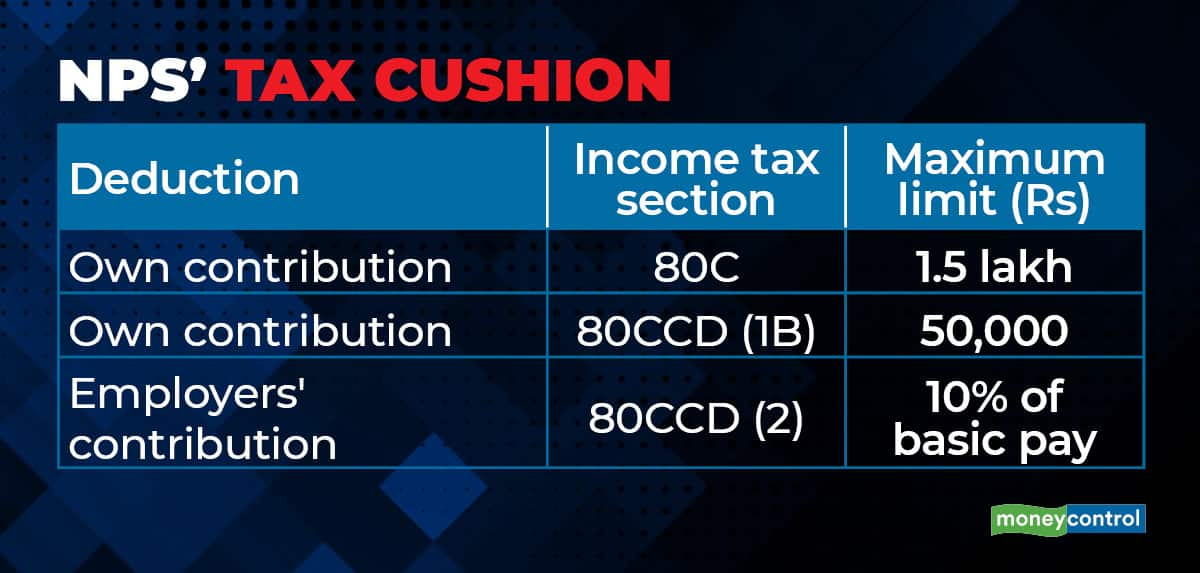

who can claim 80ccd 2 Section 80CCD 2 of Income Tax Act Employer s can also claim for additional deduction for contributing towards employee s pension account of up to 10 of the salary of the employee

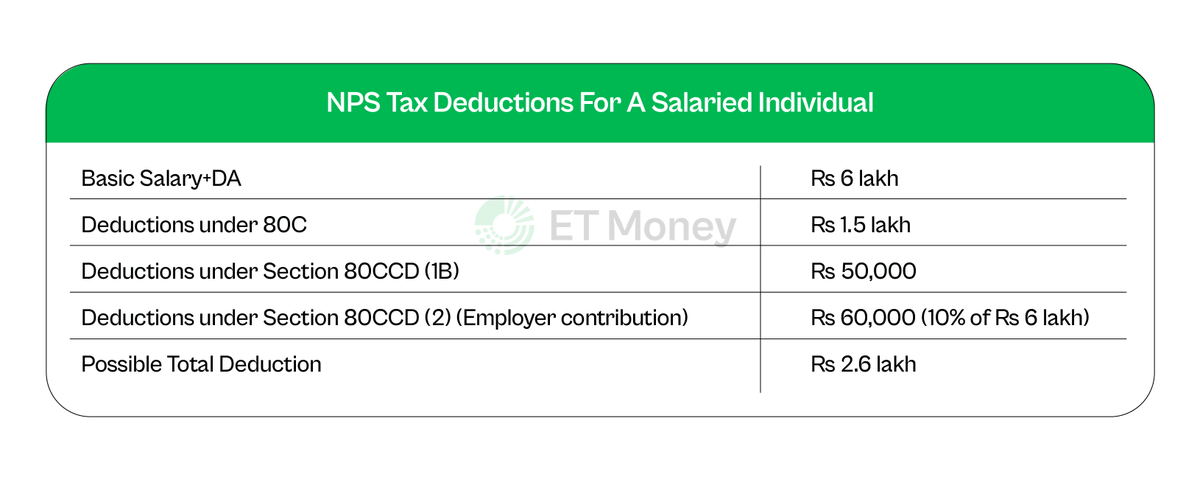

A salaried person is eligible to claim the following deduction under Section 80CCD 2 a maximum contribution from the Central Government or State Government to NPS of 14 of their income basic DA a maximum Rs 2 lakhs is the 80CCD 2 maximum limit that can be claimed under the section It contains the additional deduction of Rs 50 000 that is available under 80CCD 1B Tax benefits that have

