amazon tax code 18 The best way to update your products tax codes on Amazon after configuring them in Sellercloud is to use the Post to Amazon Existing Catalog

What Product Tax Code Do you use by Seller 7WLrNxqVNqkN2 2 years ago Our products should have tax and my merchant invoices show the price inc VAT yet a few What is a Product Tax Code How do I know if I should add the product tax code to my listing Does this have anything to do with my resale tax certificate and if I will pay taxes

amazon tax code 18

amazon tax code 18

https://fecoms.com/wp-content/uploads/2020/01/Product-Tax-Code.png

Tax Codes Explained Suretax Accounting

https://assets-global.website-files.com/5e5e0a963f2bf9d0d9d31e01/617c1ff9b7f9c113e5bff755_Suretax-Tax-Codes---Explained.jpg

FAQs About The Amazon Tax Exempt Program Answered

https://unloop.com/wp-content/uploads/2022/08/how-to-use-tax-exempt-on-amazon.jpg

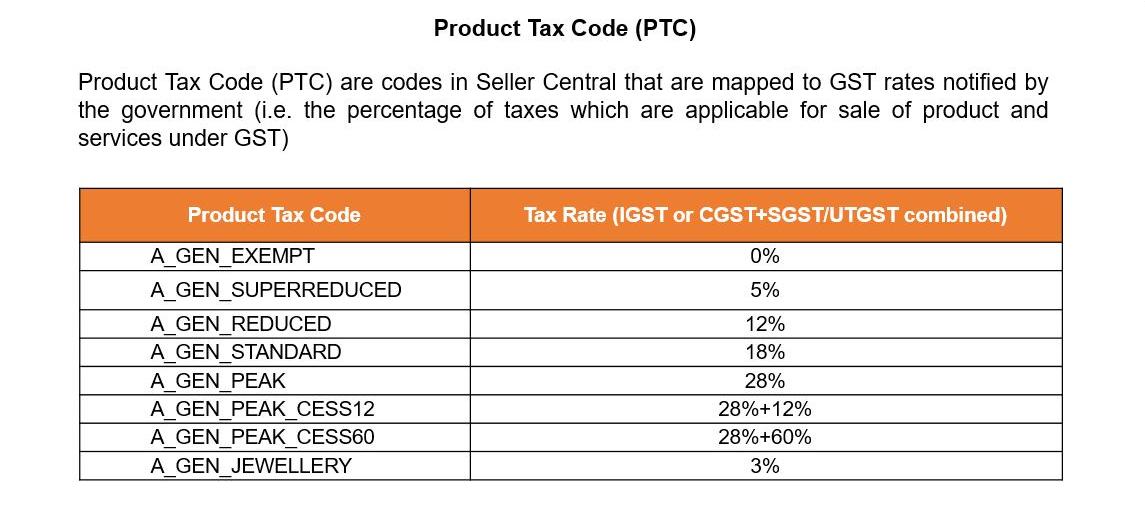

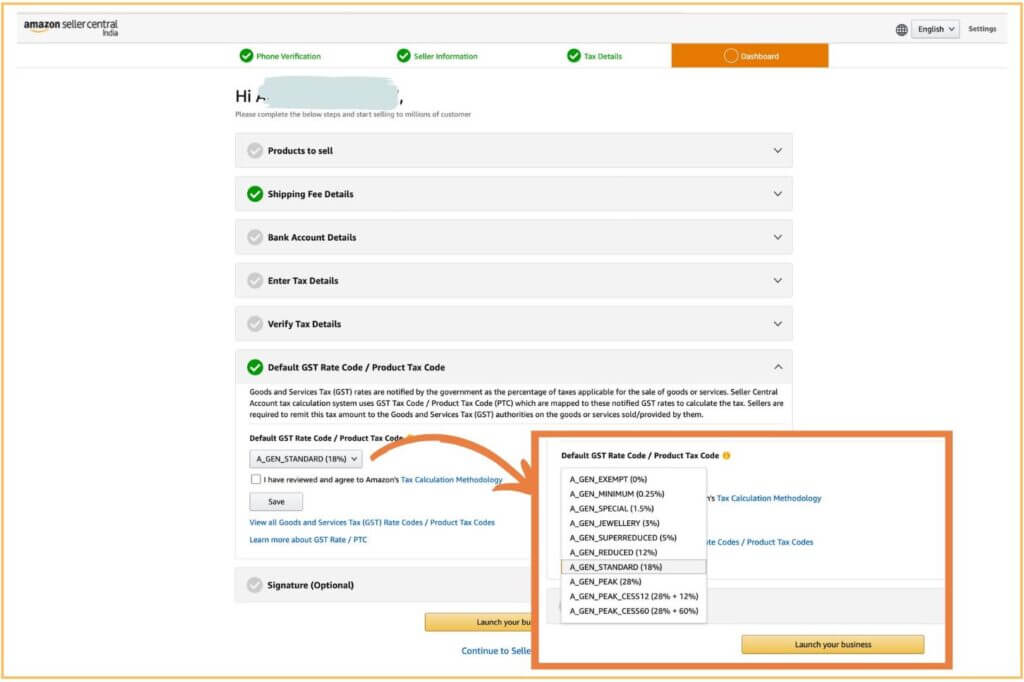

We get a lot of questions about setting up your Amazon FBA account to collect sales tax There s a lot of confusion around product tax codes often called Amazon Product Tax Codes PTC are codes within Seller Central that are mapped to GST rates notified by the Government They help determine the applicable

Amazon s VAT Calculation Service provides sellers with tax calculation VAT invoicing and transactional VAT calculation reporting functionality By enrolling in our VAT Calculation Confused about Amazon tax codes We ll help you get your Amazon account set up to collect sales tax on all of your SKUs

More picture related to amazon tax code 18

Amazon Tax Code List Store Correct Codes For Products

https://madebybrain.com/wp-content/uploads/2021/03/Amazon-Steuercode-Liste.jpg

