why would prepaid expenses increase Key Takeaways In business accounting a prepaid expense is any good or service that has been paid for but not yet incurred Prepaid expenses are recorded on the balance sheet as an asset

Key Takeaways Prepaid expenses are incurred for assets that will be received at a later time Prepaid expenses are first recorded in the prepaid asset account on the balance sheet The GAAP Learn what prepaid expenses are how to classify them as an asset or expense on your financial statements and examples of prepaid expenses Get ideas here

why would prepaid expenses increase

why would prepaid expenses increase

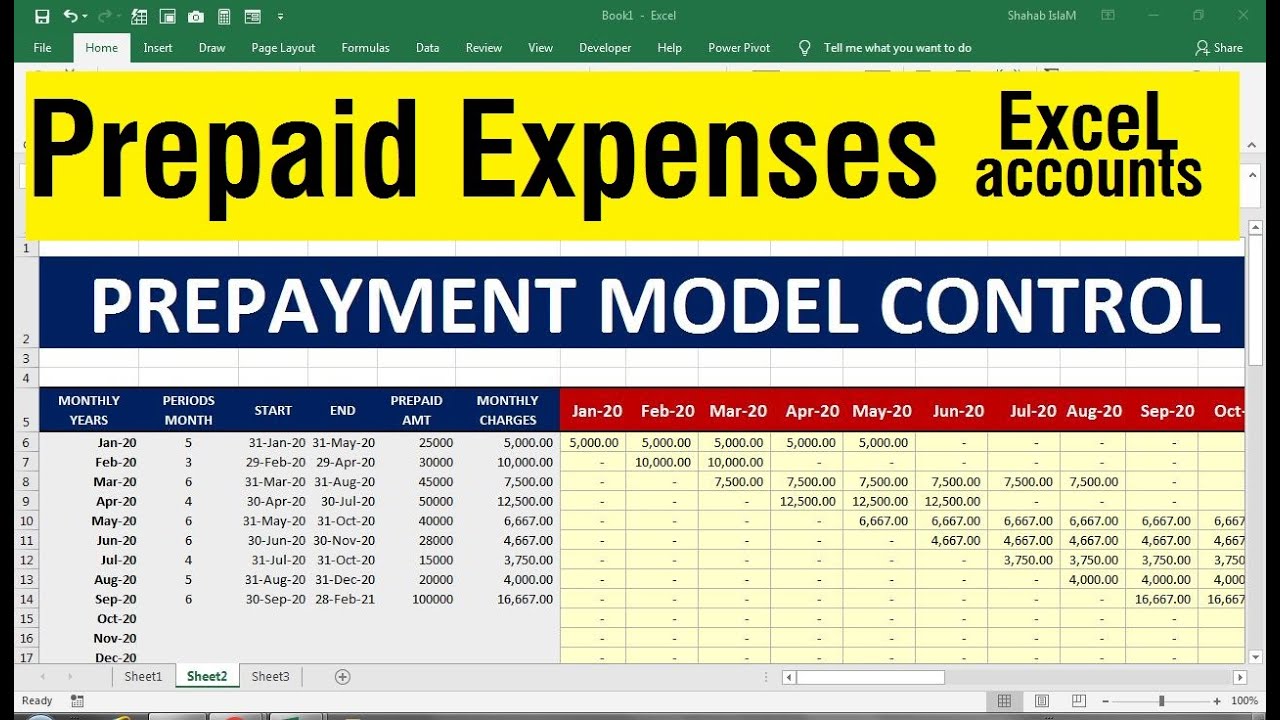

https://i.ytimg.com/vi/AykmRNyAlto/maxresdefault.jpg

Best Guide To Prepaid Expense Definition Journal Entry And Examples

https://www.emagia.com/blog/wp-content/themes/mainblog/assets/images/prepaid-expenses-on-balance-sheet.jpg

Prepaid Expenses Definition Importance Types And Examples

https://happay.com/blog/wp-content/uploads/sites/12/2023/08/prepaid-expenses.webp

The most common examples of prepaid expenses in accounting are prepaid rent from leases prepaid software subscriptions and prepaid insurance premiums Below you ll find a detailed description The key difference lies in the cash flow timing prepaid expenses involve advance payments while accrued expenses involve expenses without immediate payment Properly distinguishing and accounting for these

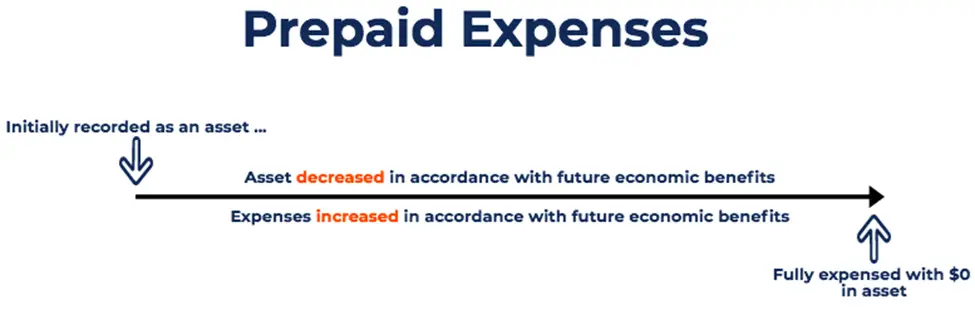

Prepaid expenses are recognized as an asset because they provide future economic benefits to a company While prepaid expenses are initially recorded as an asset they eventually transition to an expense on the Prepaid expenses are expenses that have not yet been recorded but have already been paid in advance Learn how to record prepaid expenses in four steps

