which of the following expenses is not a variable cost Variable costs are costs that Select one a vary in total directly and proportionately with changes in the activity level b remain the same per unit at every activity level

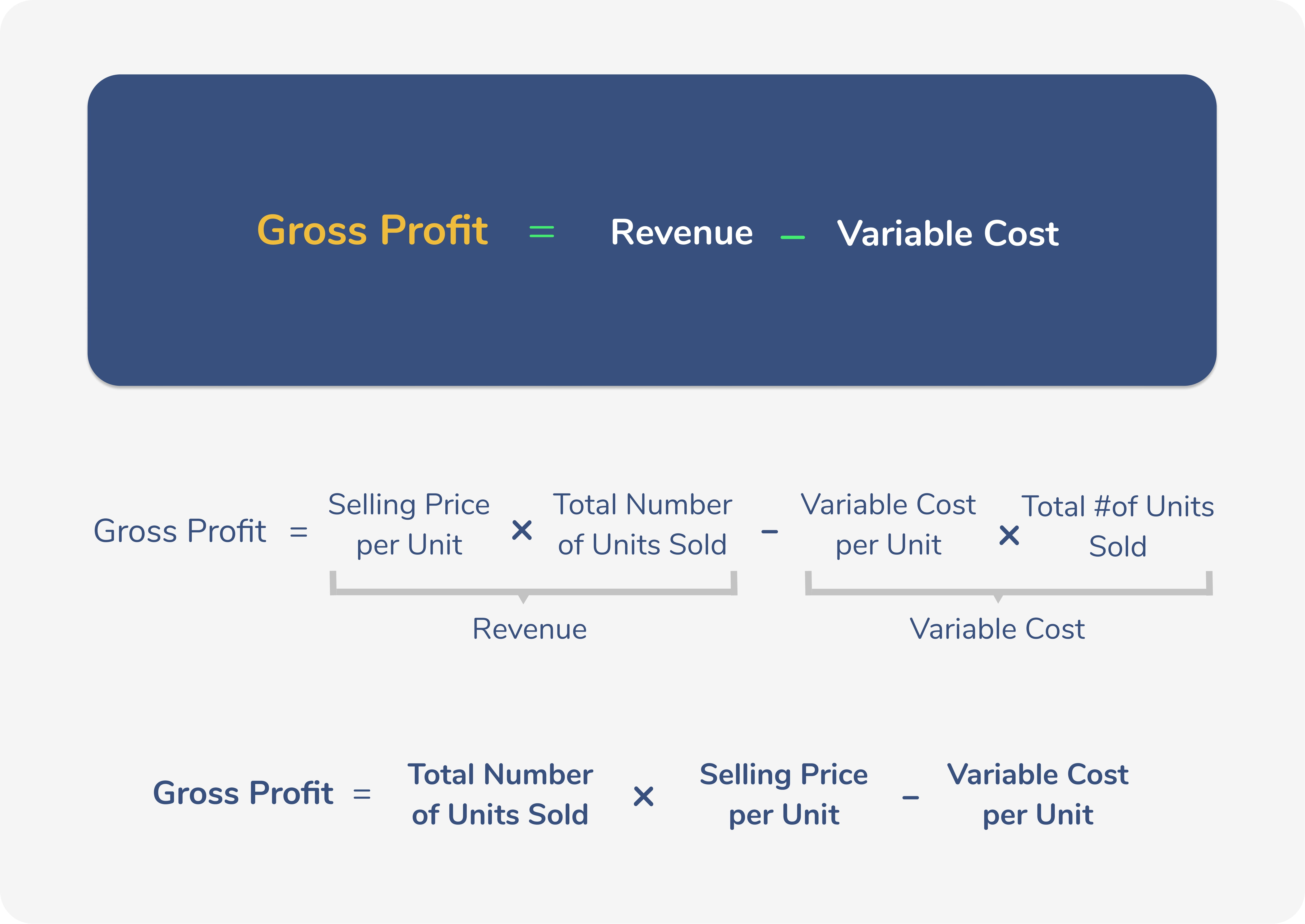

Variable costs stand in contrast with fixed costs since fixed costs do not change directly based on production volume Examples of fixed costs are employee wages building costs and insurance As mentioned above variable expenses do not remain constant when production levels change On the other hand fixed costs are costs that remain constant regardless of production levels such as office rent