Amazon Tax Exemption Program All You Need To Know Cherry Picks

https://www.cherrypicksreviews.com/rails/active_storage/representations/redirect/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBaW9VIiwiZXhwIjpudWxsLCJwdXIiOiJibG9iX2lkIn19--be31c71f562656d9cc5e454084bb307d4ed84dd2/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaDdCem9MWm05eWJXRjBTU0lJYW5CbkJqb0dSVlE2QzNKbGMybDZaVWtpRHpFMk1EQjRNVFl3TUQ0R093WlUiLCJleHAiOm51bGwsInB1ciI6InZhcmlhdGlvbiJ9fQ==--d2458723d1660d4c788aec614604ecbbc0e913a0/Amazon Tax Exemption Program.jpg

Value Added Tax Code Mozambique

https://static.africa-press.net/mozambique/sites/64/2023/02/postQueueImg_1676701411.66.jpg

Amazon s VAT Calculation Service VCS allows sellers to show VAT exclusive prices to Amazon Business customers and get the Downloadable VAT Invoice Amazon Web Services Inc will bill you on behalf of the ISV or Partner seller and will collect IGST at 18 on your purchases unless you update your tax settings page with your

HSN Harmonised System of Nomenclature is an internationally accepted product coding system In India HSN coding is currently used under Excise Customs If you are selling on Amazon you will need to give a product tax code to your products This is a guide for Amazon FBA sellers You will get the scoop on

Amazon Product Tax Code For India GST CODE LIST EcomLearner

https://ecomlearner.in/wp-content/uploads/2023/05/Amazon-Seller-Account-Registration-Default-Product-Tax-Code-Setting-1024x682-1-1.jpg

Amazon Product Tax Code Product Tax Code Amazon India Amazon Seller

https://i.ytimg.com/vi/gJIF7m0dvdE/maxresdefault.jpg

amazon tax code 18 - The GST tax slabs are as under 0 for exempted goods 5 for essential commodities 12 for merit goods 18 standard rate and 28 for demerit sin goods