More picture related to why would prepaid expenses increase

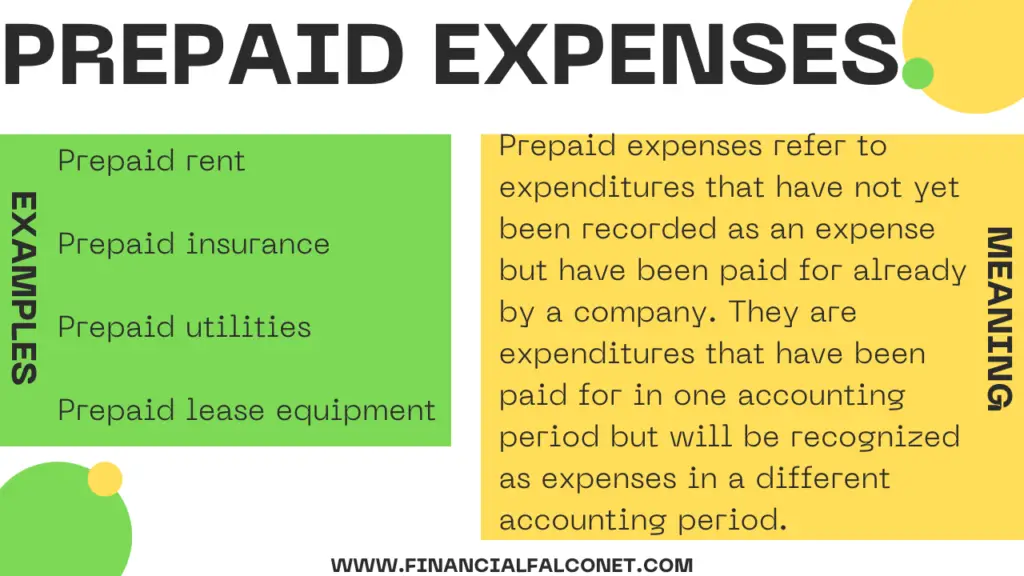

Why Prepaid Expenses Appear In The Current Asset Section Of The Balance

https://financialfalconet.com/wp-content/uploads/2023/01/Prepaid-expenses-Meaning-and-example-1024x576.png

Prepaid Expenses Definition Journal Entry And Examples

https://global-uploads.webflow.com/628cb4acdaf9087cd633cc6b/648c8148f5403c2c20593f99_Screenshot 2023-06-16 at 15.23.58.webp

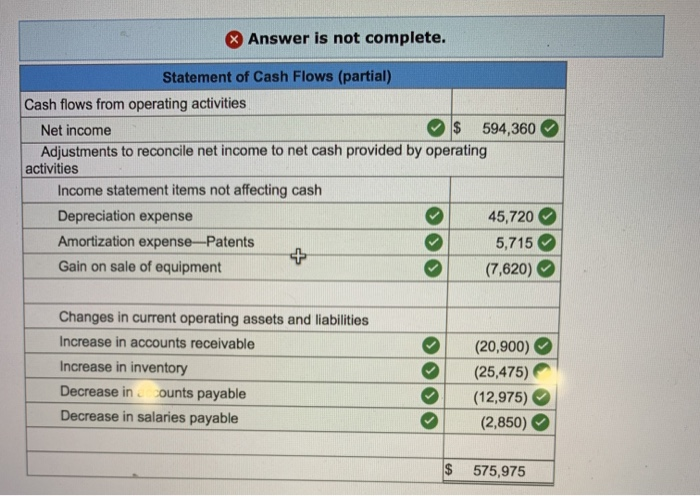

Solved The Following Income Statement And Additional Chegg

https://media.cheggcdn.com/study/c7e/c7e67187-8ac7-4b4d-949d-e06505167840/image.png

The reason for the current asset designation is that most prepaid assets are consumed within a few months of their initial recordation If a prepaid expense were likely to not be consumed within the next Accounting prepaid expenses are the expenses that are paid before they are incurred Accounting prepaid expenses are recorded as assets in the balance sheet and are expensed in the income statement

Prepaid accounting is important for several reasons It helps businesses plan and budget their cash flow by spreading out large payments over time It helps businesses avoid interest charges late Prepaid expenses serve as a strategic tool for businesses to manage their financial obligations and streamline their budgeting processes By paying for services or

Understanding Prepaid Expenses

https://accountinghubspot.com/wp-content/uploads/2023/11/PREPAID-EXPENSES.jpg

How To Create A Prepaid Expenses Journal Entry Step By Step AUDITHOW

https://audithow.com/wp-content/uploads/2022/05/image.png

why would prepaid expenses increase - This journal entry shows that when we make an advance payment there is an increase in prepaid expenses debit However at the same time the cash balance decreases