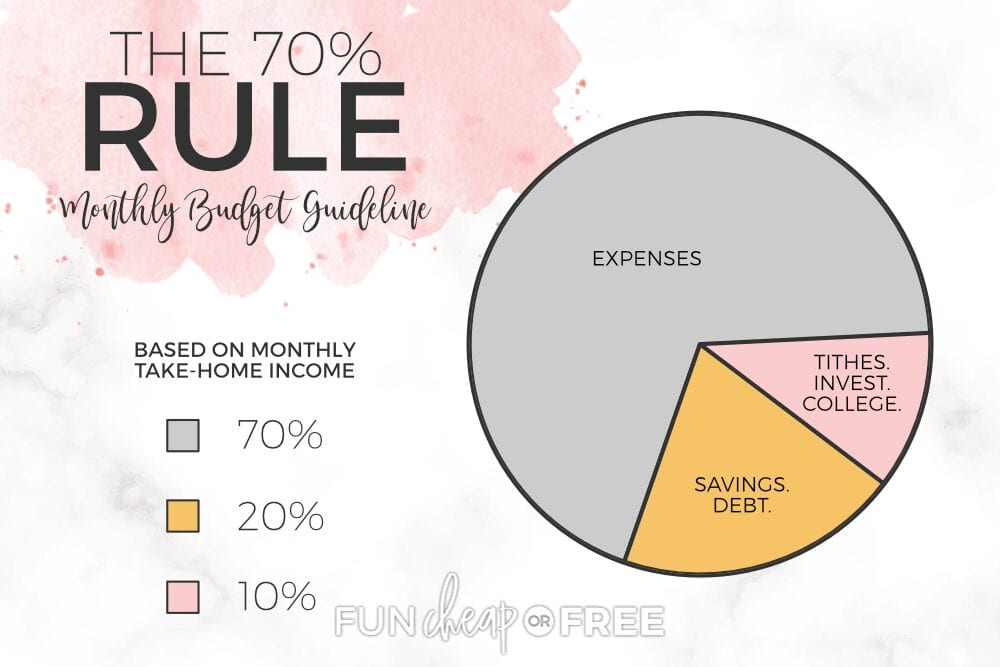

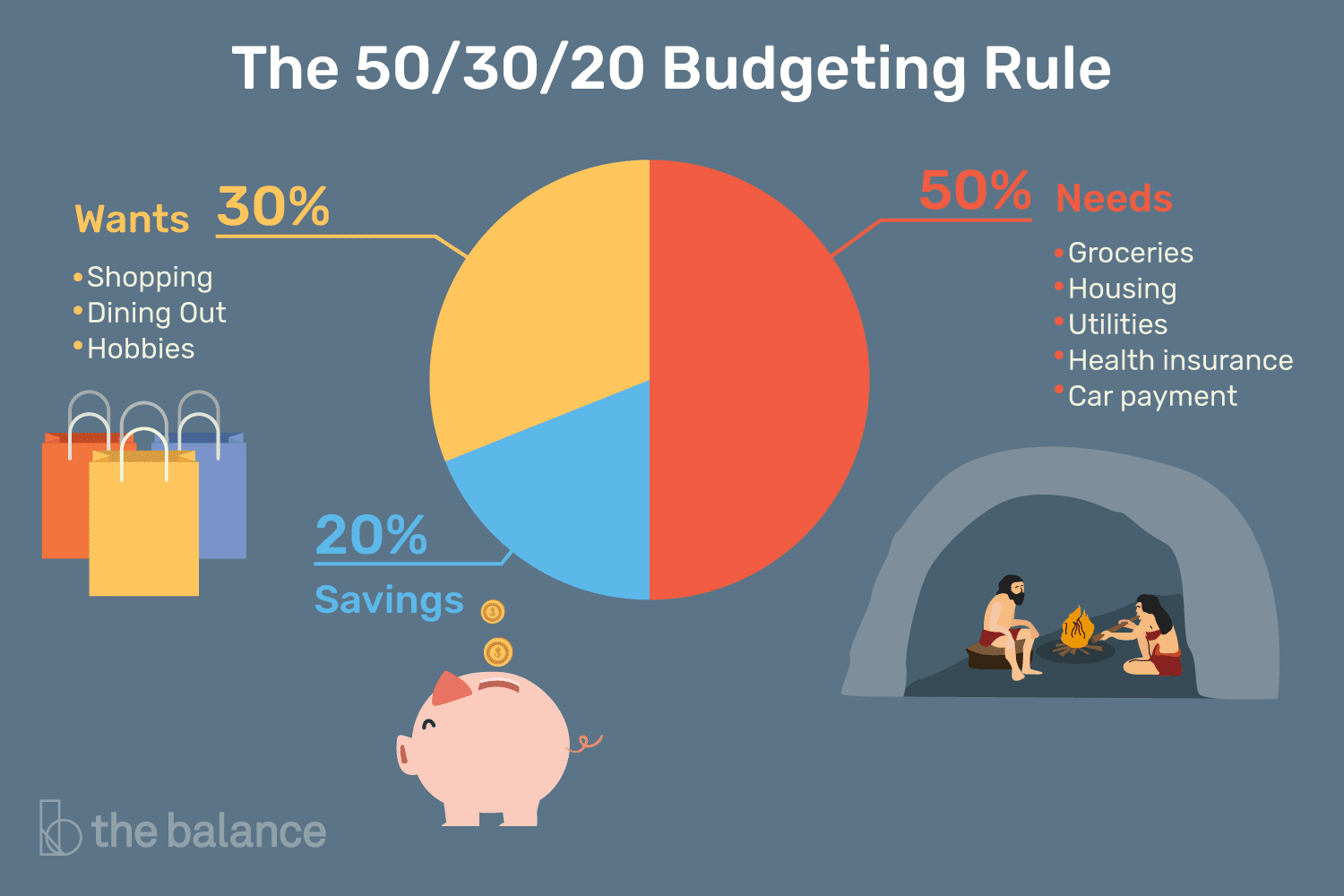

70 30 20 rule Our 50 30 20 calculator divides your take home income into suggested spending in three categories 50 of net pay for needs 30 for wants and 20 for savings and debt

Use this 50 30 20 rule calculator to determine how to distribute your after tax income according to your wants needs and savings The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income i e your take home pay 50 to needs 30

70 30 20 rule

70 30 20 rule

https://funcheaporfree.com/wp-content/uploads/2020/05/70-Rule-And-Overspending.jpg

The 50 30 20 Rule A Quick Start Guide To Budgeting

https://www.stylesalute.com/wp-content/uploads/2018/07/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1.png

