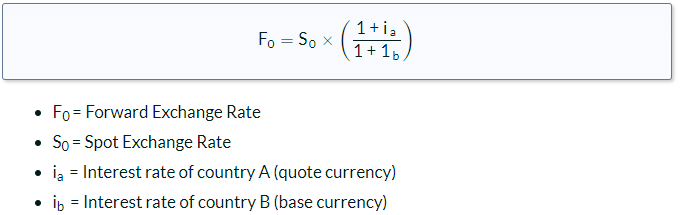

fx forward formula Calculate the currency forward price The final step is to evaluate the currency forward price using the following formula currency forward price spot price 1 price currency interest rate 1 base currency interest rate For our GBP MYR currency forward contract its price is 0 1735 1 002 1 008 0 1725

Using the relative purchasing power parity forward exchange rate can be calculated using the following formula Where f is forward exchange rate in terms of units of domestic currency per unit of foreign currency s is spot exchange rate in terms of units of domestic currency per unit of foreign currency Id domestic inflation rate An FX forward curve is a curve that shows FX forward pricing for all the different dates in the future FX forward pricing is determined by the current exchange rate the interest rate differentials between the two currencies and the length of the FX forward

fx forward formula

fx forward formula

https://media.cheggcdn.com/media/3dc/3dcd5c4d-3cef-49e3-a785-eaf15fc8abd8/phpJNlbFf.png

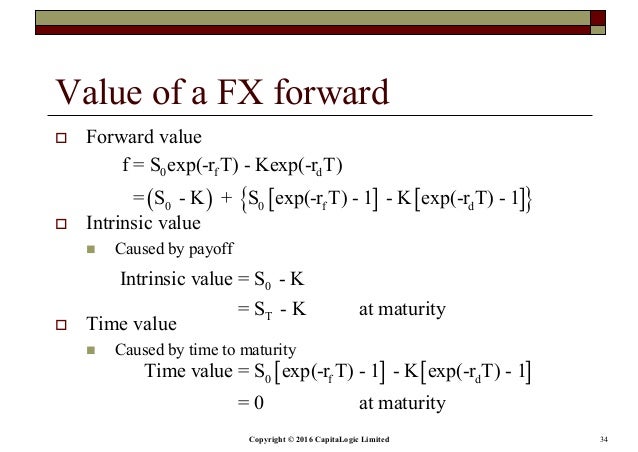

Financial Engineering Continuously Compound Forward Rate Formula

https://i.stack.imgur.com/k1h9a.png

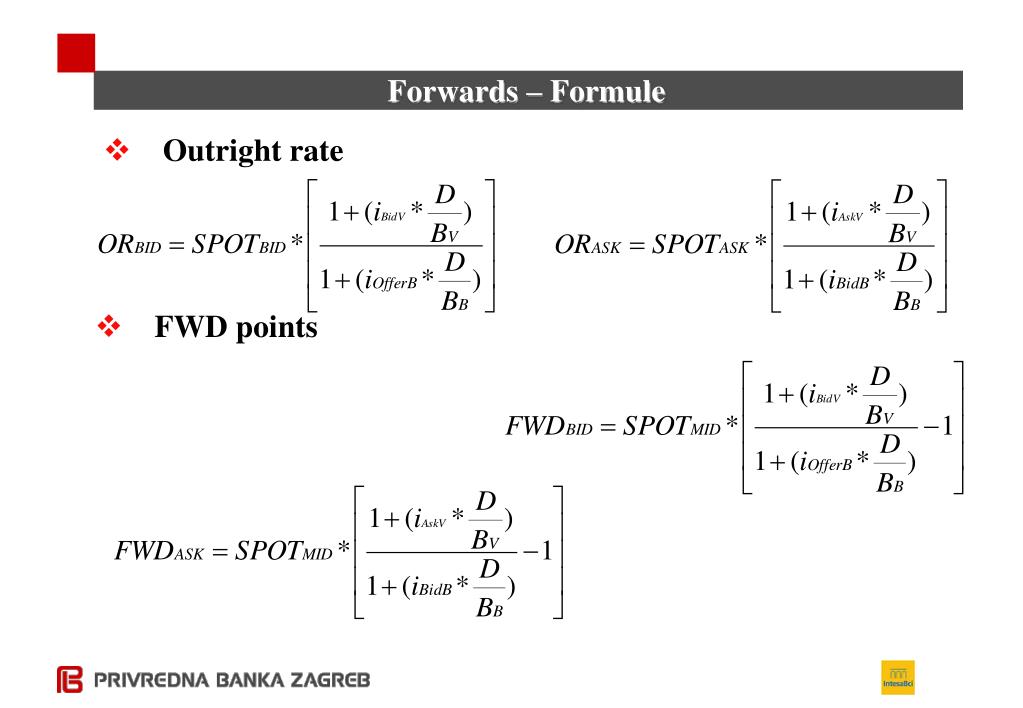

Chapter 5 Fx Forwards

https://image.slidesharecdn.com/chapter5-fxforwards-160128042849/95/chapter-5-fx-forwards-34-638.jpg?cb=1454898497

