Sez Supply Gst Rate - Worksheets have come to be important devices for numerous functions, extending education and learning, service, and personal organization. From easy math workouts to complex service analyses, worksheets serve as organized structures that facilitate discovering, preparation, and decision-making procedures.

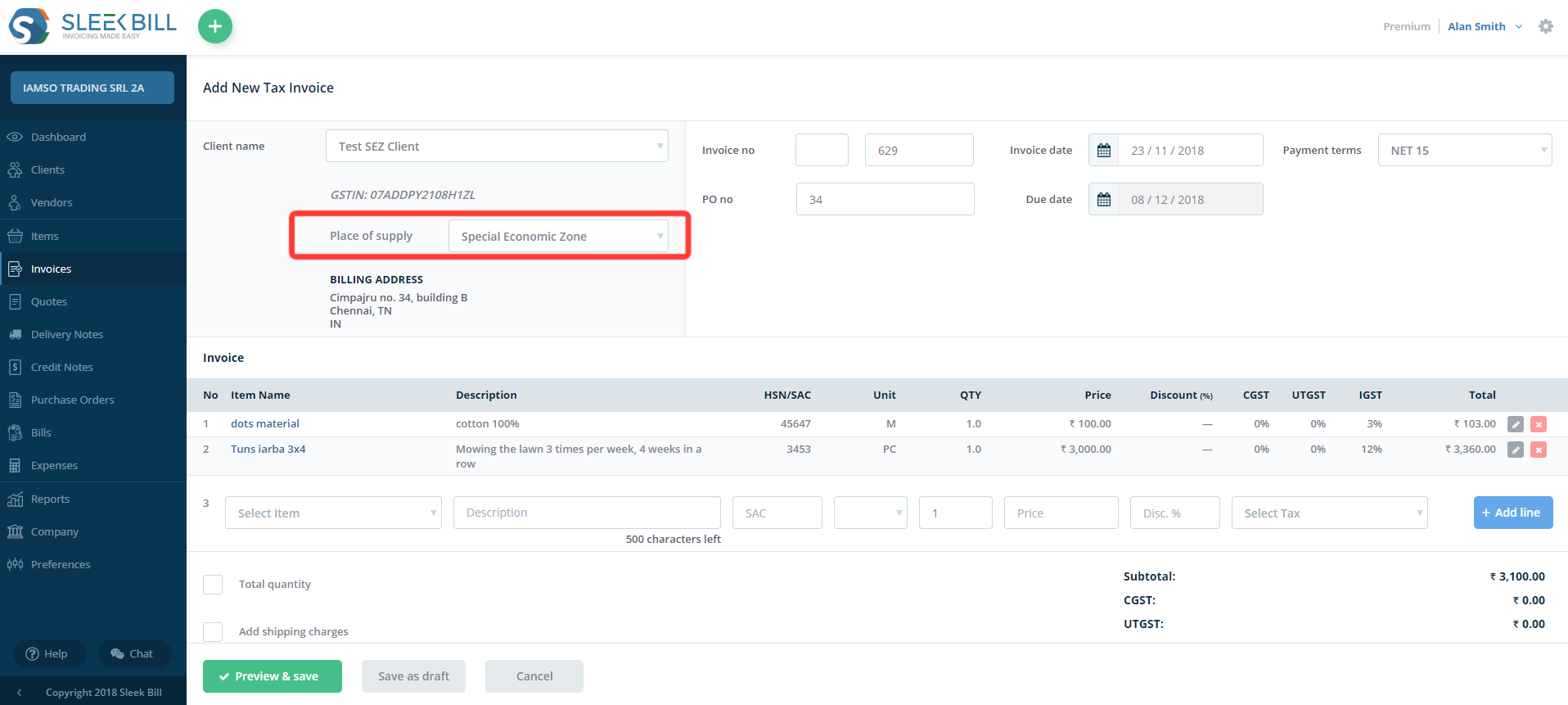

SEZ And How To Invoice SEZ India

SEZ And How To Invoice SEZ India

Worksheets are arranged data that assistance systematically set up information or jobs. They provide a visual representation of ideas, allowing customers to input, handle, and assess information successfully. Whether made use of in school, conferences, or personal settings, worksheets streamline procedures and enhance efficiency.

Worksheet Varieties

Learning Equipment for Children

In educational settings, worksheets are important sources for instructors and students alike. They can range from mathematics problem sets to language comprehension exercises, providing opportunities for practice, support, and analysis.

Work Vouchers

In business world, worksheets serve several features, including budgeting, task planning, and information analysis. From monetary declarations to SWOT evaluations, worksheets help companies make notified decisions and track progress towards objectives.

