who has to report 1099 You may either use box 7 on Form 1099 MISC or box 2 on Form 1099 NEC to report the direct sales totaling 5 000 or more If you use Form 1099 NEC to report these sales then you are required to file the Form 1099 NEC with the

Form 1099 reports freelance payments income from investments retirement accounts Social Security benefits and government Form 1099 MISC is used to report miscellaneous compensation such as rent prizes awards medical and healthcare payments and payments to an attorney Until 2020 it was also used to report

who has to report 1099

who has to report 1099

https://lili.co/wp-content/uploads/2022/12/1099-K_Form_1000x1294-1.jpg

Form 1099 INT What To Know Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2019/07/form-1099-INT-what-to-know_1157237489.jpg

How To File A 1099 Form For Vendors Contractors And Freelancers

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/62febbe85290864275ec05d3_Blog_Hero_1099.png

Form 1099 is used to report certain types of non employment income to the IRS such as dividends from a stock or pay you received as an independent contractor Businesses must issue 1099s to any 1099 forms report a taxpayer s non employment income received throughout the tax year to the Internal Revenue Service IRS The IRS compares reported income on Form 1040 with the information

File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest Rents Prizes and A 1099 form is an information return that reports taxable income other than wages salary and tips For example if you re self employed or earn rental income you ll likely receive a 1099

More picture related to who has to report 1099

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

Types Of 1099 Form 2023 Printable Forms Free Online

https://www.investopedia.com/thmb/l3-zjfAJeBX_pupiS9fdoXdKD-w=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg

1099 Form 2023 Fillable Printable Forms Free Online

https://d3pbdh1dmixop.cloudfront.net/pdfexpert/content_pages/mac_how-to-fill-1099-misc-form/new_2023-how-to-fill-1099-filledform2x.png

1099 Form 2022

https://www.taxbandits.com/content/images/1099-INT-instruction.png

Who receives a 1099 Form Form 1099 is a collection of forms used to report payments that typically aren t from an employer 1099 forms can report different types of incomes These can include payments to independent 22 rowsEach payee taxpayer is legally responsible for reporting the correct amount of total income on his or her own Federal income tax return regardless of whether a Form 1099 was

