When Should A 1099 Nec Be Used - Worksheets have actually become important devices for different objectives, extending education and learning, service, and individual company. From straightforward arithmetic workouts to complex company analyses, worksheets serve as organized structures that promote knowing, planning, and decision-making processes.

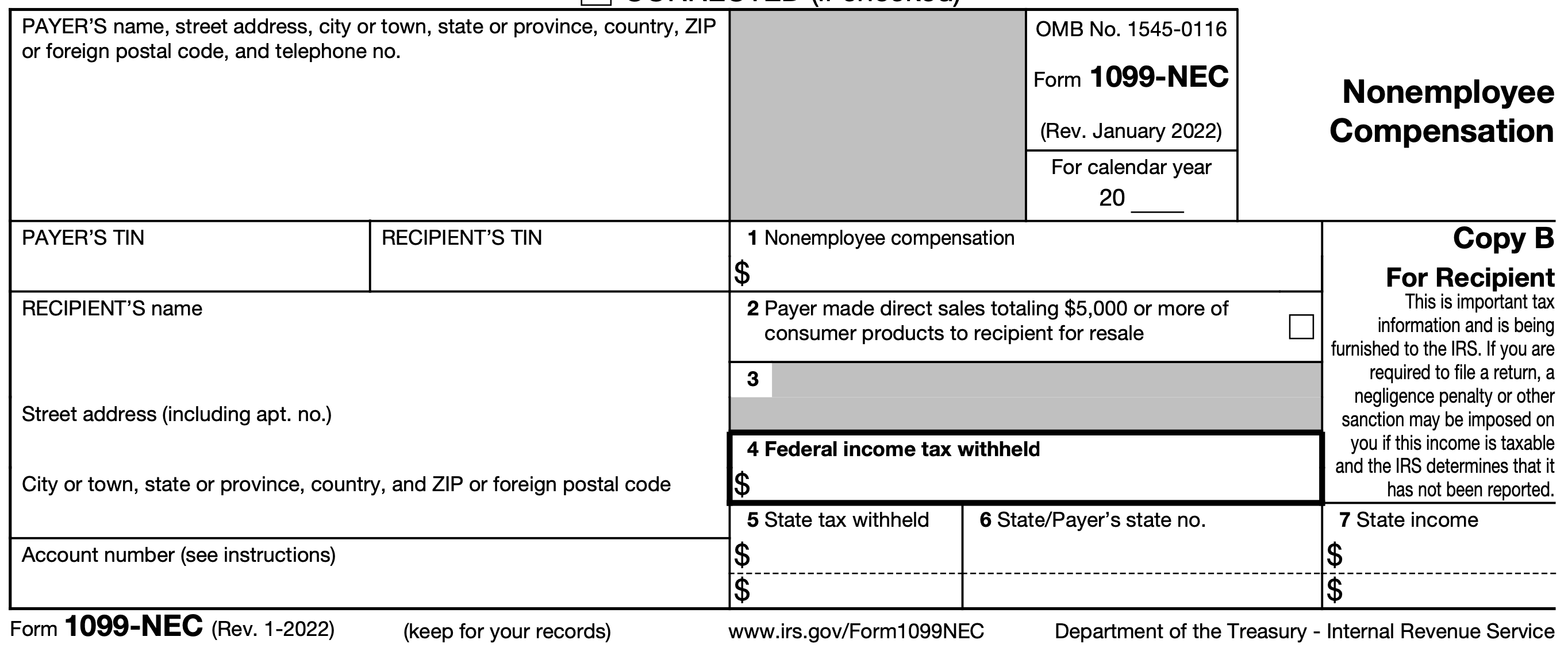

New IRS Form 1099 NEC Used To Report Payments To Nonemployee Service

New IRS Form 1099 NEC Used To Report Payments To Nonemployee Service

Worksheets are structured files used to organize data, info, or jobs methodically. They supply a graph of ideas, enabling customers to input, adjust, and evaluate information effectively. Whether in the class, the conference room, or in your home, worksheets streamline processes and enhance productivity.

Worksheet Varieties

Understanding Devices for Success

In educational settings, worksheets are important sources for teachers and pupils alike. They can vary from mathematics problem readies to language understanding exercises, providing chances for method, reinforcement, and evaluation.

