will i receive a 1098 Who Receives Form 1098 Your lender is required to send Form 1098 to you if you paid 600 or more for the previous year in interest and points on a mortgage If you paid less than 600 you will

You ll receive a Form SSA 1099 if you receive social security benefits If you receive equivalent railroad retirement benefits you ll receive a Form RRB 1099 For information on the taxability of these benefits see IRS Tax Topic 423 Learn how to use Form 1098 to report mortgage interest or mortgage insurance premiums of 600 or more received from an individual in the course of your trade or business Find out who must file when and where to file and what exceptions apply

will i receive a 1098

will i receive a 1098

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

E file Form 1098 E IRS Form 1098 E Student Loan Interest Statement

https://d2rcescxleu4fx.cloudfront.net/images/1098-E.jpg

Form 1098 is used to report mortgage interest of 600 or more received by you from an individual including a sole proprietor Find out how to file download the form and instructions and check for recent updates and developments If you the homeowner paid at least 600 in interest during the tax year you should receive a copy of Form 1098 by January 31st If you paid less than 600 in interest the lender is not required to send the form but you will probably still receive a copy

Learn how to use Form 1098 Mortgage Interest Statement to claim a deduction for your home or rental property Find out what information to report who can deduct and how to split expenses for personal and rental use Learn about the different types of 1098 forms such as Form 1098 Q for qualified longevity annuity contracts and how they may affect your taxes Find out what information is on each form and what to do with it when you file your return

More picture related to will i receive a 1098

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

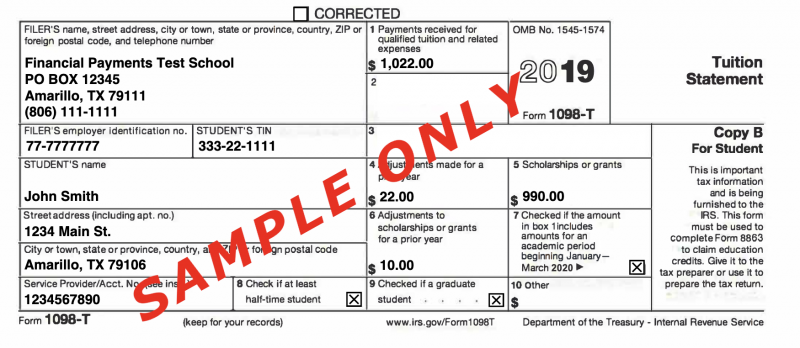

Learn about the IRS Form 1098 T which reports qualified tuition and related expenses QTRE paid by students Find answers to common questions about when how and why to receive or update your Form 1098 T Learn how to access your online or mailed year end tax statements for your mortgage interest and expenses Find out the differences between Form 1098 and Form 1099 and when you may need them for your taxes

IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form If you or your parents paid qualified tuition and college related expenses during the tax year you ll likely receive a Form 1098 T from your school This form may help you claim valuable education credits come tax time Learn what information is on the form when to get it and what to do with it

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

will i receive a 1098 - Learn about the different types of 1098 forms such as Form 1098 Q for qualified longevity annuity contracts and how they may affect your taxes Find out what information is on each form and what to do with it when you file your return