what s 1099 nec Information about Form 1099 NEC Nonemployee Compensation including recent updates related forms and instructions on how to file Use Form 1099 NEC to

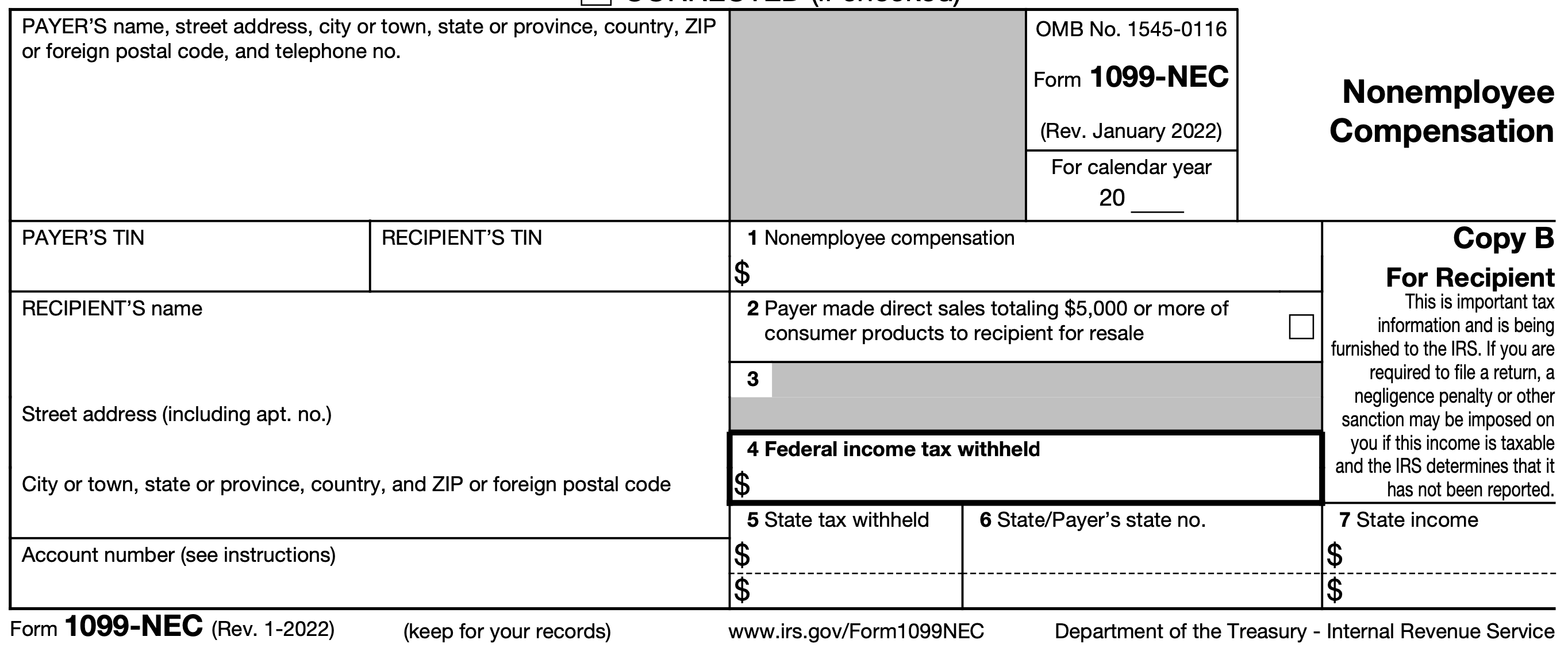

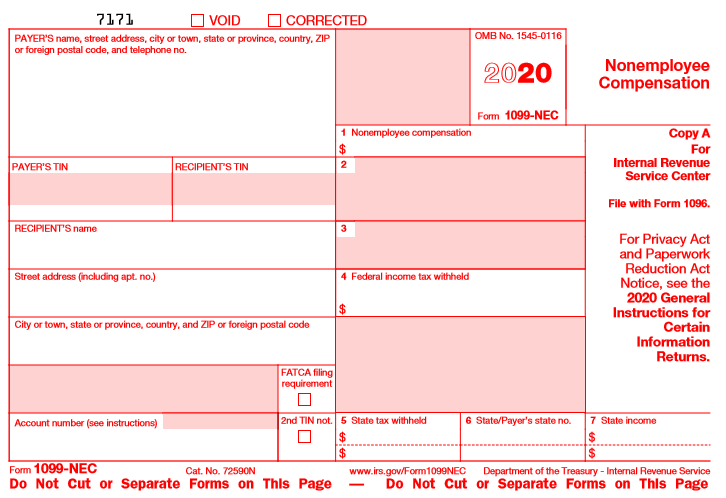

Form 1099 NEC is the Internal Revenue Service IRS form used by businesses to report payments made to independent contractors freelancers sole proprietors and self employed individuals The What is Form 1099 NEC Form 1099 NEC is part of the 1099 series of information returns Starting in 2020 the IRS requires business owners to report payments to non employees

what s 1099 nec

what s 1099 nec

https://www.efile4biz.com/images/difference_1099MISC_1099NEC.jpg

What Is Form 1099 NEC For Nonemployee Compensation

https://falconexpenses.com/blog/wp-content/uploads/2020/02/Form-1099-NEC-1024x803.jpg

What Is Form 1099 NEC And Who Needs To File 123PayStubs Blog

https://blog.123paystubs.com/wp-content/uploads/2021/01/Untitled-design-2021-01-22T122726.463-1024x576.png

Form 1099 NEC is used to report any compensation given to non employees by a company or for business purposes A non employee can be a freelancer Form 1099 NEC is a tax document that reports compensation paid by a business to someone who is not an employee It s a relatively new tax document having been reintroduced in 2020

Form 1099 NEC is a new form that businesses are required to file with the IRS annually to r eport nonemployee compensation NEC This means that if you ve made payments to individuals or companies for If you use Form 1099 NEC to report sales totaling 5 000 or more then you are required to file Form 1099 NEC with the IRS by January 31 You must also file Form 1099 NEC for each person from whom you have

More picture related to what s 1099 nec

1099 NEC Vs 1099 MISC FundsNet

https://fundsnetservices.com/wp-content/uploads/1099b.jpg

Form 1099 NEC Instructions And Tax Reporting Guide

https://www.efile4biz.com/images/1099-nec-overview-thumbnail.png

Track1099 1099 NEC Filing Track1099

https://www.track1099.com/images/1099NECform.png

Form 1099 NEC Nonemployee Compensation is a form that solely reports nonemployee compensation Form 1099 NEC is not a replacement for Form 1099 MISC Form 1099 NEC is only replacing the What is a 1099 NEC The 1099 NEC is the Internal Revenue Service IRS form to report nonemployee compensation that is pay from 1099 independent contractor jobs also sometimes referred to as self

If you were self employed in 2020 you may have received Form 1099 NEC Nonemployee Compensation instead of Form 1099 MISC you may have received in years past Why the change In short the Q What is Form 1099 NEC Jenna LeeBusiness finance writer Bookmark Run payroll and benefits with Gusto How it works If you pay independent contractors for

What The Heck Is Form 1099 NEC

https://activerain-store.s3.amazonaws.com/blog_entries/140/5604140/original/Form_1099-NEC.png?1608589867

What You Need To Know About Form 1099 NEC Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/629e4fdfa46cf8270dba4e9d_hero-What You Need To Know About IRS Form 1099-NEC.jpg

what s 1099 nec - Form 1099 NEC is a new form that businesses are required to file with the IRS annually to r eport nonemployee compensation NEC This means that if you ve made payments to individuals or companies for