relief u s 89 calculator Section 89 1 Relief Calculator for FY 2023 24 AY 2024 25 To make the process easier we ve developed a user friendly Excel calculator It assists in calculating relief under section 89 1 for arrears received in FY 2023 24

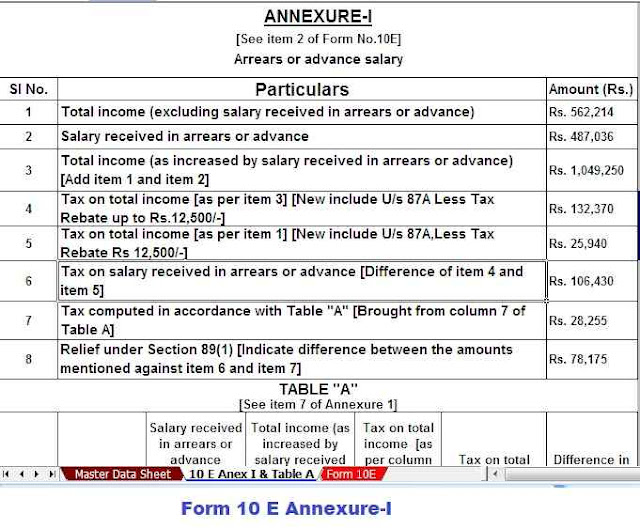

How do I calculate tax relief under Section 89 for salary arrears A Tax relief under Section 89 is computed by multiplying the average tax difference for each relevant year by the number of Calculation of tax relief under Article 89 1 for back pay Income tax return for failure to file Form 10E From the financial year 2014 15 the tax year 2015 16 ITD has made

relief u s 89 calculator

relief u s 89 calculator

https://i.ytimg.com/vi/NSFQNfIoeTw/maxresdefault.jpg

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174413_d.png

Relief U S 89 Calculator Calculator for knowing tax relief under Sec 89 i e on receipt of arrear of salary 1 Applicable for those persons whose total income does not include Excel Form 10E Salary Arrears Relief calculator AY 2024 25 FY 2023 24 for claiming rebate under section 89 1 of Income Tax Act 1961 Download As per section 89 1 of the Income Tax Act 1961 relief for income

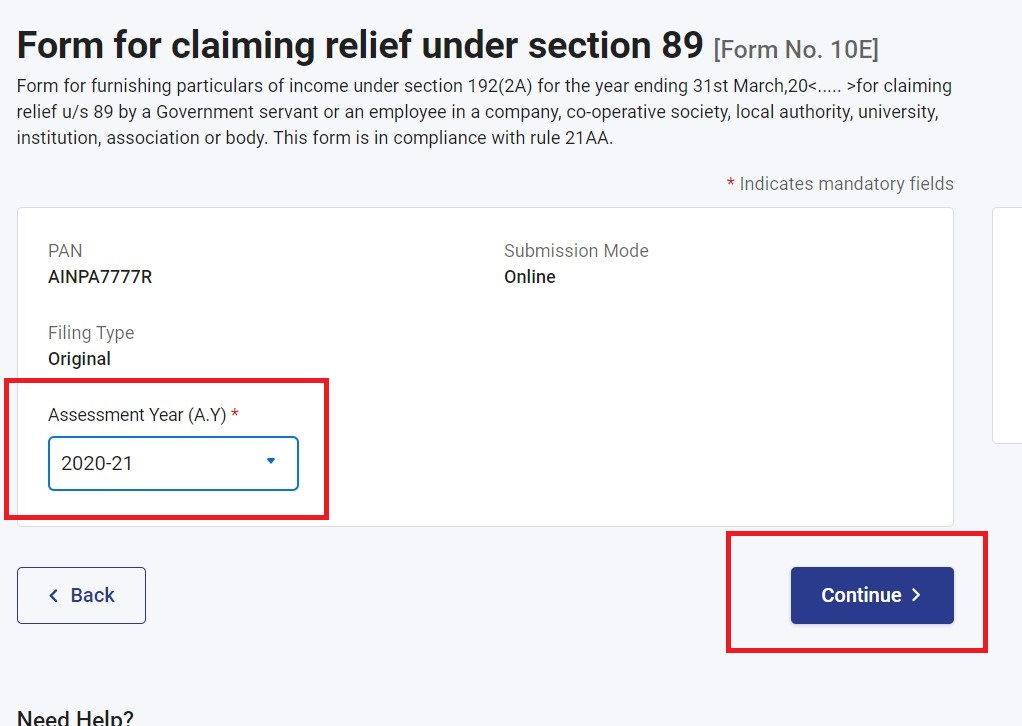

It is mandatory to file Form 10E for claiming benefits under section 89 1 The taxpayer has to submit this form online at the income tax e filing portal Calculation of tax relief under Article 89 1 for back pay How to Claim Tax How to calculate relief under Section 89 1 on salary arrears Step 1 First calculate the tax due in the current year i e the year of receipt of salary by including the arrears in your total income The arrears provided will

More picture related to relief u s 89 calculator

Relief Under Section 89 1 Income Under The Head Salaries

https://1.bp.blogspot.com/-QyfjTlwqo4c/YHaVGkR9nHI/AAAAAAAAIFk/P1cVPtiNzo4oOoVdIz8eOGwRd6DPQPD-ACLcBGAsYHQ/s600/relief%2Bunder%2Bsection%2B89%2B%25281%2529-min.png

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://www.caclubindia.com/editor_upload/671907_20211129141713_form_10_e_annexure_i.jpg

Income Tax Relief Under Section 89 1 Read With Rule 21A With

https://1.bp.blogspot.com/-NfC7vVdLCss/WfQvjk7wqdI/AAAAAAAAFtA/l58RcloHSosIKsLbvc_gpycm49-JzfVNgCLcBGAs/w1200-h630-p-k-no-nu/Arrears%2BRelief%2BPage%2B1.jpg

The Income Tax Act u s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year This relief is granted as the total income assessed is at a If anyone needs this Excel Utility as Automatic Arrears Relief Calculator U s 89 1 with Form 10 E for the F Y 2023 24 then feel free to contact me My email ID is email

Calculation of relief under Section 89 Step 1 Calculate the tax liability for the current year by adding the liabilities to the gross income Step 2 Calculate the tax liability for Step 1 Calculate any tax exemptions refunds you can claim Remaining in rent entitles you to HRA Home Rent Allowance the maximum payroll deduction In addition other

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

https://i.ytimg.com/vi/EF-Mx98SOnY/maxresdefault.jpg

Relief U S 89 1 Short Taxation CA Inter CA IPCC Shrey Rathi

https://i.ytimg.com/vi/r2CyheMADSs/maxresdefault.jpg

relief u s 89 calculator - Excel Form 10E Salary Arrears Relief calculator AY 2024 25 FY 2023 24 for claiming rebate under section 89 1 of Income Tax Act 1961 Download As per section 89 1 of the Income Tax Act 1961 relief for income