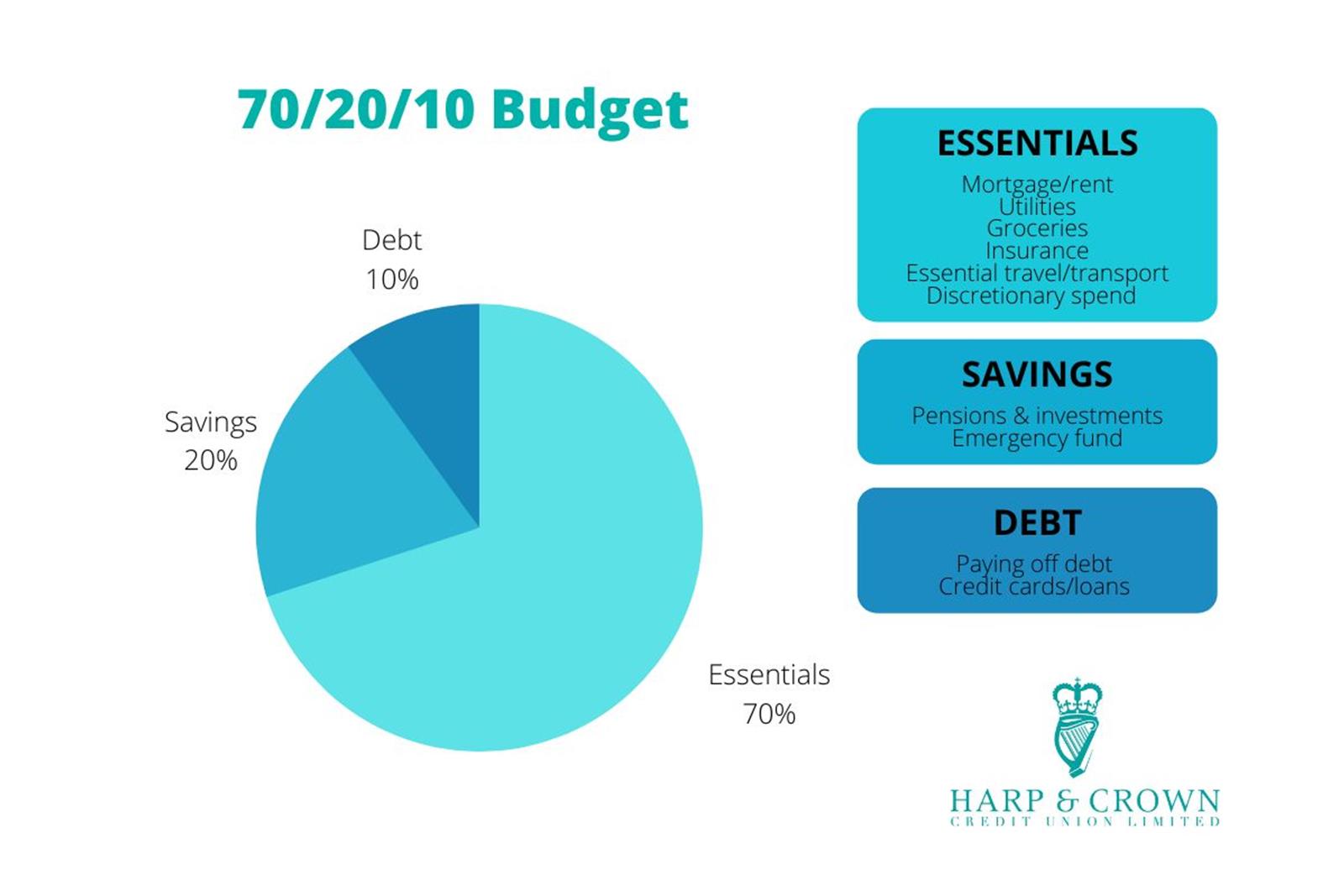

Budgeting 70 20 10 Rule Credit Union News Financial Wellbeing

https://harpandcrown.co.uk/download/images/70-20-10-budget-news.jpg

What is the 50 30 20 rule The idea is you d aim to spend 50 of your income on needs essential living expenses such as rent mortgage bills food and transport to work 30 on wants discretionary spending such as eating out shopping trips and subscriptions What is the 50 30 20 budget In its simplest form the 50 30 20 budget rule divides your after tax income into three distinct buckets which are A plan like this helps

The 50 30 20 rule of thumb is a guideline for allocating your budget accordingly 50 to needs 30 to wants and 20 to your financial goals The rule was popularized in a book by U S Senator Elizabeth Warren The 50 30 20 rule dictates that you spend 50 of your net income on necessities 30 on miscellaneous expenses and 20 on debts savings and investments List of necessities List of miscellaneous expenses List savings

