30 tax of 50000 How much is 30 of 50 000 What is three tenths 3 10 of 50 000 Use this easy and mobile friendly calculator to calculate 30 percent of 50 000 or any other percentage

See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is Calculate gross pay vs net pay with our net to gross calculator Gain clearer insight into your earnings before and after tax

30 tax of 50000

30 tax of 50000

https://freefincal.com/wp-content/uploads/2022/02/30-percent-tax-on-Cryptocurrencies-explained.jpg

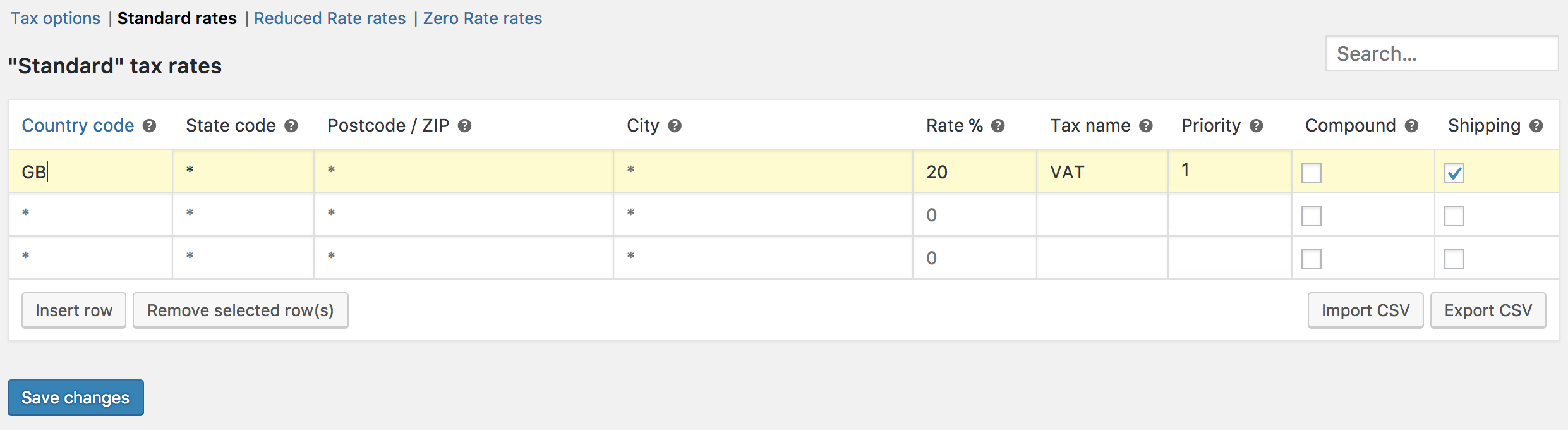

Setting Up Tax Rates

https://woocommerce.com/wp-content/uploads/2013/02/standard-vat-20.png

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/620450db01a484a11166f3c8_Tax Demonstration (1).jpg

Rachel Reeves vowed to restore stability to the British economy as she unveiled 40bn of tax rises in Labour s first Budget in 14 years forecast to rise by over 31bn by Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

NerdWallet s tax calculator can help you estimate your federal income tax bill based on your earnings age deductions and credits Use the Income tax estimator if you want to estimate your tax refund or debt in detail To work out how much tax is to be withheld from current income year payments made to employees and

More picture related to 30 tax of 50000

Cherish Childhood Memories Quotes

https://www.coursehero.com/qa/attachment/19096866/

Dc 30 Tax Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/607/538/607538666/large.png

