how to calculate depreciation expense To calculate depreciation follow these steps Get the original value of the asset OV the residual value RV and the lifetime of the asset n in years Apply the depreciation formula annual depreciation expense OV RV n Substitute the values Calculate the annual depreciation

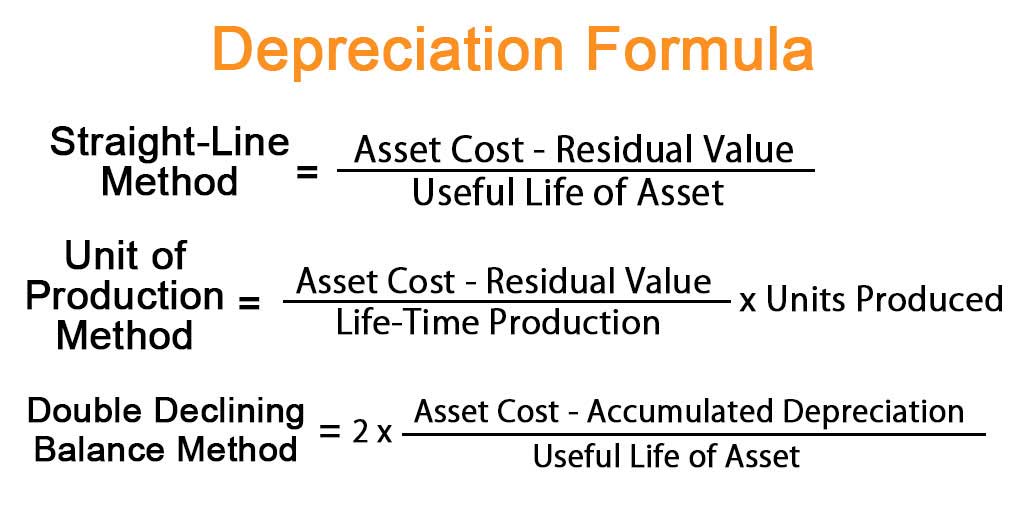

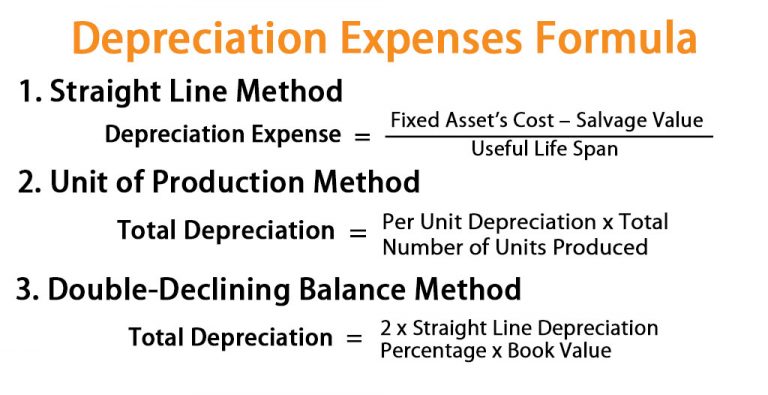

How to Calculate Depreciation Expense The most common methods to calculate depreciation are the following Straight Line Depreciation Method Declining Declining Depreciation Method DDB Units of Production Depreciation Method 1 Straight Line Depreciation Method Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes Here are the different depreciation methods and how they work

how to calculate depreciation expense

how to calculate depreciation expense

https://www.deskera.com/blog/content/images/2021/06/Depreciation-Formula.jpg

How To Calculate Depreciation Macroeconomics Haiper

https://1investing.in/wp-content/uploads/2020/02/straight-line-depreciation_1.png

Depreciation Expenses Formula Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Depreciation-Expenses-Formula-768x395.jpg

Fixed assets lose value over time This is known as depreciation and it is the source of depreciation expenses that appear on corporate income statements and balance sheets The four methods for calculating depreciation allowable under GAAP include straight line declining balance sum of the years digits and units of production The best method for a business

