relief u s 89 in hindi Relief under section 89 of income tax act in hindi

Income Tax Section 89 in Hindi Dhara 89 89 Important For AY 2020 21 take FY in place of AY during 10E calculation Video with excel sheet for calculationFrom Assessment year 2020 21 Please put financ

relief u s 89 in hindi

relief u s 89 in hindi

https://i.ytimg.com/vi/NSFQNfIoeTw/maxresdefault.jpg

Surah 89 Chapter 89 Al Fajr Quran With Urdu Hindi Translation YouTube

https://i.ytimg.com/vi/yaW3aNm8FO8/maxresdefault.jpg

Relief Under Section 89 1 Income Under The Head Salaries

https://1.bp.blogspot.com/-QyfjTlwqo4c/YHaVGkR9nHI/AAAAAAAAIFk/P1cVPtiNzo4oOoVdIz8eOGwRd6DPQPD-ACLcBGAsYHQ/s600/relief%2Bunder%2Bsection%2B89%2B%25281%2529-min.png

section 89 relief 89 relief 2024 25

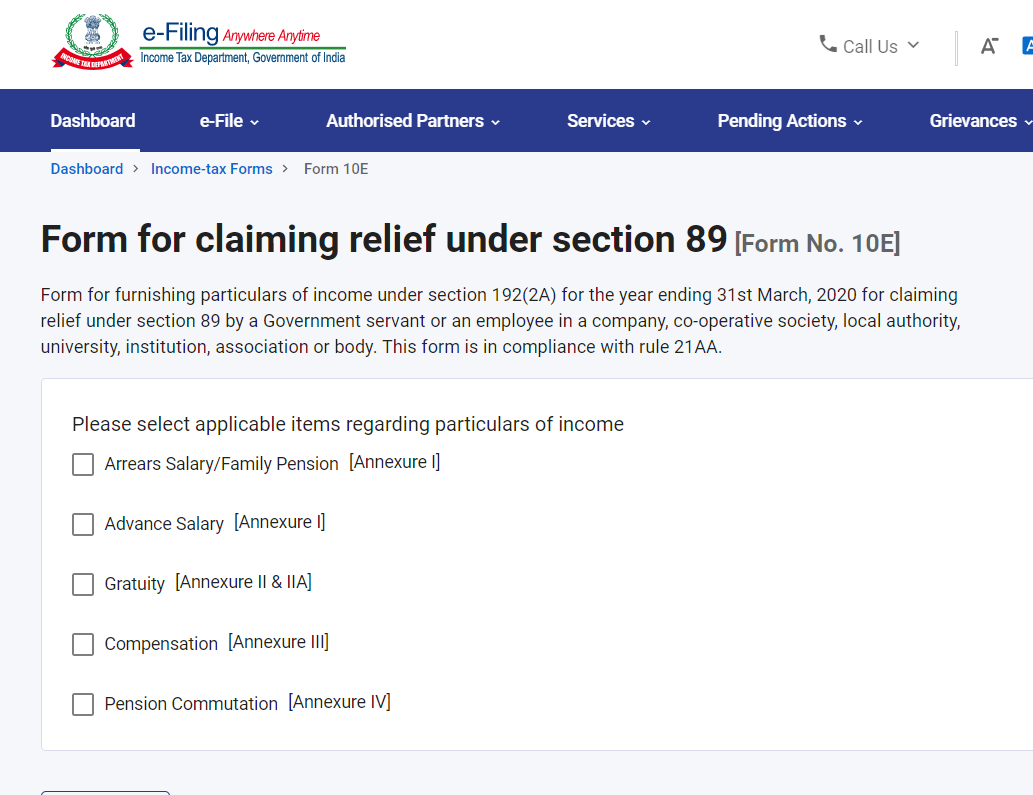

89 1 File Form 10E and Tax relief u s 89 for arrear salary in ITR filing online 2023 24 e filing portalTax relief u s 89 calculation is explained in hindi When

More picture related to relief u s 89 in hindi

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

Relief Under Section 89 1 Hindi relief U s 89 1 How To Calculate

https://i.ytimg.com/vi/EIwMEfBtAtM/maxresdefault.jpg

Relief Under Section 89 1 For Arrears Of Salary Taxxguru in

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

89 1 89 1 89 10e

An employee must meet certain conditions to claim relief under this section To start with Section 89 reliefs can be claimed on any of the following received during a particular Section 89 1 of the Income Tax Act provides relief from paying higher taxes on past dues received in the current year by recalculating tax based on the applicable rules

89 IPC Section 89 In Hindi

http://nocriminals.org/wp-content/uploads/2020/12/IPC-89.png

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

https://i.ytimg.com/vi/EF-Mx98SOnY/maxresdefault.jpg

relief u s 89 in hindi - Learn how to claim tax relief on salary arrears received in the current year due to changes in slab rates Find out the eligibility calculation and filing of Form 10E for Section 89