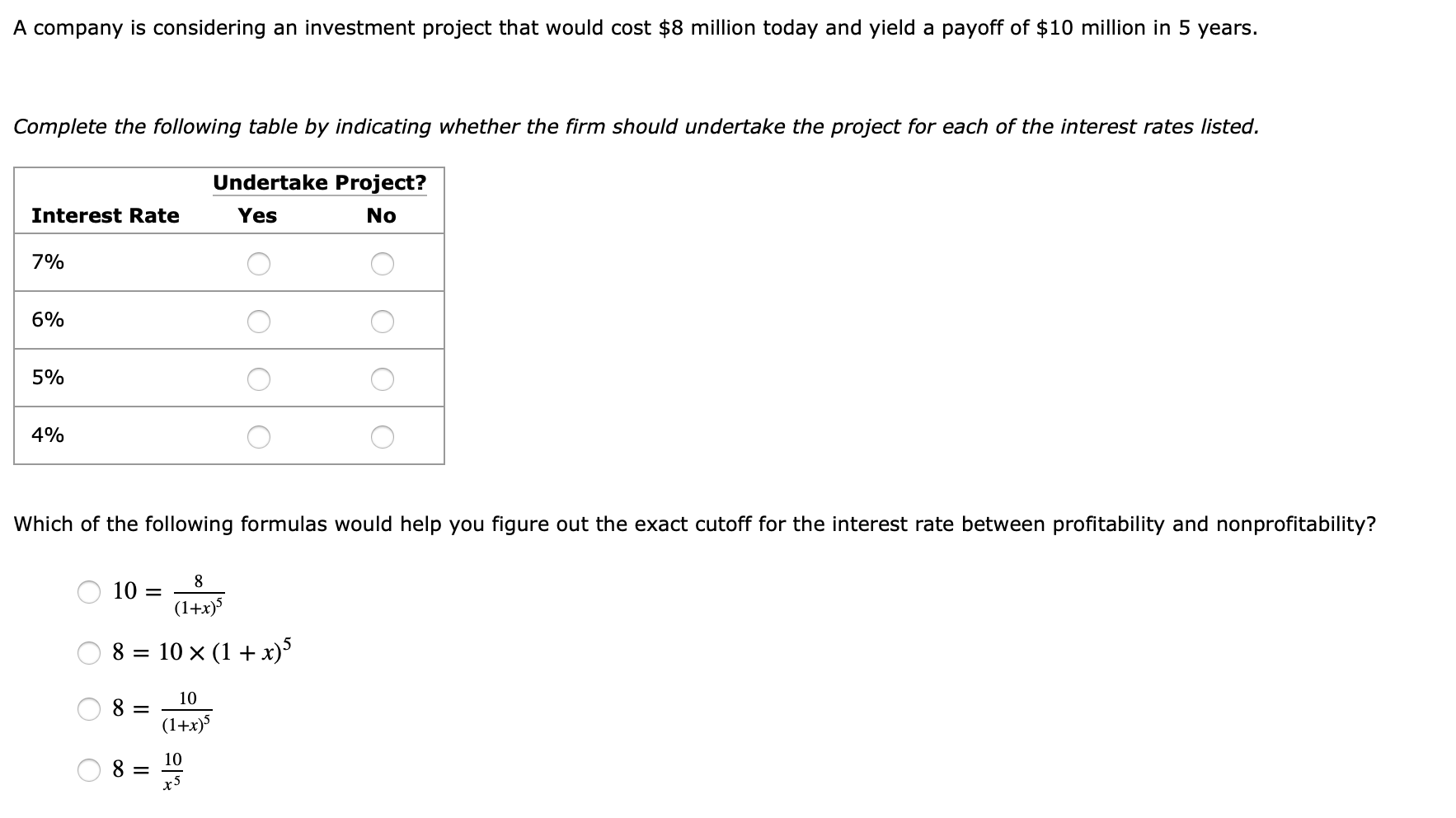

Solved A Company Is Considering An Investment Project That Chegg

https://media.cheggcdn.com/media/99a/99a9e46e-bd33-45ec-94a2-fbfbc7297203/phprveA8Z

Standard deduction of 50 000 for salaried employees Attractive tax rates compared to the Old Tax Regime No need to invest in Life Insurance Health Insurance PPF Home Loans etc to save taxes Zero tax for individuals with The Income tax calculator is an easy to use online tool that helps you calculate your tax liability based on your income details It also gives you a comparison of tax liability between the old and new tax regimes to help you decide which is

With effect from FY 2024 25 under the new tax regime the standard deduction is increased to Rs 75 000 There has been no change to the old tax regime with respect to the standard deduction Thus salaried taxpayers are eligible for the Labour s first budget since 2010 includes 40bn worth of tax rises and spending cuts across government as well as promises to invest in infrastructure and support working people

9 Tips To Help You File Your Federal Income Taxes

https://img.chdrstatic.com/media/de7d8ab0-ad3d-45a7-8ce6-de0d78d3fbdd.jpg?crop=1920:1080,smart&width=1920&height=1080&auto=webp

OUCH Alabama Has 4th Highest Combined Sales Tax Rate In The Country

http://yellowhammernews.com/wp-content/uploads/2016/05/State-Sales-tax-rates.png

30 tax of 50000 - NerdWallet s tax calculator can help you estimate your federal income tax bill based on your earnings age deductions and credits