A currency forward is a customized written contract between two parties that sets a fixed foreign currency exchange rate for a transaction set for a specified future date Currency forward contracts are used to hedge foreign currency exchange risk A forward discount occurs when the expected future price of a currency is below the spot price which indicates a future decline in the currency price

Currency forwards are OTC contracts traded in forex markets that lock in an exchange rate for a currency pair They are generally used for hedging and can have customized terms such as a The forward exchange rate also referred to as forward rate or forward price is the exchange rate at which a bank agrees to exchange one currency for another at a future date when it enters into a forward contract with an investor

More picture related to fx forward formula

PPT FX Markets PowerPoint Presentation Free Download ID 554961

https://image.slideserve.com/554961/forwards-formule-l.jpg

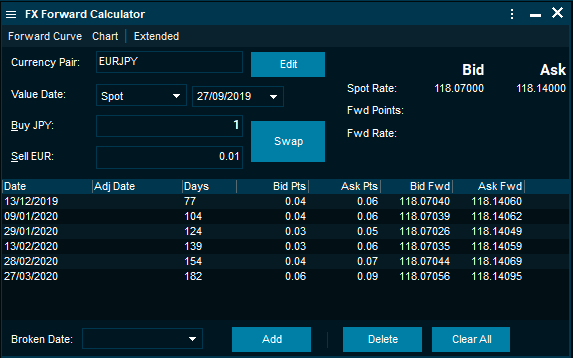

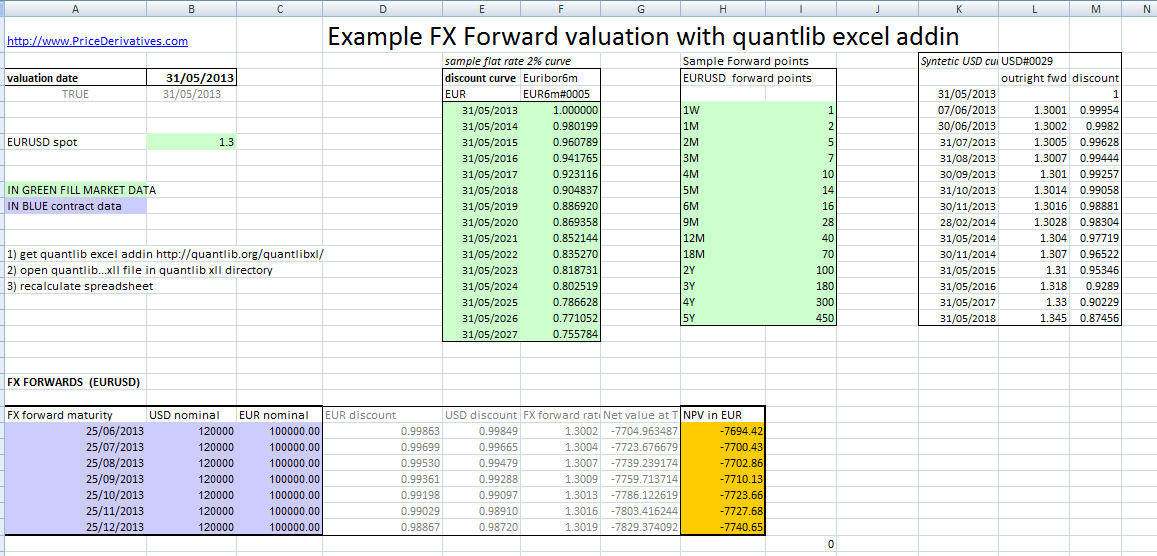

How To Value FX Forward Pricing Example

https://www.pricederivatives.com/en/wp-content/uploads/2013/09/fx-forward-calculator-1024x557.png

Fx Forward Rate Calculation Example Oil Futures Trading Strategy

https://financetrainingcourse.com/education/wp-content/uploads/2012/01/013112_1058_ForwardRate2.png

An FX forward is a contractual agreement between the client and the bank or a non bank provider to exchange a pair of currencies at a set rate on a future date What is an FX forward The pricing of the contract is determined by the exchange spot price interest rate differentials between the two currencies and the length of the contract A forward contract will have a premium when the expectation in the market is for the domestic currency to depreciate in value in the future versus the foreign currency To find the forward premium for a currency pair the forward exchange rate must be calculated

An illustrated tutorial on FX forward contracts including how to calculate forward exchange rates and interest rate parity and how forward arbitrage covered interest arbitrage works To value the contract we need to use the following formula where FP is the forward price at initiation FPt is the forward price of a contract at time t for a contract maturing at T and rpc is the interest rate of the price currency

FX Forward Calculator

https://software.infrontservices.com/helpfiles/infront/v86/en/fxforward.png

FX Forward Valuation Excel

http://www.pricederivatives.com/en/wp-content/uploads/2013/10/Capture.png

fx forward formula - A currency forward is a customized written contract between two parties that sets a fixed foreign currency exchange rate for a transaction set for a specified future date Currency forward contracts are used to hedge foreign currency exchange risk