which of the following expenses is not a variable cost

which of the following expenses is not a variable cost

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

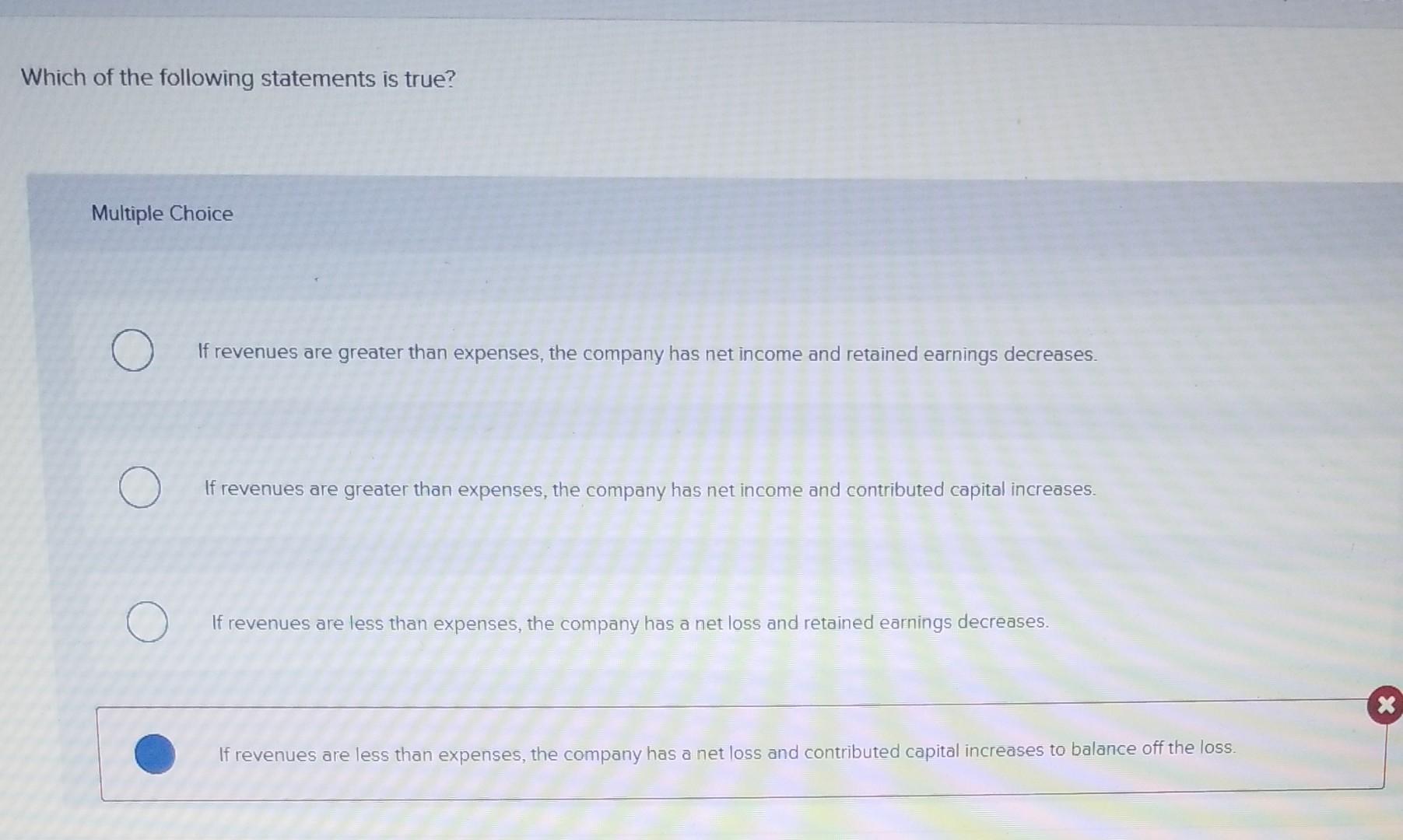

Solved Business Solutions s Second quarter 2020 Fixed Budget Chegg

https://media.cheggcdn.com/media/863/863c994a-644b-4069-a1c2-2c5b7281c750/phpsVEV2z.png