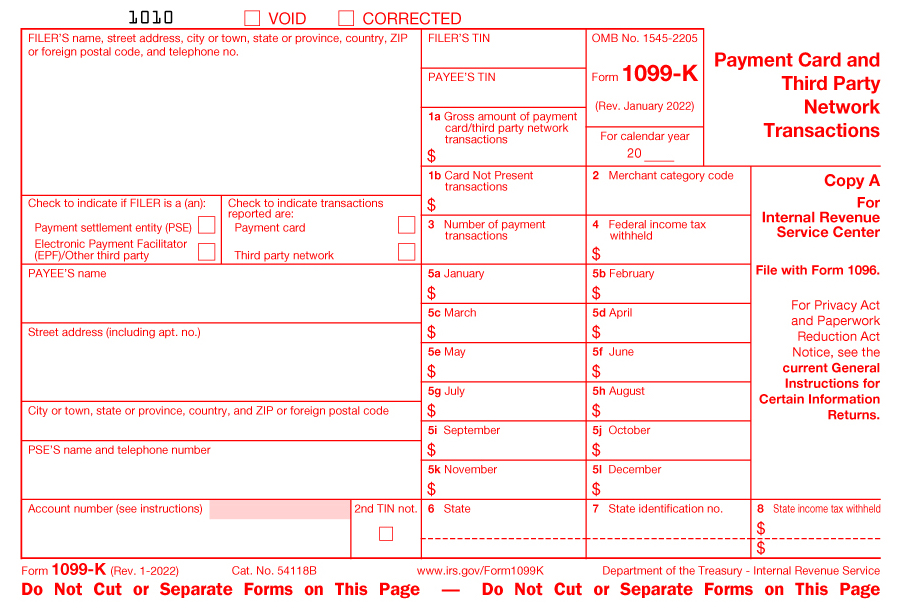

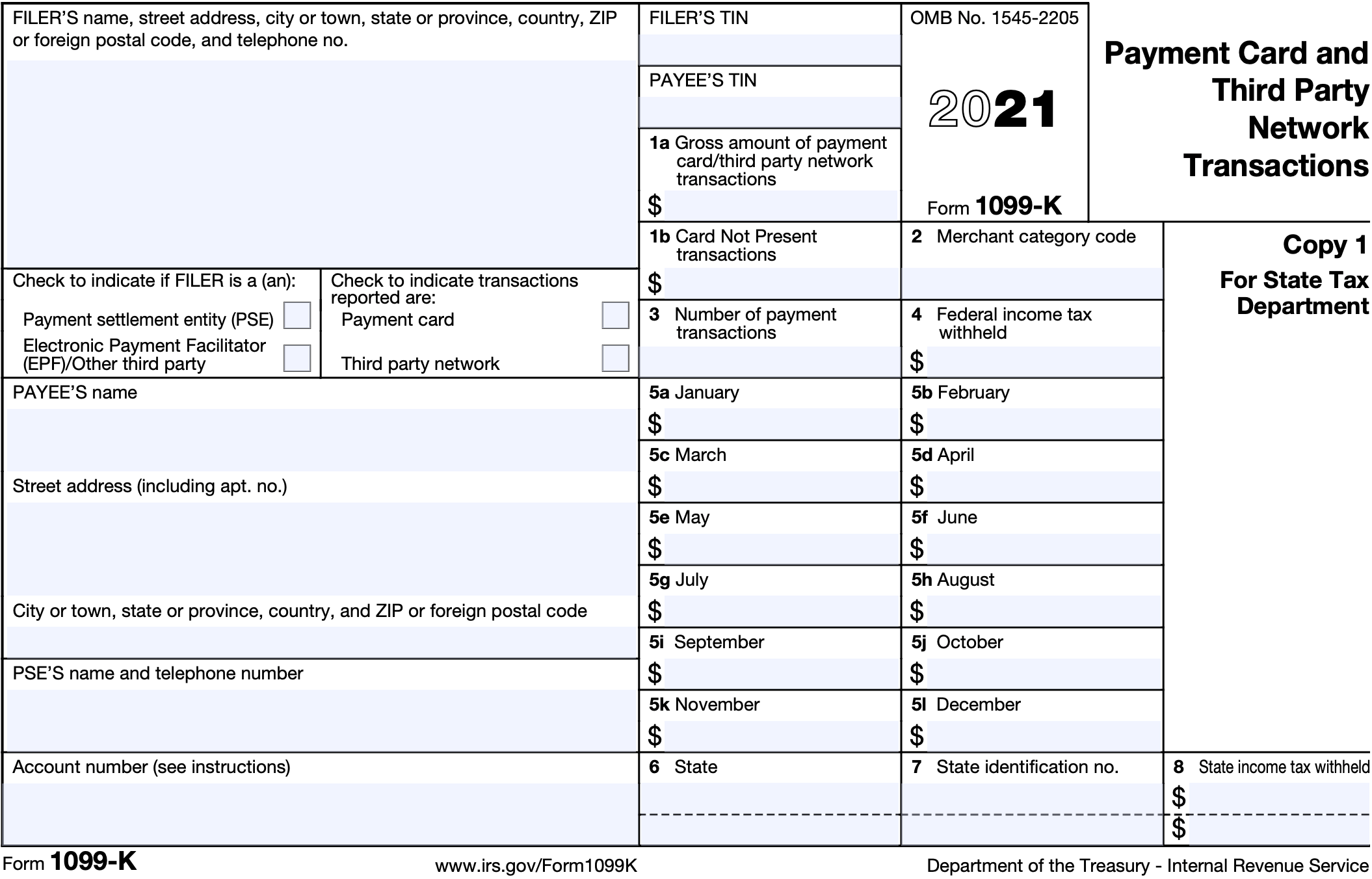

However the most common use of Form 1099 is reporting independent contractor payments for services provided to a business In this post we ll cover what a 1099 How to file a 1099 form There are two copies of Form 1099 Copy A and Copy B If you hire an independent contractor you must report what you pay them on Copy A and submit it to the

Payment Card And Third Party Network Transactions 1099 K Crippen

https://crippencpa.com/wp-content/uploads/2022/07/1099-K-form.png

Free 1099 Tax Forms Printable

https://free-printablehq.com/wp-content/uploads/2019/07/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-form.png

who has to report 1099 - Form 1099 is used to report certain types of non employment income to the IRS such as dividends from a stock or pay you received as an independent contractor Businesses must issue 1099s to any