what is 10 of 8995 The result 10 of 8995 is 899 5 In words ten percent of eight thousand nine hundred ninety five is eight hundred ninety nine point five

How to calculate a percentage increase or decrease X is Y percentage of what number What is a percentage A percentage is a number that expresses a portion or proportion Information about Form 8995 Qualified Business Income Deduction Simplified Computation including recent updates related forms and instructions on how to file Use

what is 10 of 8995

what is 10 of 8995

https://www.pdffiller.com/preview/581/853/581853093/large.png

IRS Form 8995 Walkthrough QBI Deduction Simplified Computation YouTube

https://i.ytimg.com/vi/0gjpTaeVHlE/maxresdefault.jpg

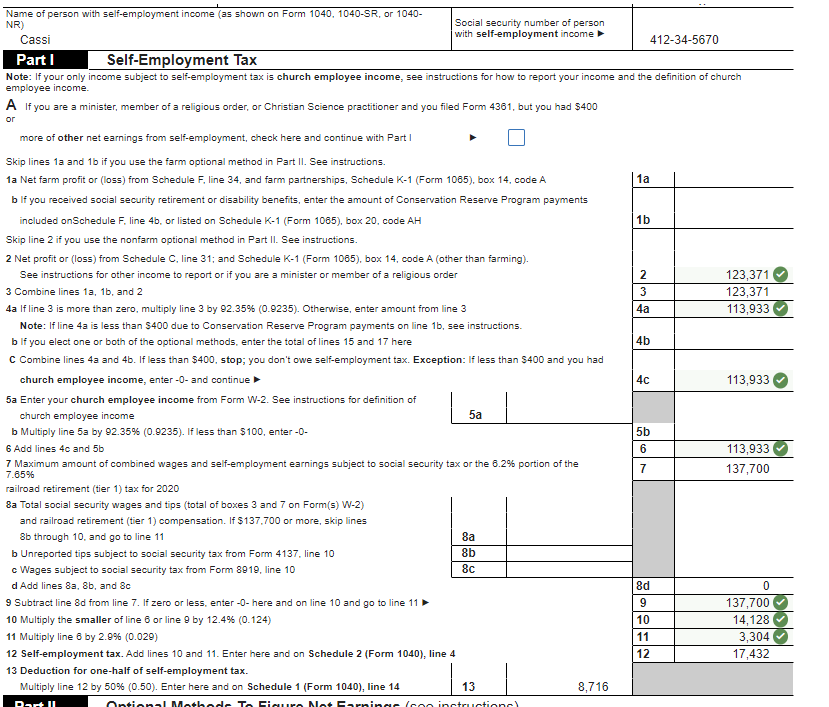

I Have The Schedule C And SE Finished Below Please Chegg

https://media.cheggcdn.com/media/08a/08a39ea7-7680-4e21-b76d-93f3f471602c/phpaywZMS

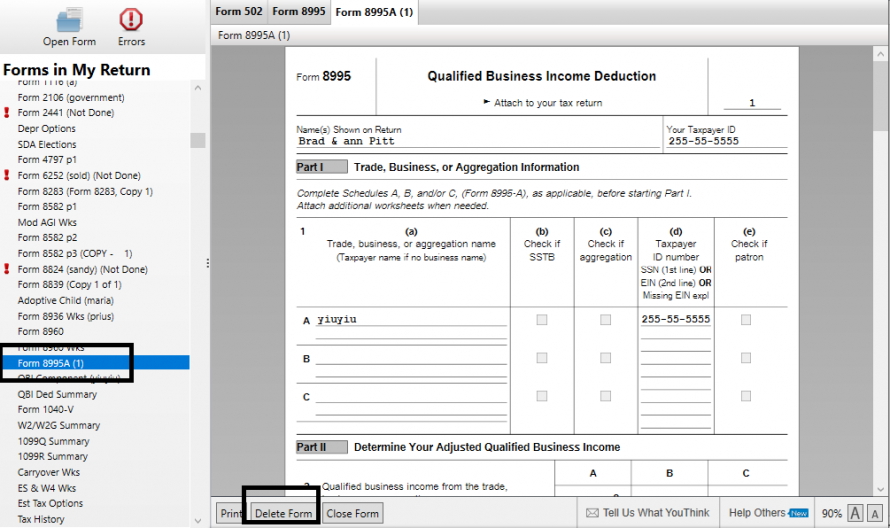

Form 8995 or 8995 A as applicable must be attached to any return claiming a qualified business income deduction beginning in 2019 As with most tax issues the What is Form 8995 Form 8995 is the IRS tax form that owners of pass through entities sole proprietorships partnerships LLCs or S corporations use to take the qualified

