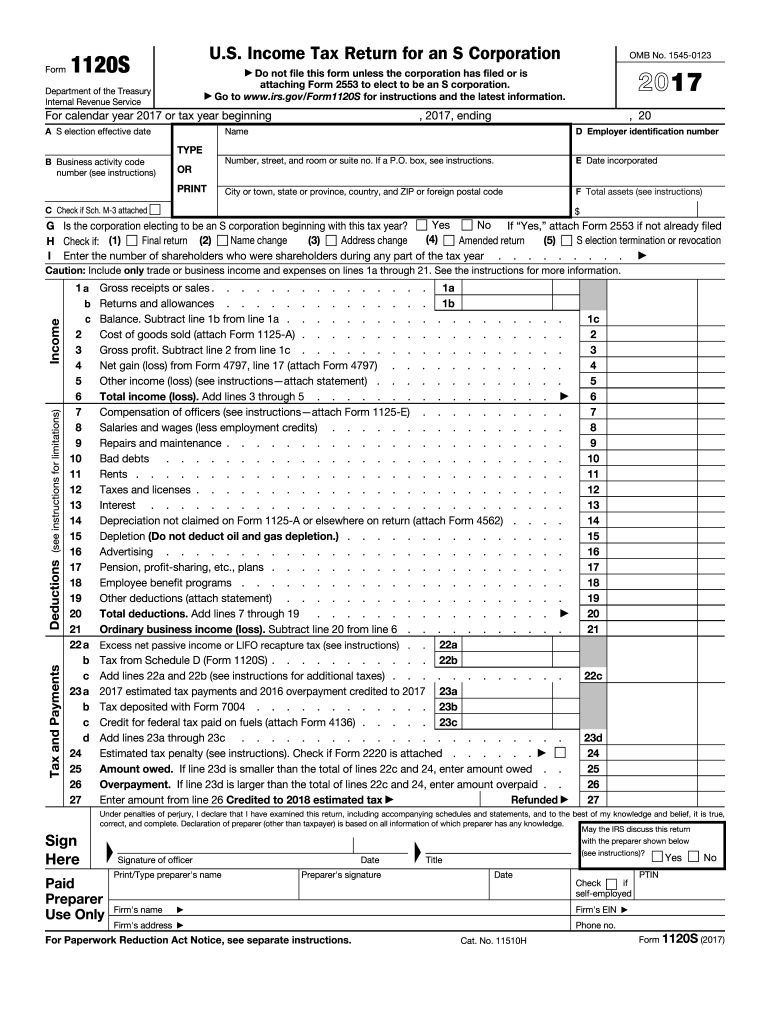

what is 1120s corporation A corporation or other entity must file Form 1120 S if a it elected to be an S corporation by filing Form 2553 b the IRS accepted the election and c the election remains in effect After filing

Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax Not sure if you need to file a form 1120 or form 1120 S Learn more about what each form is when to use them and how to fill them out with Paychex A new business must define its organizational structure to file the

what is 1120s corporation

what is 1120s corporation

https://images.ctfassets.net/ifu905unnj2g/4CNBW9sQAi1ohEXxqWQ61e/700e85f7da67b2af25f0f92385a00819/BenchBlog_TaxTips_HowToCompleteForm1120.png