who can claim 80ccd 2

who can claim 80ccd 2

https://pbs.twimg.com/media/FrzB90wWAAEJgBF?format=jpg&name=large

What Are The Tax Benefits That NPS Offers

https://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

https://pbs.twimg.com/media/FcI0Ex5aAAIs5Uy.png

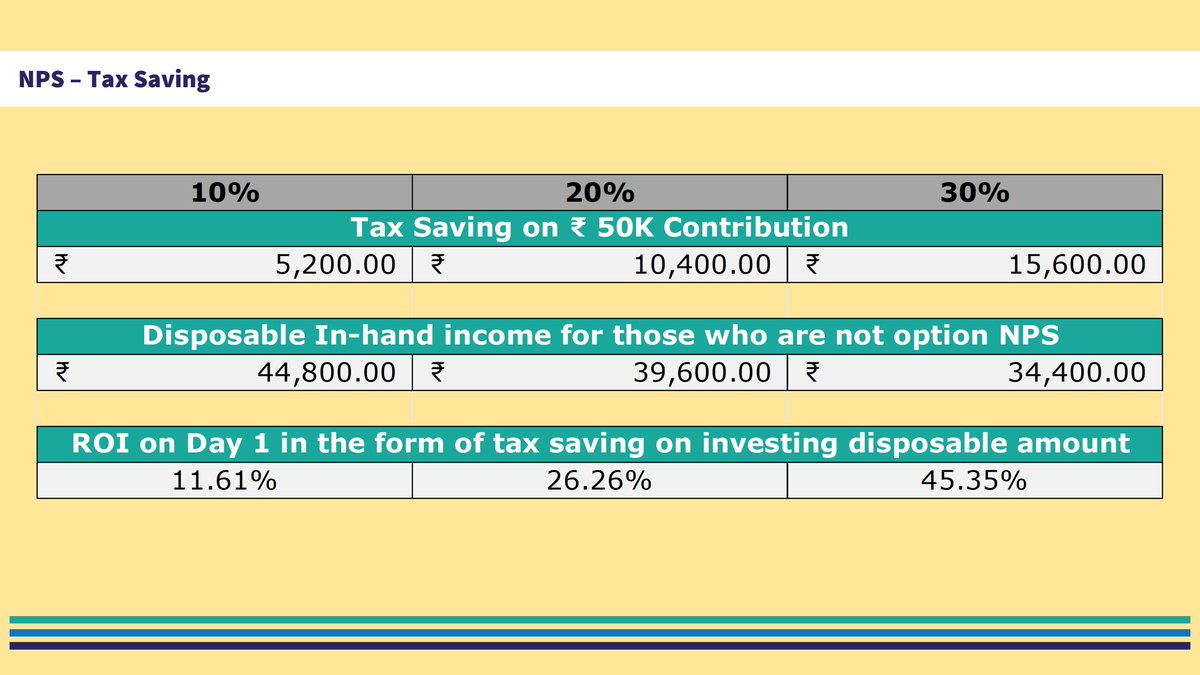

Employees can claim tax deductions upto Rs 1 5 lakh under Section 80CCD 1 for NPS contribution Also they can claim additional tax deductions of upto Rs 50 000 under Section 80CCD 1B What investment Learn how to claim deduction under Section 80CCD for contribution to pension funds notified by Central Government Find out the eligibility quantum and impact of Finance Act 2020 on this deduction

Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits with NPS Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for

More picture related to who can claim 80ccd 2

My 80C Investments Are Completed If I Invest Rs 50K In NPS Tier 1 Can I

https://i.ytimg.com/vi/aIHQMwkN0u8/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBaKEYwDw==&rs=AOn4CLCjRHmlM9XWgfjY-xEgcpaOk9l5og

8 Things You Must Know About National Pension Scheme NPS

https://pbs.twimg.com/media/FaKrc6vVsAMIHaI.jpg

Tax Planning Should Be An Integral Part Of Your Overall Financial

https://pbs.twimg.com/media/FhGRScpaAAE2Cnc.jpg

Deduction for employer s contribution to NPS u s 80CCD 2 is allowed upto maximum of 10 of basic salary DA Therefore only Rs 1 40 000 is allowed as deduction Deduction can be claimed up to the limit of Individuals 10 basic annual salary basic dearness allowance or 10 of gross annual income in case self employed Upper limit on

Learn how to claim an additional tax deduction under Section 80CCD 2 on contributions made by your employer towards your National Pension System NPS account Yes eligible individuals can claim tax benefits of a maximum of Rs 1 5 lakhs while reading both Section 80CCD 1 and 80CCD 2 together Who can claim Section 80CCD 2 deduction

Deduction Under Section 80CCD 2 For Employer s Contribution To

https://img.etimg.com/thumb/msid-97694570,width-640,resizemode-4,imgsize-406338/deduction-under-section-80ccd-2-for-employers-contribution-to-employees-national-pension-system-nps-account.jpg

Tax Planning Should Be An Integral Part Of Your Overall Financial

https://pbs.twimg.com/media/FhGRScqacAEteAA.jpg

who can claim 80ccd 2 - Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for