gratuity relief u s 89 calculation If in case of receipt of past salary salary in advance or receipt of family pension in arrears you are allowed some tax relief under section 89 1 Here s how you can calculate the tax relief yourself Step 1 Calculate tax payable on the total income including additional salary in the year it is received

Learn how to calculate tax relief under Sections 89 and 89A for arrears gratuity and foreign retirement benefits Understand the steps and eligibility criteria Relief Under Section 89 helps you to claim salary arrears Our comprehensive guide covers everything from eligibility to filing Form 10E online

gratuity relief u s 89 calculation

gratuity relief u s 89 calculation

https://1.bp.blogspot.com/-QyfjTlwqo4c/YHaVGkR9nHI/AAAAAAAAIFk/P1cVPtiNzo4oOoVdIz8eOGwRd6DPQPD-ACLcBGAsYHQ/s600/relief%2Bunder%2Bsection%2B89%2B%25281%2529-min.png

How To Take Relief On Salary Arrears Form 10 E To Claim Tax Relief U

https://i.ytimg.com/vi/xAByWeWhtEg/maxresdefault.jpg

Relief Under Section 89 And Computing The Relief U s 89 Rule 21A

https://i.ytimg.com/vi/RWnbSWa3sow/maxresdefault.jpg

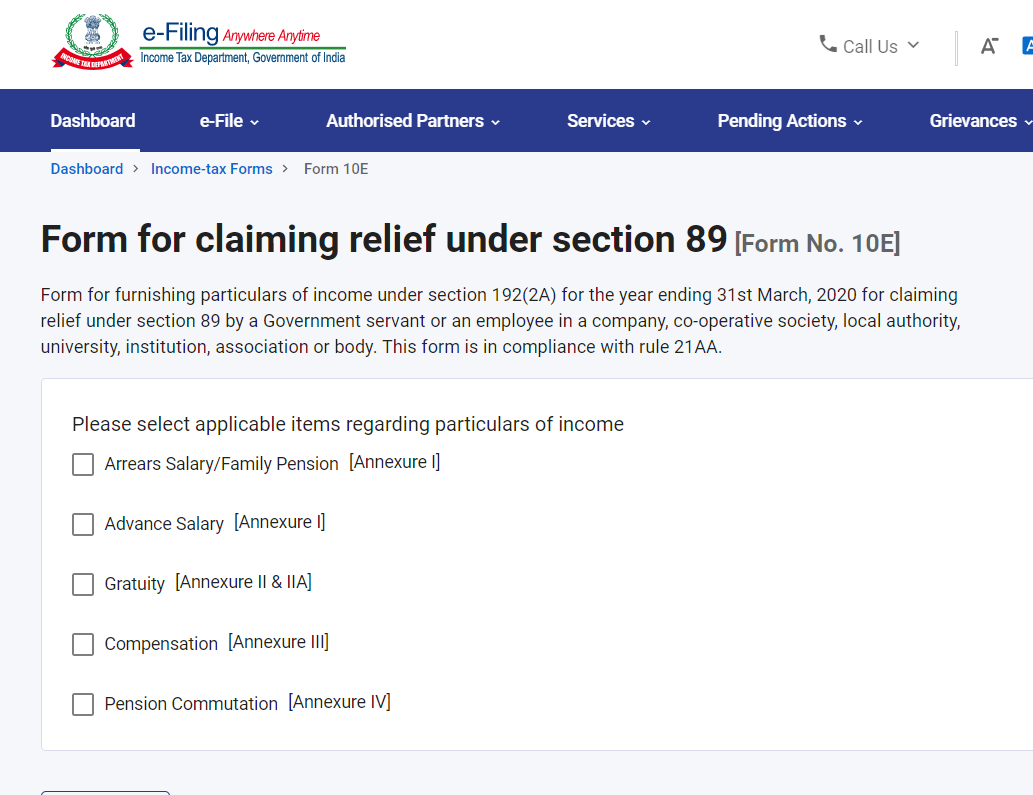

How to calculate relief under Section 89 1 for salary arrears Step 1 First calculate the tax due in the current year i e the year of receipt of salary by including the arrears in your total income Step 2 Now calculate the tax due in the current year i e the year of receipt by excluding the arrears from your total income Calculation of tax relief under Article 89 1 for back pay Income tax return for failure to file Form 10E From the financial year 2014 15 the tax year 2015 16 ITD has made it mandatory to file Form 10E if you want to claim an exemption under Section 89 1

Form 10E Calculator Compute Tax Relief u s 89 1 for the FY 2017 18 to FY 2020 21 Calculate Tax Income Tax for FY 2017 18 2018 19 2019 20 2020 21 with without arrears The primary purpose of Form 10E is to facilitate the computation and claim of relief under Section 89 As mentioned earlier this relief is designed to mitigate the additional tax burden that might arise due to the receipt

More picture related to gratuity relief u s 89 calculation

U S 89 USED United States General Issue Stamp HipStamp

https://storage.googleapis.com/hipstamp/p/a7cb3404bd9563b3ec198ada6b459617.jpg

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

US 89 Upgrade Marks Milestone Fourth And Final New Interchange Done

https://ogden_images.s3.amazonaws.com/www.standard.net/images/2022/11/01182457/89-01-1200x860.jpg

The Income Tax Act u s 89 provides relief to an assesse for any salary or profit in lieu of salary or family pension received by an assesse in advance or arrears in a Financial Year This relief is granted as the total income assessed is at a rate higher than that at which it would otherwise have been assessed An employee who has received arrears in salary can save tax on such additional income in the following ways Calculate the relief u s 89 1 File Form 10E to claim relief u s 89 1

Section 89 1 of the Income Tax Act provides relief from paying higher taxes on past dues received in the current year by recalculating tax based on the applicable rules Relief is granted if there is an increase in tax rates due to delayed income Form 10E must be filed to claim relief under Section 89 1 Tax is calculated on the taxpayer s total income earned or received during the year If the assessee has received any portion of salary in arrears or in advance or received a family pension in arrears under the Income Tax Act it is allowed to claim tax relief under section 89 1

File Form 10E And Tax Relief U s 89 For Arrear Salary Arrear Salary

https://i.ytimg.com/vi/VaRirb7z3zY/maxresdefault.jpg

Relief Under Section 89 1 Hindi relief U s 89 1 How To Calculate

https://i.ytimg.com/vi/EIwMEfBtAtM/maxresdefault.jpg

gratuity relief u s 89 calculation - Form 10E Calculator Compute Tax Relief u s 89 1 for the FY 2017 18 to FY 2020 21 Calculate Tax Income Tax for FY 2017 18 2018 19 2019 20 2020 21 with without arrears