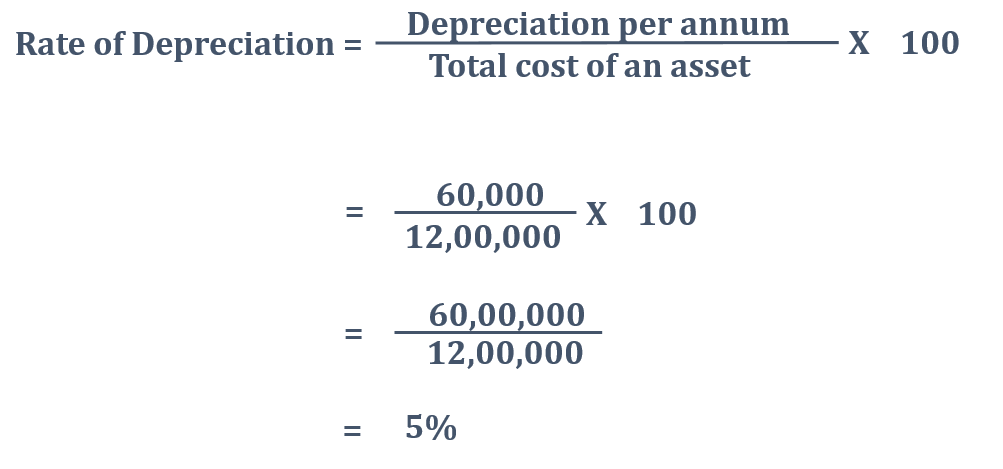

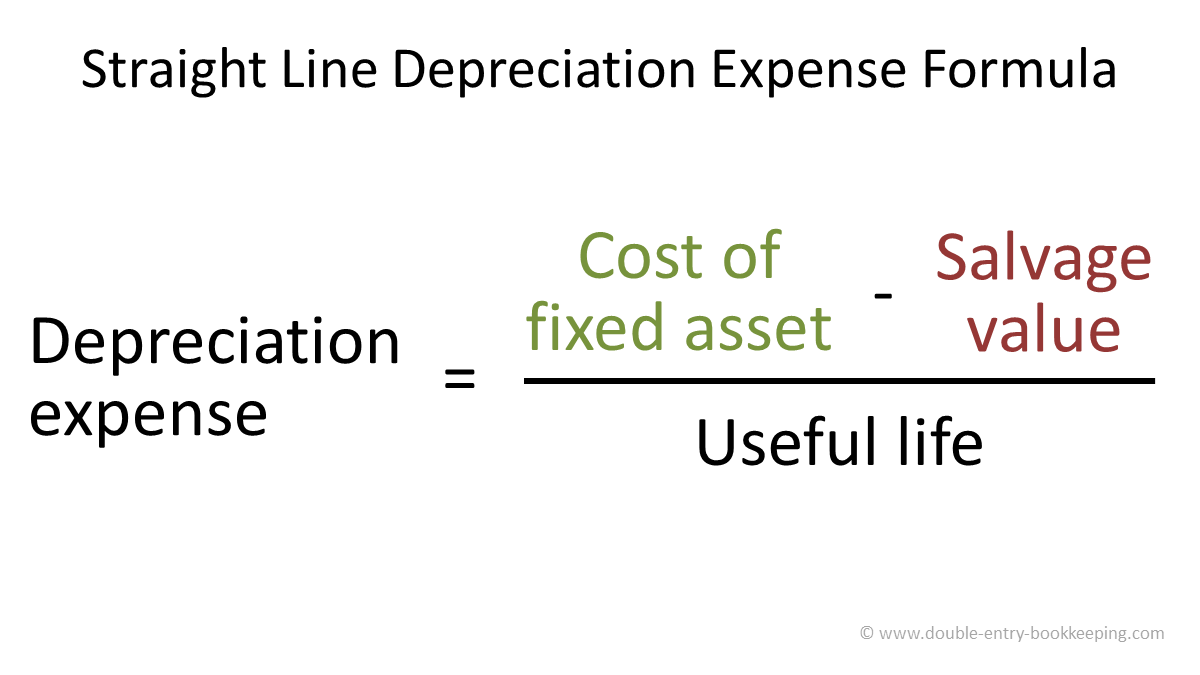

There are three common methods of calculating depreciation for a company 1 Straight line depreciation The straight line depreciation method is the most widely used and is also the easiest to calculate The method takes an equal depreciation expense each year over the useful life of the asset To calculate depreciation using the straight line method subtract the asset s salvage value what you expect it to be worth at the end of its useful life from its cost The result is the depreciable basis or the amount that can be depreciated

More picture related to how to calculate depreciation expense

How To Calculate Depreciation Expense Haiper

https://cdn.educba.com/academy/wp-content/uploads/2019/11/Depreciation-Formula-1.3.png

How To Calculate Depreciation Percentage Haiper

http://1.bp.blogspot.com/-WSKXJm_aXIk/Vhu1OF3l0tI/AAAAAAAAACM/4JvxHv1MceE/s1600/8-depreciation-19-638.jpg

D Is For Depreciation Simply Taxes CPA PLLC

https://simplytaxesaz.com/wp-content/uploads/2020/08/straight-line-depreciation-formula.png

Find out what your annual and monthly depreciation expenses should be using the simplest straight line method as well as the three other methods in the There are several methods to calculate depreciation each requiring the use of hard data and informed estimates Companies may use different methods to calculate depreciation for profit and loss P L statements and tax purposes

[desc-10] [desc-11]

White Goods Depreciation Calculator DanikaSofiah

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/06115027/Depreciation-Expense-Formula-960x300.jpg

How To Calculate Depreciation Expense Simandhar Education AICPA

https://i.ytimg.com/vi/oOrou4l28WA/maxresdefault.jpg

how to calculate depreciation expense - To calculate depreciation using the straight line method subtract the asset s salvage value what you expect it to be worth at the end of its useful life from its cost The result is the depreciable basis or the amount that can be depreciated