Personal Worksheets

Personal worksheets can be a valuable tool for accomplishing success in numerous aspects of life. They can assist individuals established and function towards objectives, handle their time properly, and monitor their progression in areas such as fitness and financing. By supplying a clear framework and sense of liability, worksheets can assist individuals stay on track and attain their purposes.

Making the most of Understanding: The Benefits of Worksheets

Worksheets use various benefits. They stimulate involved learning, increase understanding, and support logical thinking capacities. Furthermore, worksheets support framework, rise efficiency and enable teamwork in team scenarios.

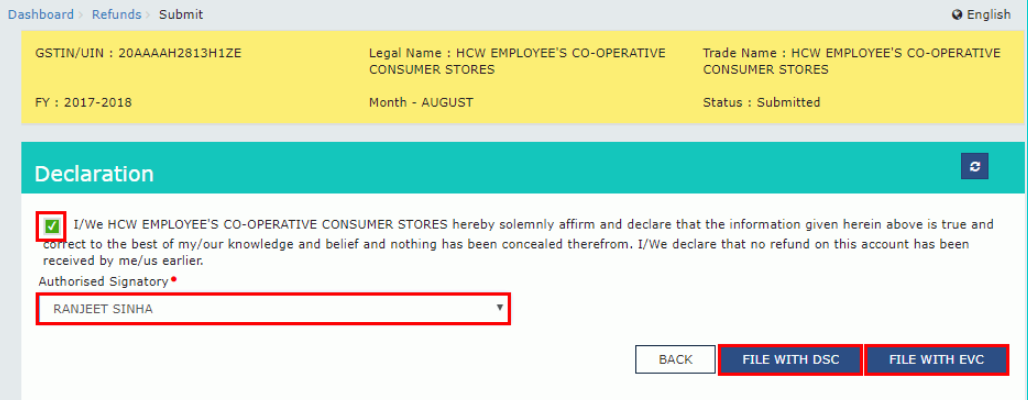

GST Refund Supply To SEZ Eligibility Application IndiaFilings

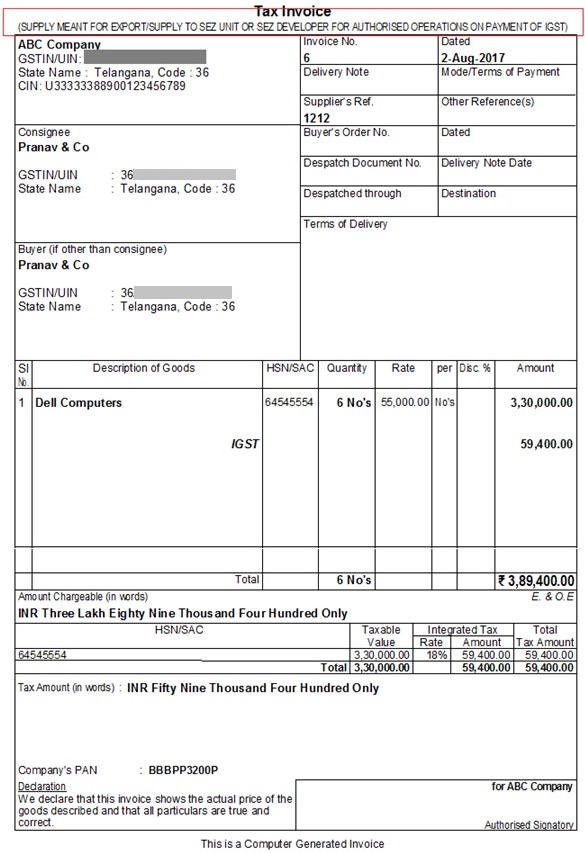

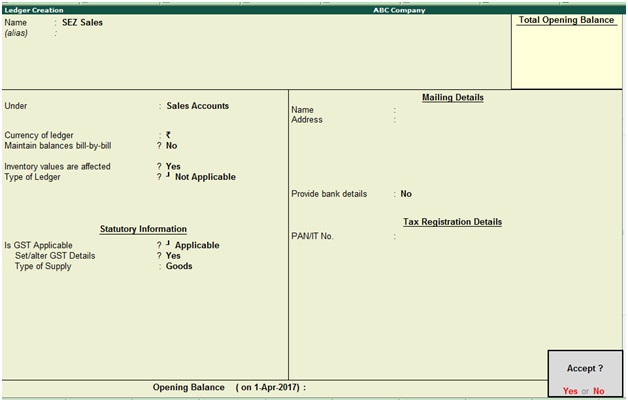

GST SEZ Sales In Tally ERP9 Waytosimple

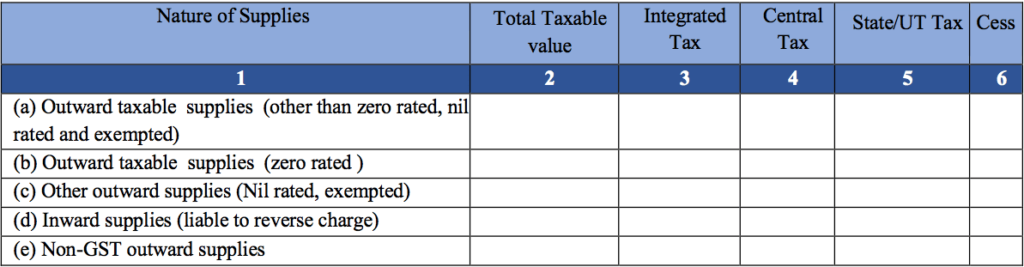

Zero Rated Supply Under GST

