difference between 990 pf and 990 t There are several versions of Form 990 public charities file a Form 990 990 EZ or 990 N private foundations file Form 990 PF PF stands for Private Foundation Learn more about the difference between public charities and private foundations

Form 990 is filed with the IRS to report information on the activities conducted by the organization whereas 990 T is filed only if an organization has 1 000 or more gross income from an unrelated business The 990 PF is the information return U S private foundations file with the Internal Revenue Service This public document provides fiscal data for the foundation names of trustees and officers application information and a complete grants list

difference between 990 pf and 990 t

difference between 990 pf and 990 t

https://www.2ndswing.com/images/standard/W-82225324146.jpg

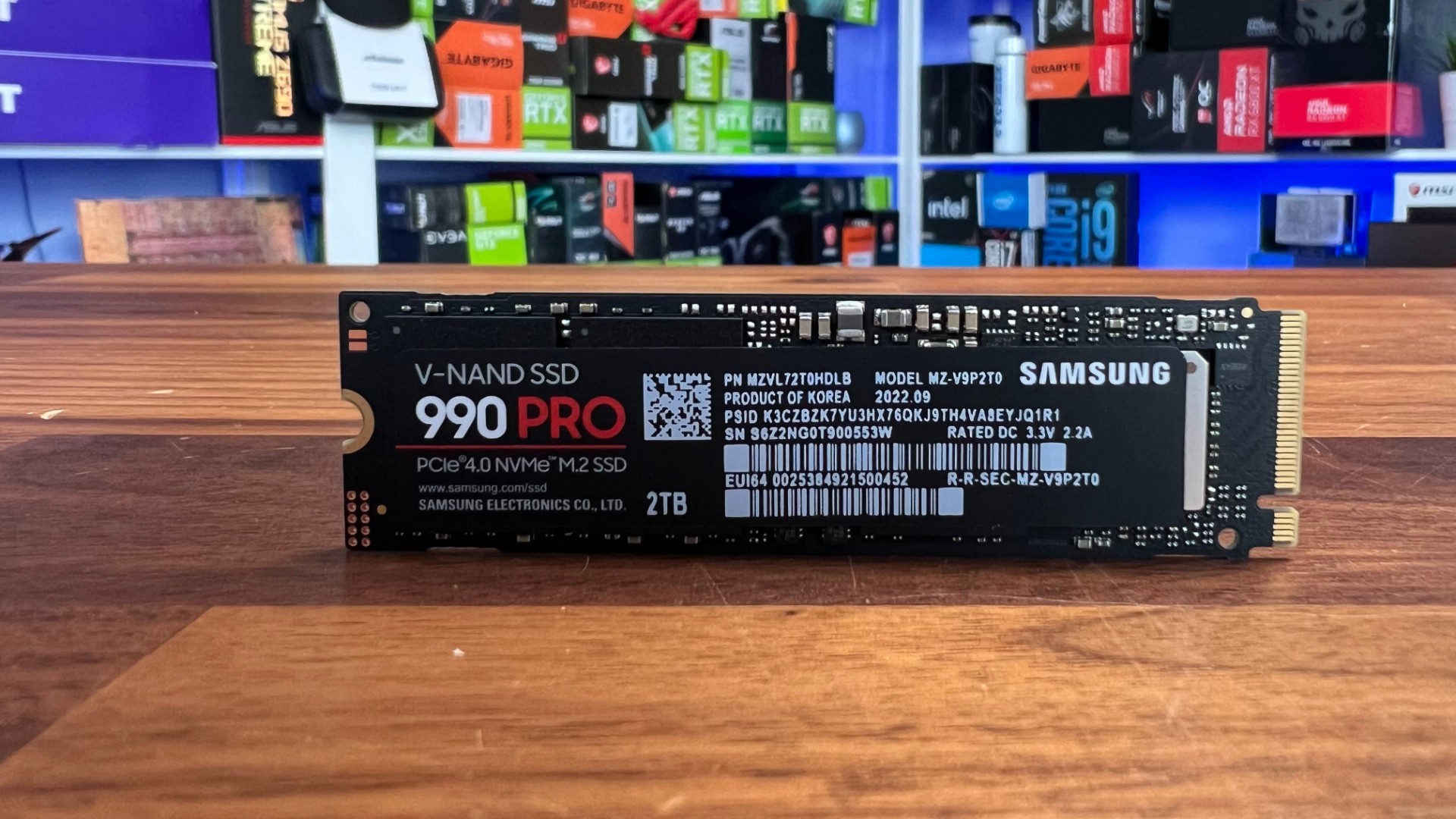

Samsung 990 Pro PCIe 4 0 NVMe M 2 SSD Review Page 6 Of 9 ETeknix

https://cdn.eteknix.com/wp-content/uploads/2022/10/samsung-990-003-2.jpg

New Balance 990v5 Vs 990v6 What Generator Fuel Is Best In 2023 Shoe

https://i.ytimg.com/vi/k2bpmQos6Vs/maxresdefault.jpg

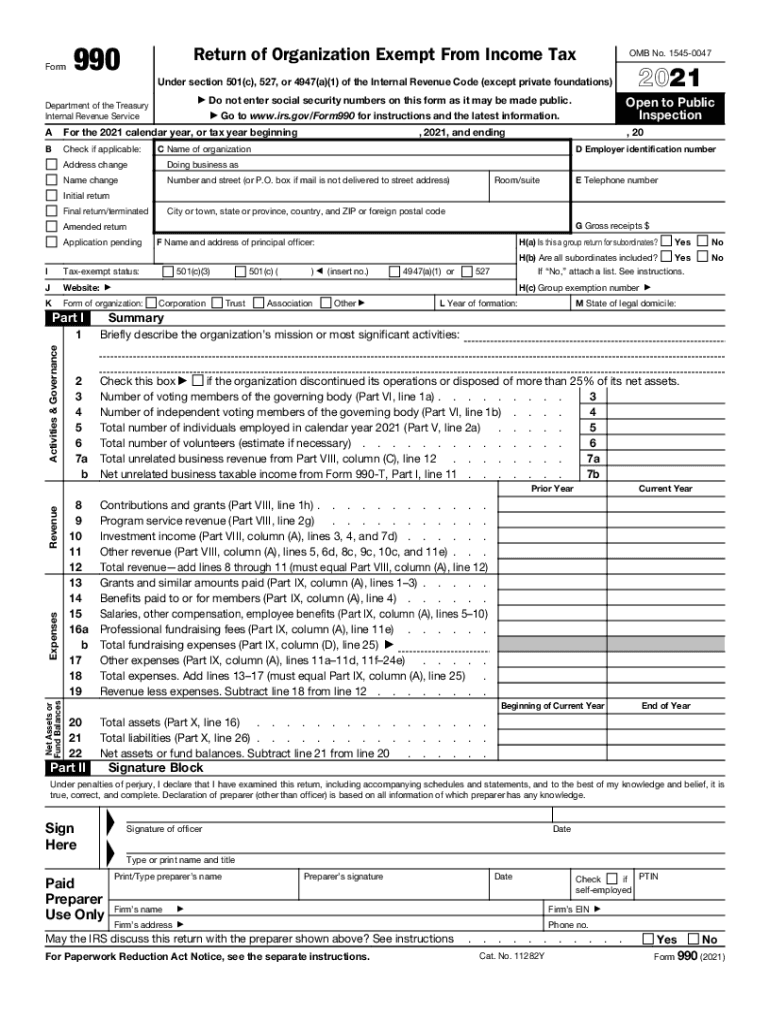

Most tax exempt organizations other than churches are required to file an annual Form 990 990 EZ 990 PF or 990 N e Postcard with the IRS If an organization fails to file an annual return or notice for 3 consecutive years it will automatically lose its Most tax exempt organizations are required to file an annual return Which form an organization must file generally depends on its financial activity as indicated in the chart below Status Form to File Instructions Gross receipts normally 50 000 Note Organizations eligible to file the e Postcard may choose to file a full return 990 N

Information about Form 990 T Exempt Organization Business Income Tax Return and proxy tax under section 6033 e including recent updates related forms and instructions on how to file Form 990 T is used by exempt organizations to The primary difference between Form 990 and Form 990 PF is that Form 990 is required for tax exempt organizations in general such as public charities while Form 990 PF is required specifically for private foundations