More picture related to 70 30 20 rule

What Is 70 30 Rule In Investing And Managing Money

https://mmk-s3-cms.s3.us-west-2.amazonaws.com/1605706660198.jpeg

The 50 30 20 Rule How To Save More And Spend Less LiVE WELL

https://live-well.co.in/wp-content/uploads/2021/02/50_30_20-Rule-1024x727.png

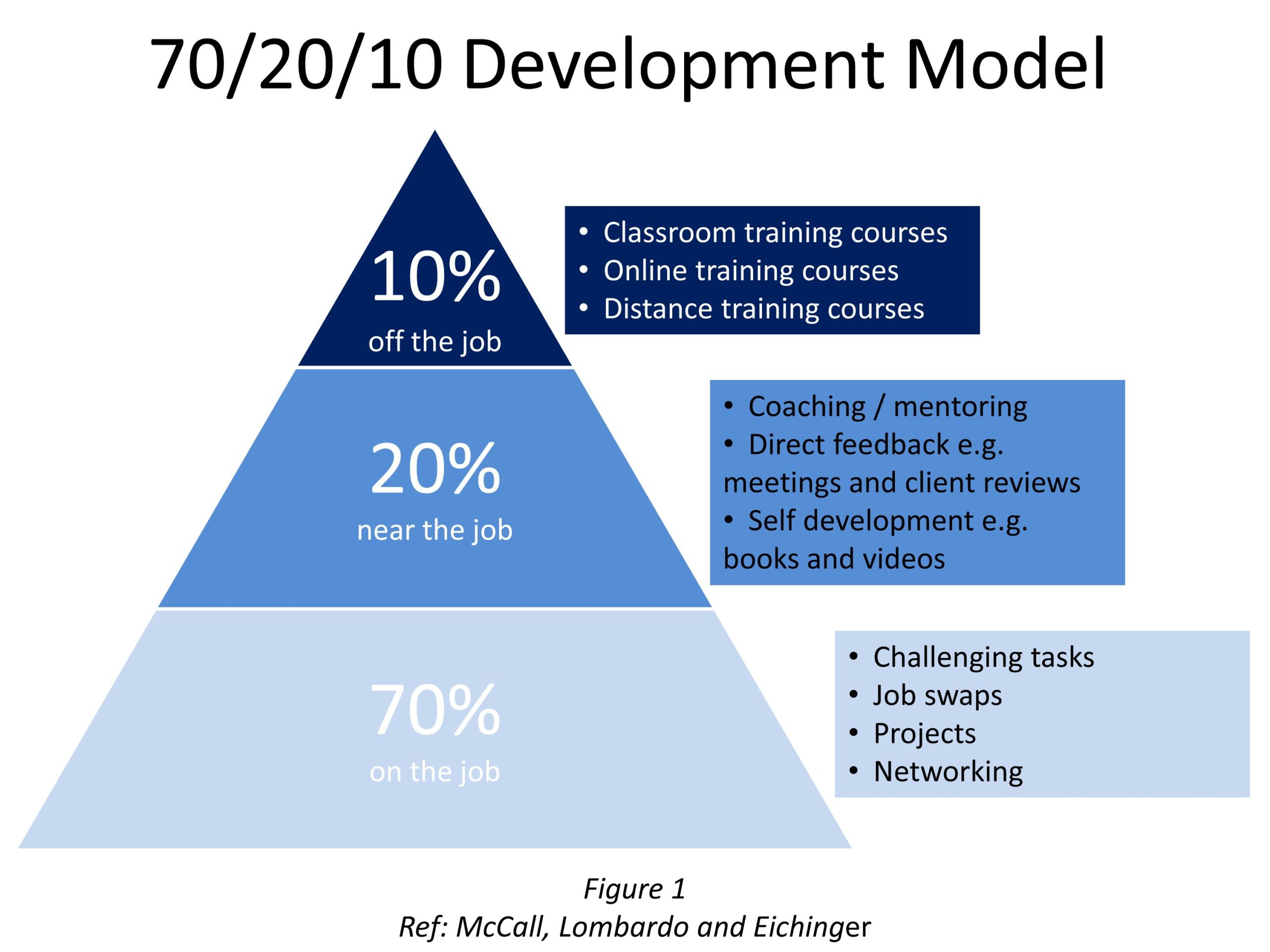

Maggie s E learning Reflections The 70 30 Rule

http://4.bp.blogspot.com/-HBE3LmLJr7I/UKEJQUNhODI/AAAAAAAAAK4/RPQFjsIoxvU/s1600/keep-your-suppliers-eager-with-a-70-30-split_image.GIF

What is the 50 30 20 budget rule The 50 30 20 budget rule slices your monthly pay to cover three different categories of expenses 50 of your after tax income take home pay covers The 50 30 20 rule divides your income into three categories 50 for needs 30 for wants and 20 for debt repayment and savings The rule is a solid starting point for a monthly budget and you can tweak the percentages to fit your evolving financial situation Follow along to find out how to use the rule to your advantage

[desc-10] [desc-11]

The 80 20 Rule For Artists The Nashville Voice

https://images.squarespace-cdn.com/content/v1/570ee640cf80a1a7b7c0d672/1460709088974-2645CPFK26MIGKNMVF9Y/shutterstock_382723642.jpg

What Is The 70 20 10 Rule Money

https://bridefeed.com/wp-content/uploads/2021/08/What-is-the-70-20-10-Rule-money-scaled.jpg

70 30 20 rule - [desc-14]