How To Record Sales Under GST In TallyPrime TallyHelp

What Is Gst Gst Full Form Gst Rates Its Impact And What It Means For

GST SEZ Sales In Tally ERP9 Waytosimple

Calculation Of GST Based On Slab Rate Price Cess On Quantity Cess On

How To Claim GST Refund On Supplies To SEZ Unit Developer Without Tax

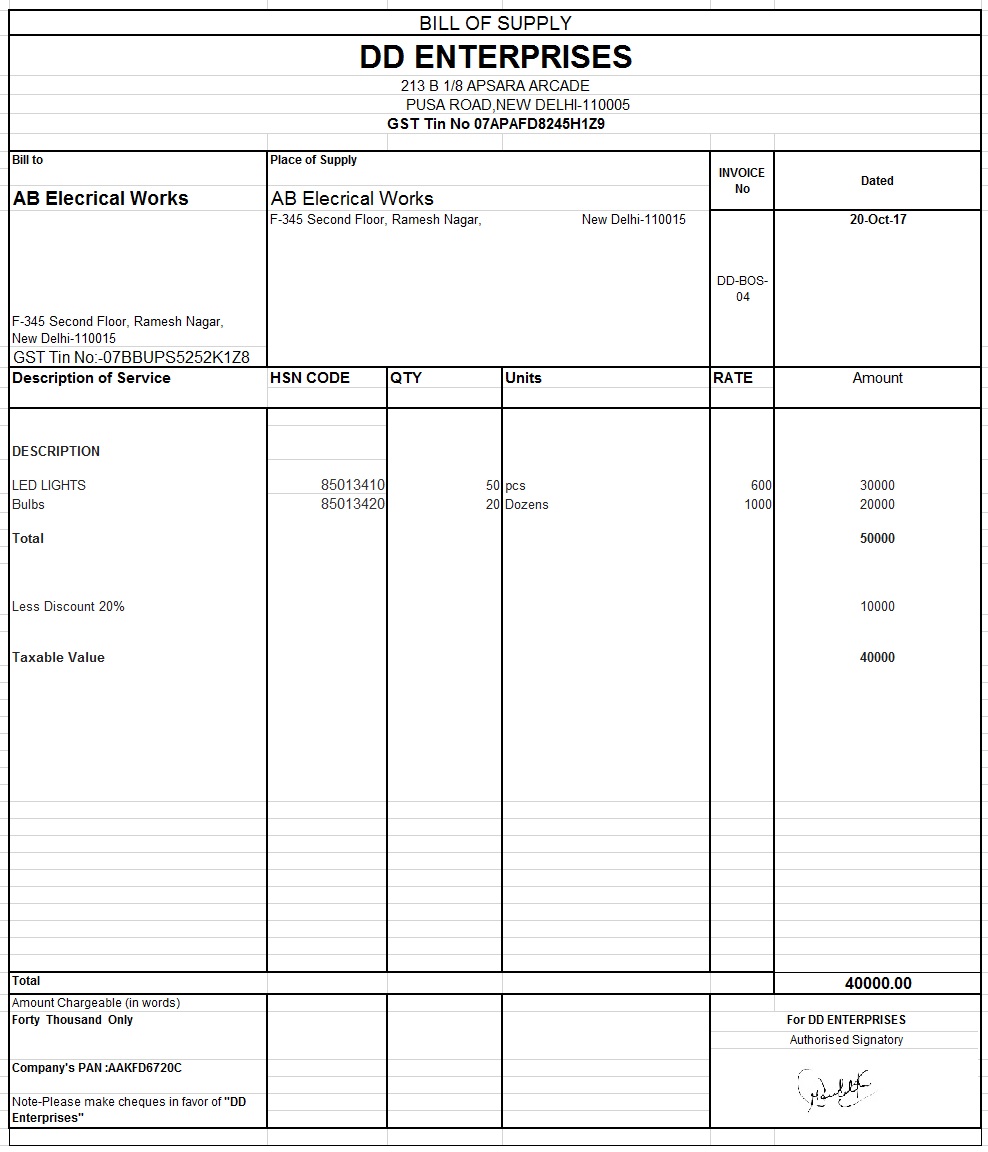

What Is Bill Of Supply In GST GST Invoice Format

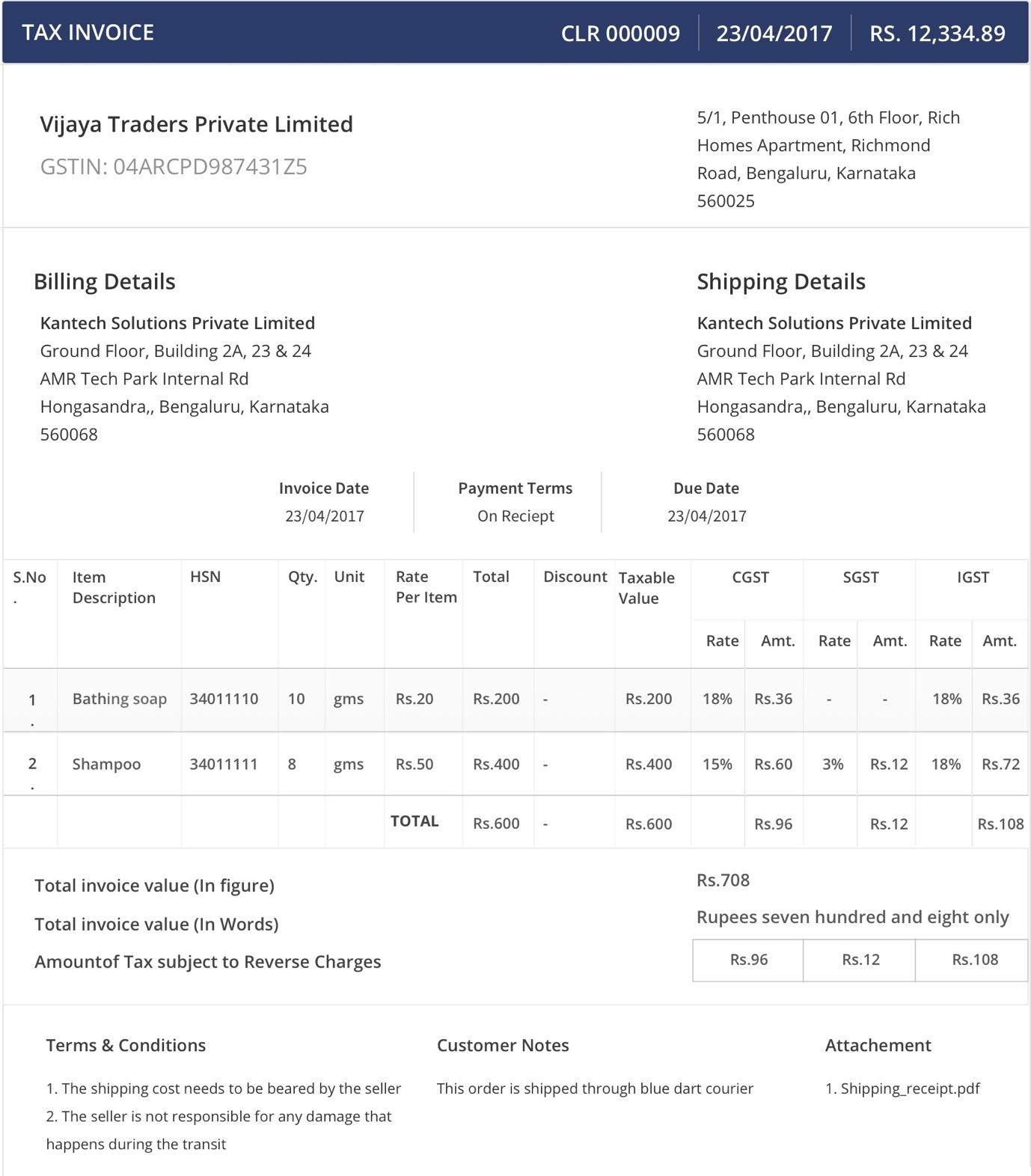

GST Tax Invoice Format Requirements Rules SoftwareSuggest