Productivity Pages

Worksheets in the corporate round have numerous objectives, such as budgeting, project monitoring, and assessing data. They assist in informed decision-making and tracking of goal achievement by companies, covering monetary reports and SWOT evaluations.

Private Activity Sheets

On an individual level, worksheets can help in goal setting, time monitoring, and habit monitoring. Whether planning a budget, organizing a day-to-day timetable, or keeping an eye on health and fitness progress, individual worksheets supply framework and accountability.

Optimizing Learning: The Advantages of Worksheets

Worksheets supply numerous benefits. They promote engaged understanding, boost understanding, and nurture logical thinking capacities. Additionally, worksheets support structure, rise effectiveness and enable synergy in group scenarios.

1099 MISC Box 6 What You Need To Know FundsNet

Avoid These Common Errors For Form 1099 NEC

Track1099 1099 NEC Filing Track1099

What You Need To Know About Form 1099 NEC Hourly Inc

What Is Form 1099 NEC For Nonemployee Compensation

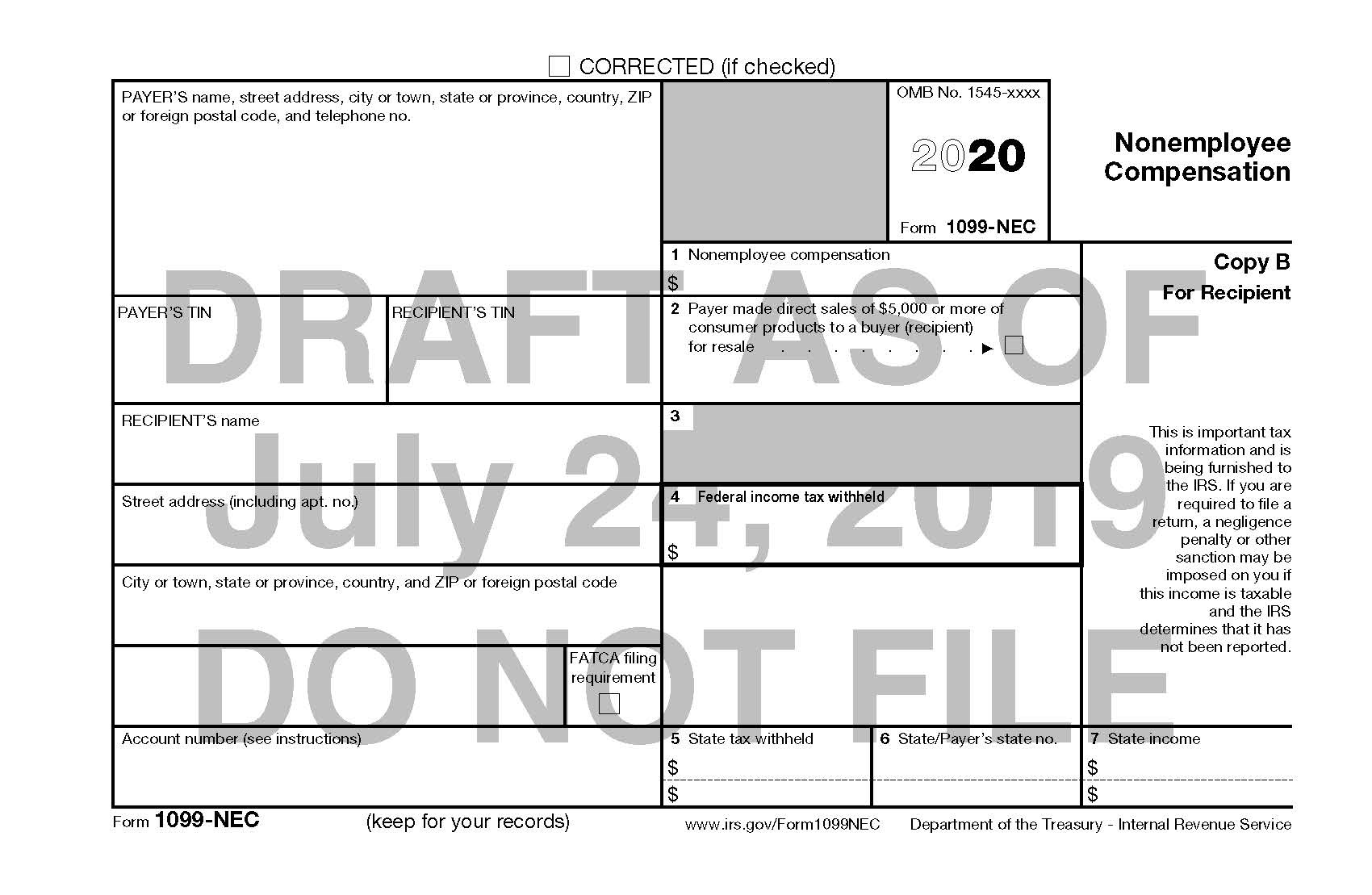

IRS To Bring Back Form 1099 NEC Last Used In 1982 Current Federal

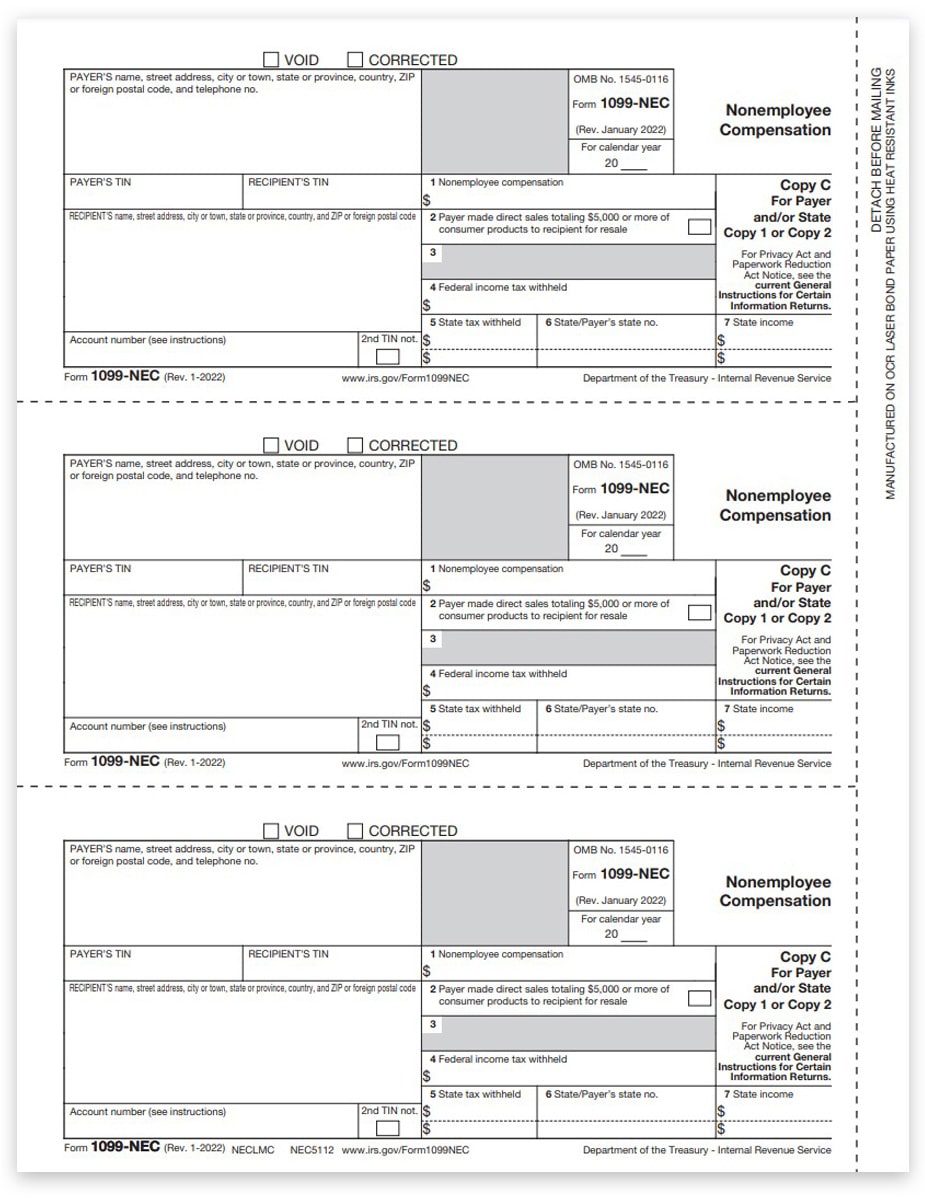

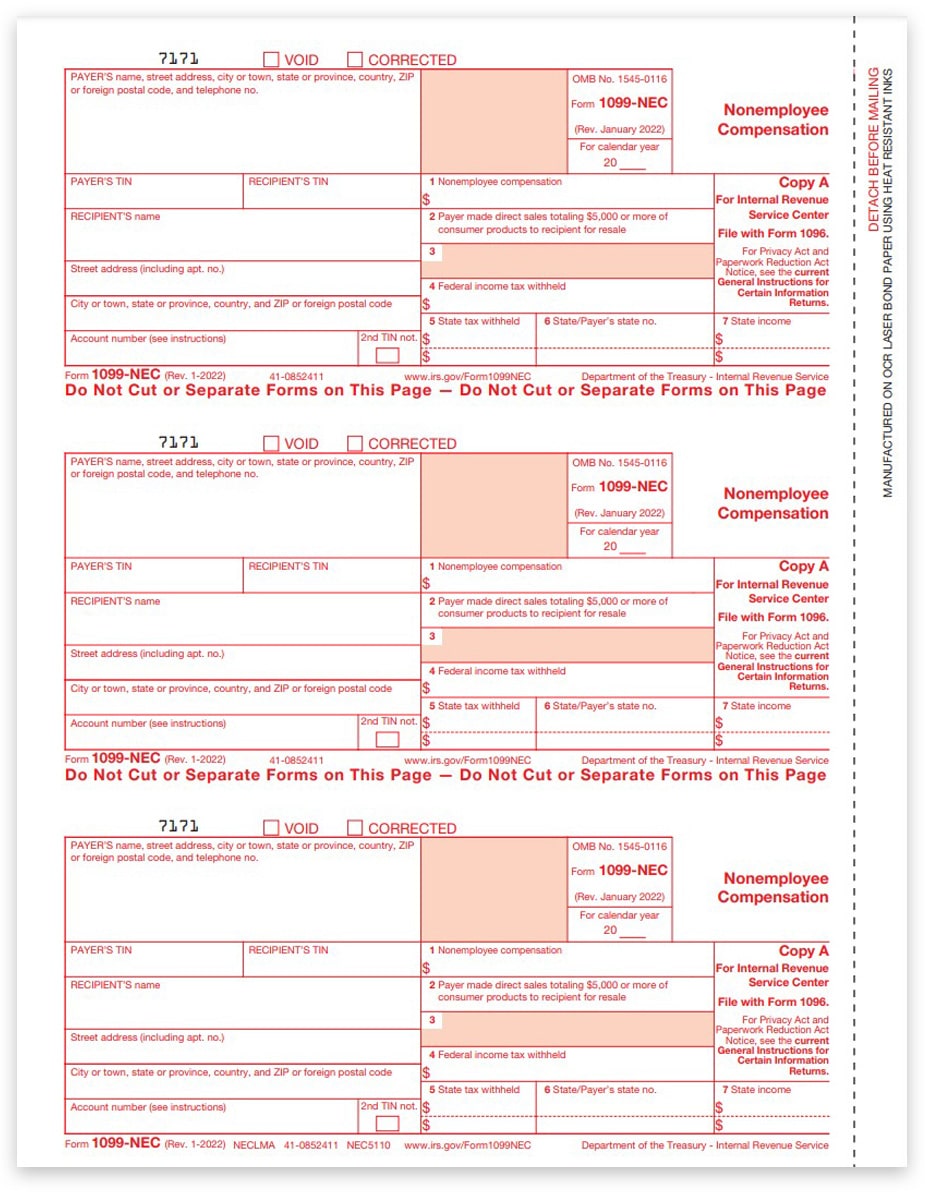

1099NEC Form Sets For 2023 Nonemployee Compensation ZPBforms

W 9 Vs 1099 IRS Forms Differences And When To Use Them

1099 NEC Or 1099 MISC What Has Changed And Why It Matters IssueWire

1099NEC Tax Form Copy A For Non Employee Compensation ZBP Forms