1120s Form Fill Out And Sign Printable PDF Template AirSlate SignNow

https://www.signnow.com/preview/425/425/425425022/large.png

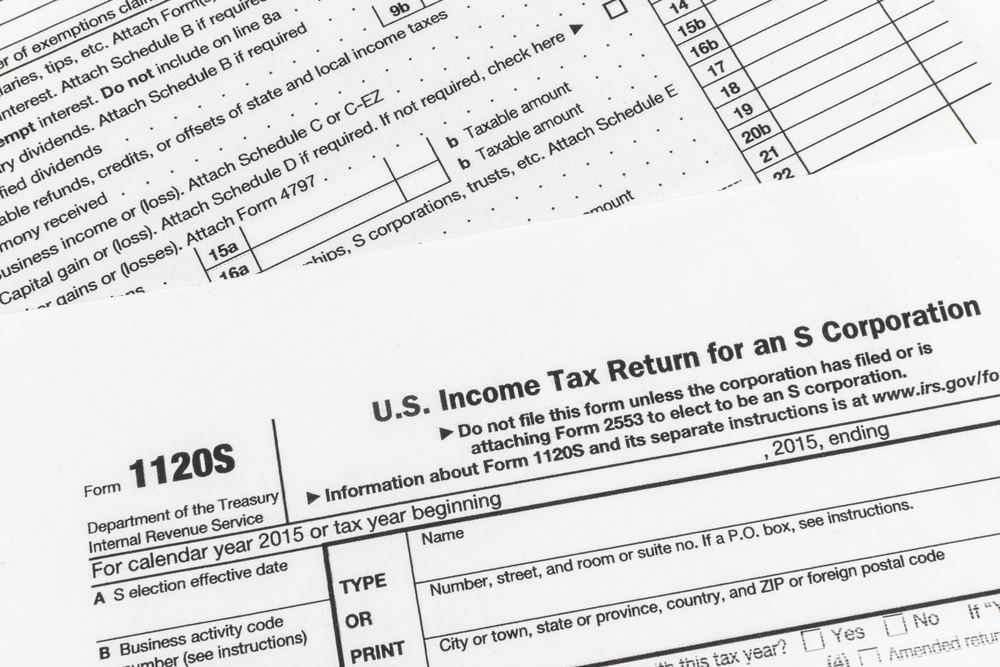

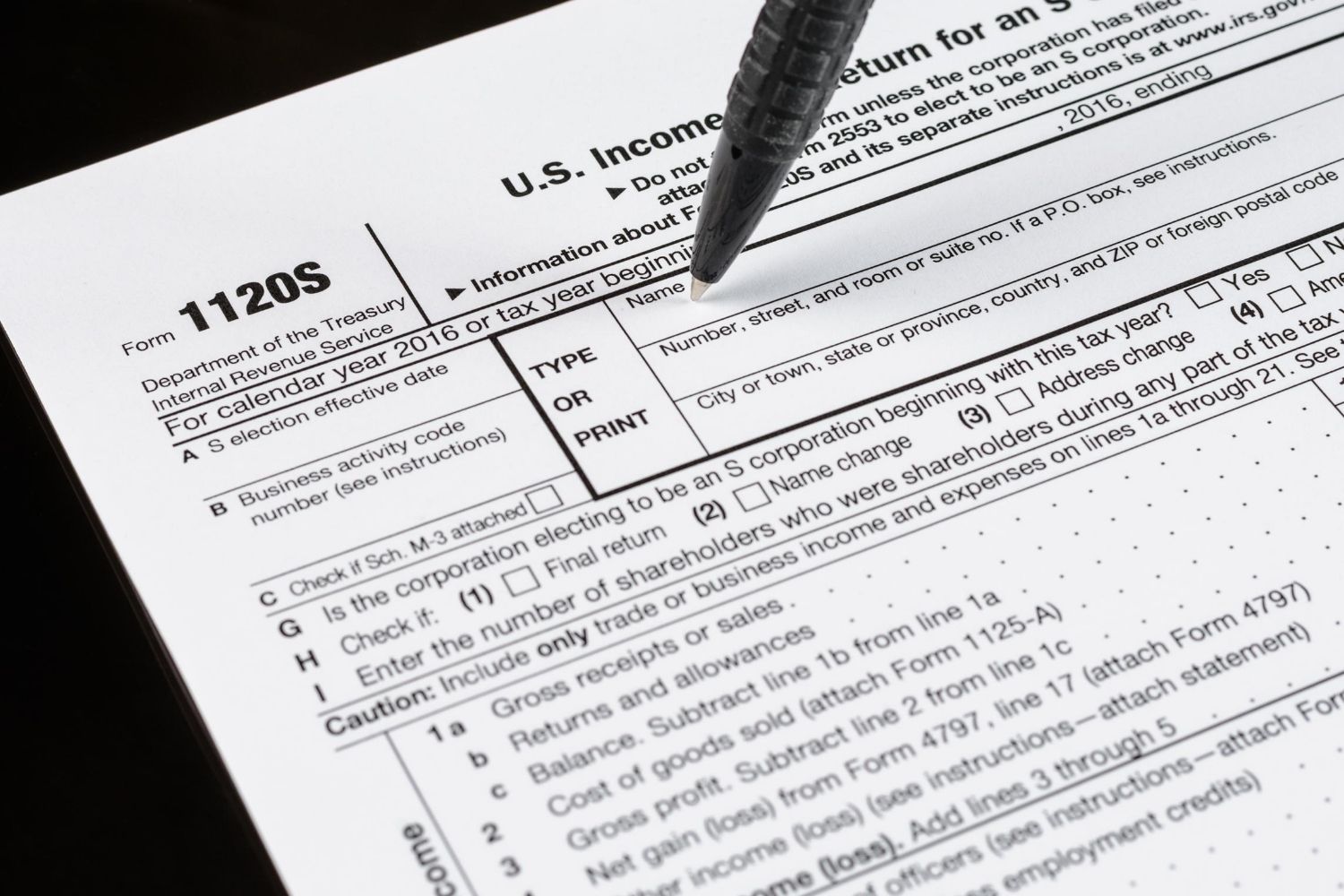

How To Complete Form 1120S Income Tax Return For An S Corp

https://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Tax-and-Payments-Section-1024x275.png