More picture related to difference between 990 pf and 990 t

990 N 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/578/135/578135613/large.png

Samsung Unveils High Performance 990 PRO Series SSDs Optimized For

https://img.us.news.samsung.com/us/wp-content/uploads/2022/08/22153838/990PROHS-front-and-back-1-scaled.jpg

OUTDATED The Ultimate New Balance 990 V1 V2 V3 V4 And V5

https://i.ytimg.com/vi/HmqGllue3Y4/maxresdefault.jpg

The full length 990 form is required for nonprofits who gross 200 000 or more in total receipts or total assets of 500 000 or more The 990 EZ and 990 N are for nonprofits who grossed less during the year over 50 000 in total gross receipts and under 50 000 respectively The 990 PF is for private foundations This article contains answers to frequently asked questions regarding exempt organization returns Form 990 990 PF or 990 T Click on a question below to view the answer

Along with the specific line items the Form 990 PF instructions provide guidance as to the filing requirements definitions payment of taxes penalties and public inspection requirements The 990 PF form is a reporting document for private foundations or those applying for private foundation status The form asks for basic identifying information as well as information regarding your foundation s revenue and expenses balance sheets staff salary information and more

Samsung Unveils High Performance 990 PRO Series SSDs Optimized For

https://img.us.news.samsung.com/us/wp-content/uploads/2022/08/22153845/990PRO-4-scaled.jpg

How Do I Know If My 990 Has Been Filed Blogolu

https://blogolu.com/wp-content/uploads/2022/09/f990ez.jpg

difference between 990 pf and 990 t - Most tax exempt organizations are required to file an annual return Which form an organization must file generally depends on its financial activity as indicated in the chart below Status Form to File Instructions Gross receipts normally 50 000 Note Organizations eligible to file the e Postcard may choose to file a full return 990 N