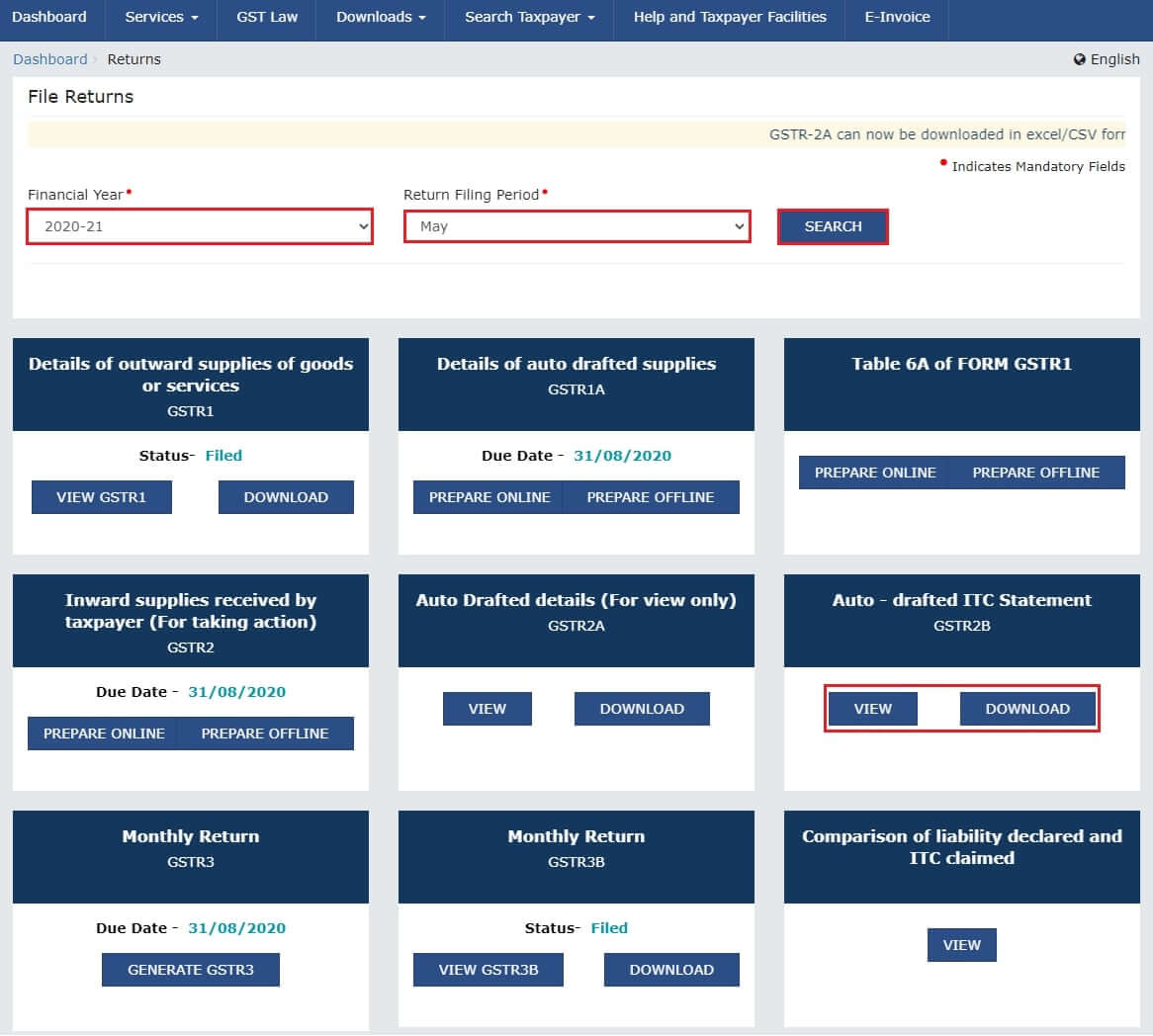

gstr 2a summary GSTR 2A reflects purchases made by a taxpayer from suppliers reconciling it with purchase data helps claim Input Tax Credit GSTR 2A can