If you are an owner or investor in an S corp you likely need to file the Schedule K 1 Form 1120S You won t have to submit the physical form to the IRS as they already get a copy with the business tax return Form 1120 S is crucial in reporting S corporations income losses and deductions It s essential to understand what this form is who needs to file it and how to do it correctly to ensure your business stays compliant

Form 1120 S is a U S Income Tax Return form used by S Corporations S corps to report income gains losses deductions and credits to the Internal Revenue Service IRS A sample 1120 S form is available IRS Form 1120 S is specifically designed to report the income gains losses deductions credits and other financial information of a domestic corporation or other entity that has elected to be an S Corporation in the United States

More picture related to what is 1120s corporation

ESBT And QSST Elections Castro Co

https://www.castroandco.com/images/blog/S-Corporation.jpg

Form 1120S S Corporation Income Tax Skill Success

https://www.skillsuccess.com/wp-content/uploads/2020/07/scorp-income-tax-2.jpg

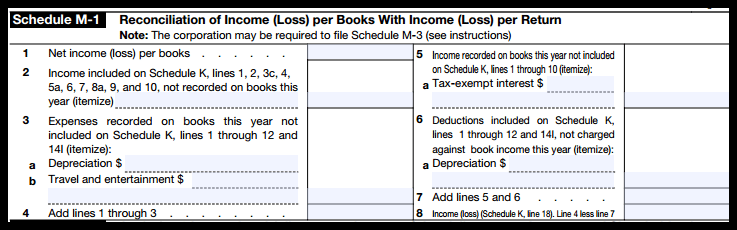

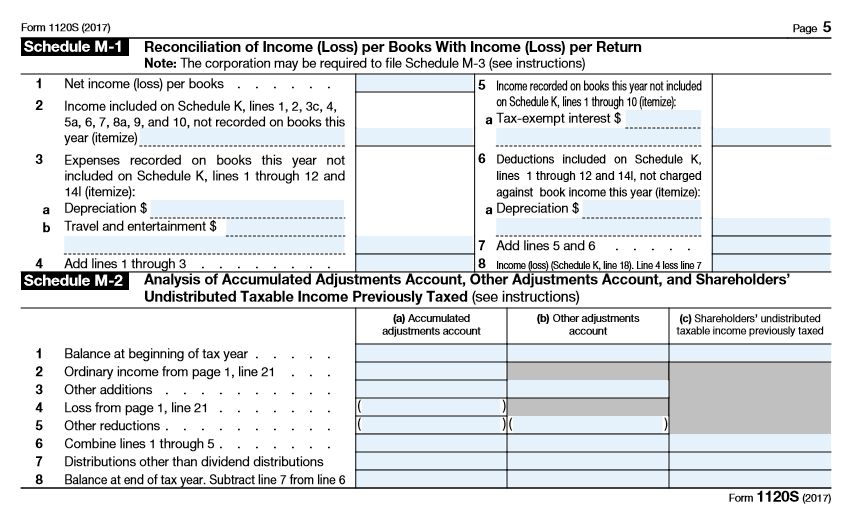

How To Complete Form 1120S Income Tax Return For An S Corp

https://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Reconciliation-of-Income-Loss-per-Books-with-Income-Loss-per-Return-Schedule-M-1.png

Form 1120 S U S Income Tax Return for an S Corporation is a tax form that S Corporations use to report their earnings losses and dividends to the IRS Form 1120 S is The corporation is a tax shelter and the corporation has business interest expense

IRS Form 1120 the U S Corporation Income Tax Return is used to report corporate income taxes to the IRS It can also be used to report income for other business IRS Form 1120 S is the tax form S corporations use to file a federal income tax return This tax form informs the IRS of your total taxable earnings in a tax year It s used to

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

IRS Form 1120S Schedule K 1 2020 Shareholder s Share Of Income

https://lh3.googleusercontent.com/5_zpuYMba3N7eazY7Z9ySHRJKB5cQ1jdZRduV6EZqGmJeKrUYBbSozNM-zkOOAs=w1200-h630-p

what is 1120s corporation - Form 1120S is the tax form S corporations use to file their federal income tax return not to be confused with Form 1120 for C corporations Every S corp needs to file one including LLCs