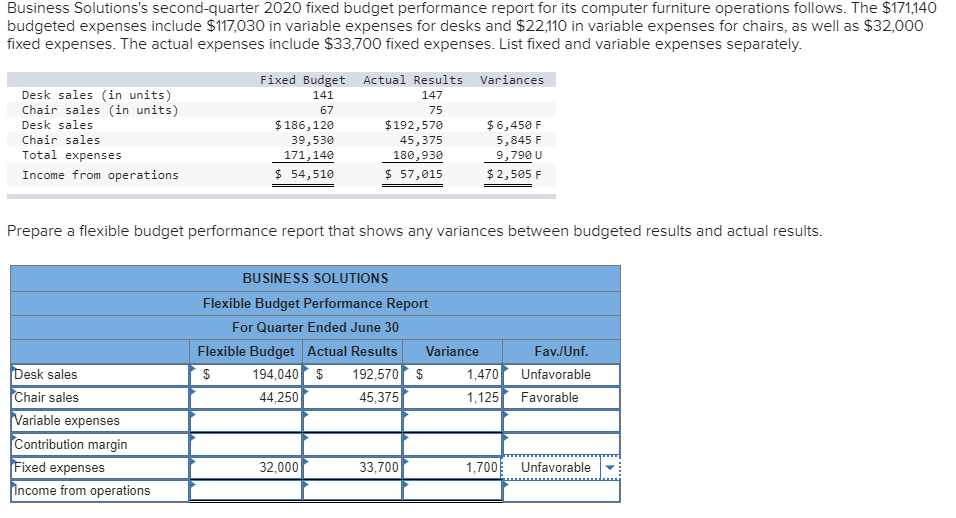

Variable Cost Definition Formula And Calculation Wise

https://wise.com/imaginary/e167c360aeb98b31c8a93061c9815c10.jpg

Key Takeaways Companies incur two types of production costs variable and fixed costs Variable costs change based on the amount of output produced Variable costs may include labor A Variable Cost is a corporate expense that changes in proportion with activity i e production levels or sales volume The opposite of that would be a Fixed

Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the product cost of production The method contrasts with absorption costing in which Variable costs are expenses that fluctuate in direct correlation with the level of production or sales These costs vary as business activities change reflecting the

More picture related to which of the following expenses is not a variable cost

KolkataTimes

http://kolkatatimes.co.in/wp-content/uploads/2018/03/Income-and-Expenses.jpg

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How Operating Expenses And Cost Of Goods Sold Differ

https://www.investopedia.com/thmb/PRGkjFMd-SG0-ebs4y1M2omqsHE=/1391x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg

Solved Which Of The Following Statements Is True Multiple Chegg

https://media.cheggcdn.com/study/576/5761f097-7bef-4f61-b796-2deb372738a1/image

Direct costs are expenses that can be directly traced to a product while variable costs vary with the level of production output Understanding Direct Costs and Variable Costs Although direct Variable costs are expenses that do not remain constant Instead they vary with time and production levels Variable expenses are directly proportional to

A variable cost is an expense that changes in proportion to the level of production or sales Among the given options rent is not a variable cost because it A variable cost is a cost that changes in relation to variations in an activity In a business the activity is frequently production volume with sales volume being

Variable Cost Definition Formula And Calculation Wise

https://wise.com/imaginary/d7675ef64e7aeccfb95497b86361d3e1.jpg

A Simple Guide To Budget Variance Finmark

https://finmark.com/wp-content/uploads/2022/01/difference-between-fixed-and-variable-costs.png

which of the following expenses is not a variable cost - A variable cost is a cost that changes in direct proportion to the level of production or sales In this case the only expense that is not a variable cost is rent