GSTR 2A is a self generated statement where visibility of all incoming supplies made by your supplier in GSTR 1 has been made available to recipients The details will be GSTR 2A is an automatically generated return from the seller s GSTR 1 for each business by the portal of GST Any information filed in GSTR 1 by the seller is captured in GSTR 2A of the purchaser One is required to

gstr 2a summary

gstr 2a summary

https://taxguru.in/wp-content/uploads/2018/08/Screenshot-6.png

Now Export GSTR 2A To Excel For Reconciliation

https://taxguru.in/wp-content/uploads/2018/08/Screenshot-3.png

GSTR 2B Return Filing Benefits Features Comparison With GSTR 2A

https://assets1.cleartax-cdn.com/s/img/2020/08/07144325/GSTR-2B-1024x534.png

What is GSTR 2A GSTR 2A means a purchase related document that the GST portal provides to each business registered with it The GSTR 2A has generated automatically when a 1 What is Form GSTR 2A Form GSTR 2A is a system generated Statement of Inward Supplies for a recipient Form GSTR 2A will be generated in below scenarios When the

GSTR 2A is an auto generated monthly statement that contains the information of goods or services that have been purchased in a given month from the sellers GSTR 1 GSTR 2A won t generate until the supplier files his her Q 1 What is Form GSTR 2A Ans Form GSTR 2A is a system generated Statement of Inward Supplies for a recipient Form GSTR 2A will be generated in below

More picture related to gstr 2a summary

An Overview Of GSTR 2B Zoho Books

https://www.zoho.com/in/books/gst/images/guides/gstr-2b-2.jpg

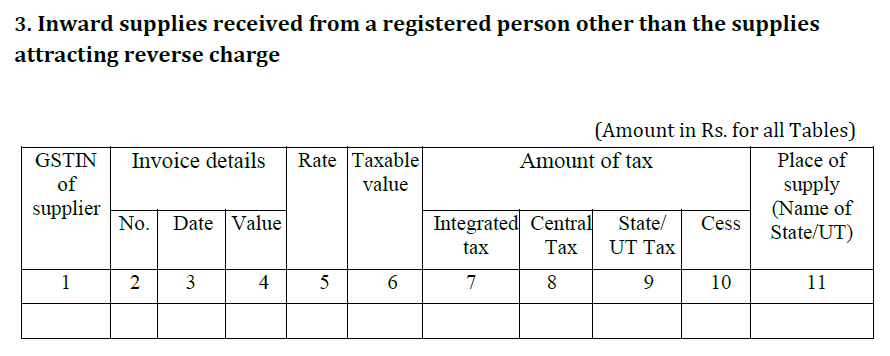

GSTR 2A Details Return Filing Format

https://professionalutilities.com/upload/GSTR-2A-1.png

Summary On Section 16 2 aa ITC GSTR 2A 2B

https://www.kanakkupillai.com/learn/wp-content/uploads/2021/12/Summary-on-Section-1-1024x536.jpg

Steps to reconcile are clearly outlined from downloading GSTR 2A to filtering results for matched and mismatched invoices Various actions can be taken based on GSTR 2A is a auto populated summary of the details of inward supplies of Goods and Services during any period or month It is created for a recipient when the Form

GSTR 2A is an auto populated GST return that is generated for a taxpayer from GSTR 1 of his sellers In this article we are going to discuss topics like GSTR 2A 2 A in GST GST 2 A what A summary statement displays the overall ITC status whether it s available or not under the respective section Each section has an advisory guide to elucidate which actions that can be

What Is GSTR 3B How To File GSTR 3B

https://mybillbook.in/blog/wp-content/uploads/2021/03/GSTR-3B.png

A Complete Guide On Difference Between GSTR 2A And GSTR 2B

https://ebizfiling.com/wp-content/uploads/2022/04/gstr-2a-and-gstr-2b.png

gstr 2a summary - GSTR 2A is a system generated draft Statement of Inward Supplies for a Receiver It is auto populated from the GSTR 1 GSTR 5 GSTR 6 ISD GST 7 TDS and