Use Form 8995 to figure your qualified business income QBI deduction Individual taxpayers and some trusts and estates may be entitled to a deduction of up to The qualified business income deduction QBI is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate There are two

More picture related to what is 10 of 8995

Printable Form 8995 Blog 8995 Form Website

https://8995form.com/images/uploads/blog/2021-12-08/0a465d3b-279d-4e2b-8573-4c2b90f0df40-trfba-rs-wX-890.default-trfba-rs-wX-890.png

2022 Form WI I 010i Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/624/401/624401892/large.png

What Is Form 8995 A TurboTax Tax Tips Videos

https://digitalasset.intuit.com/IMAGE/A4aVmW3UM/What_is_Form_8995A.jpg

Form 8995 to figure the QBI deduction if You have QBI qualified REIT dividends or qualified PTP income or loss all defined later and Your 2023 taxable To calculate your QBI deduction using Form 8995 you need to follow these steps Fill out Part I to determine your QBI component for each trade or business You

IRS Form 8995 is the tax form that taxpayers use to determine the amount of their QBI deduction There are actually two versions of this form IRS Form 8995 Use our round to the nearest calculator to get the nearest approximation to 8995 when rounded to the nearest ten well as in terms of millions thousands hundreds tens

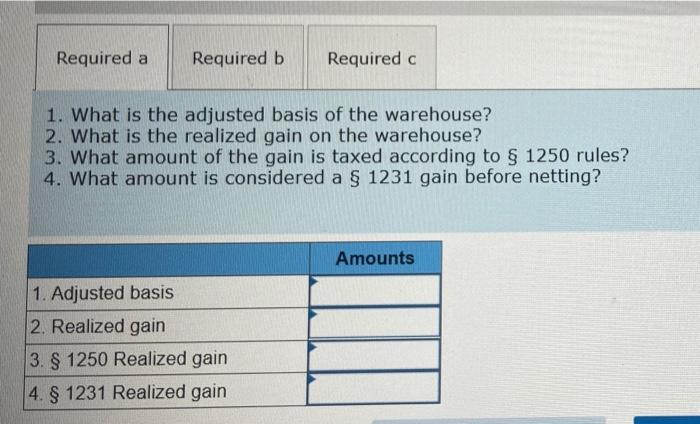

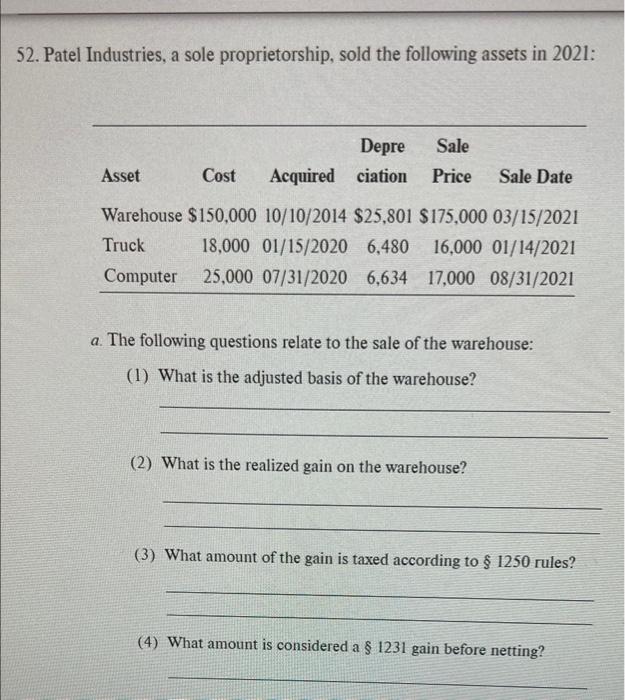

Solved Patel Industries A Sole Proprietorship Sold The Chegg

https://media.cheggcdn.com/study/3fa/3fac0670-4f9c-414f-aecf-9eaeb8731fc6/image

Solved 52 Patel Industries A Sole Proprietorship Sold The Chegg

https://media.cheggcdn.com/study/0a0/0a07e78e-ccce-4864-bd16-b9a3023452a1/image

what is 10 of 8995 - Use Form 8995 to figure your qualified business income QBI deduction Individual taxpayers and some trusts and estates may be entitled to a deduction of up to