when to use 1120f Form 1120 F is the tax document that foreign corporations must use to report their income gains losses deductions and credits to the IRS It is also the form

Form 1120 F What Expat Business Owners Need to Know Updated on April 9 2024 Reviewed by a Greenback Expat Tax Accountant If your foreign corporation does business in the US you Generally the due date for Form 1120 F is the 15th day of the fourth month after the end of your tax year for a foreign corporation that maintains an office or place

when to use 1120f

when to use 1120f

https://cdn.taxd.co.uk/when_do_i_need_to_register_as_self_employed_bcbf3658f6.jpg

Filters Purifiers And Softeners What s The Difference Reynolds

http://www.business-babble.com/wp-content/uploads/2018/10/Image-to-use-for-Reynolds.jpg

How To Use An AI Product Description Generator In E Commerce

https://narrato.io/blog/wp-content/uploads/2023/07/How-to-use-an-AI-product-description-generator.jpg

A foreign corporation that is engaged in a U S trade or business at any time during the year must file a return on Form 1120 F The return is required even if the foreign corporation The due date for filing Form 1120 F is typically the 15th day of the 4th month after the end of the corporation s tax year An automatic 6 month extension can

For tax year 2022 the 1120 F due date 2023 is April 17 2023 April 15th falls on a Saturday Timely filing Form 1120 F with Schedule F and Form 5471 is Use Form 1120 F to report the income gains losses deductions credits and to figure the U S income tax liability of a foreign corporation Also use Form 1120 F to claim any

More picture related to when to use 1120f

SPF Why To Use And Which One To Choose Roxie Cosmetics

https://cdn.shopify.com/s/files/1/0303/5027/8796/articles/spf-why-to-use-and-which-one-to-choose.jpg?v=1657971190

The 10 Most Effective Types Of Calls To Action And When To Use Them

https://imwithliz.com/wp-content/uploads/2019/12/10-calls-to-action.png

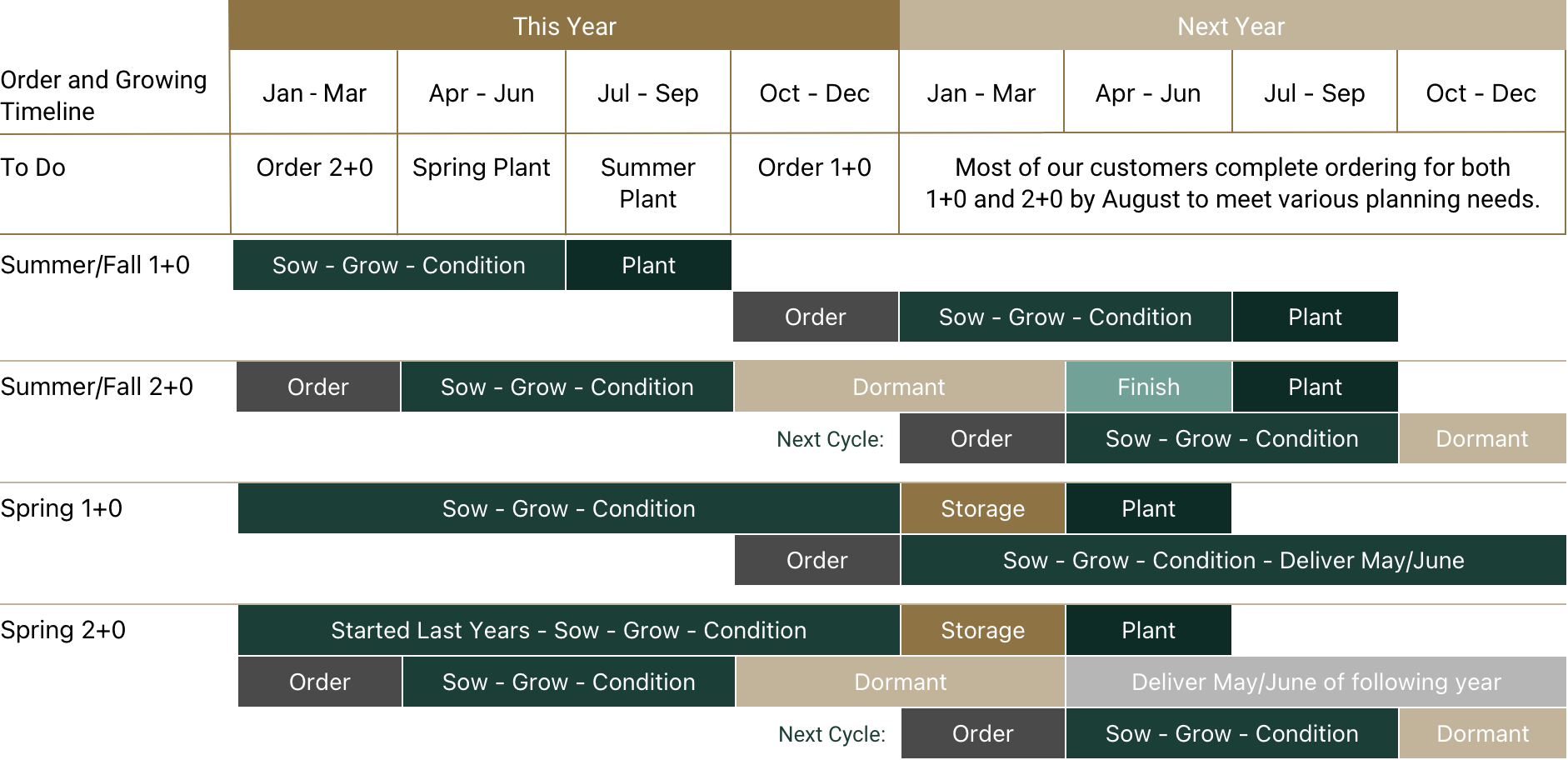

When To Order PRT Growing Services Ltd

https://www.prt.com/sites/default/files/inline-images/PRT When to Order Chart.png

We explain the benefits of filing a so called protective 1120 F with the IRS as a means to protect a foreign business from an onerous result if the business is ultimately The due date for filing Form 1120 F depends on whether the corporation has premises in the US If it does the filing date is March 15 If it doesn t the deadline is

When to File Form 1120 F As provided by the IRS Foreign Corporation With an Office or Place of Business in the United States A foreign corporation that maintains an office or Revised Form 1120 F Practical Issues and Missed Opportunities By Susan J Conklin CPA Washington DC June 30 2009 Editor Annette B Smith CPA In early 2007 the

How To Use Decentralized Apps A Comprehensive Guide

https://coinposters.com/wp-content/uploads/2023/06/How-to-Use-Decentralized-Apps.jpg

Invoicing Tips What Do To When Clients Don t Pay

https://www.dolmanbateman.com.au/hubfs/Imported_Blog_Media/Invoicing-tips-what-to-do-when-clients-dont-pay-1024x1024.png

when to use 1120f - Intuit HelpIntuit Generating Form 1120 F Income Tax Return of a Foreign Corporation in Lacerte SOLVED by Intuit 7 Updated almost 2 years ago Lacerte only