what is xvii b income tax All sums deducted in accordance with the provisions of Chapter XVII B by an office of the Government shall be paid to the credit of the Central Government a on the same day

Chapter xvii b of the income tax act 1961 collection and recovery of tax deduction at source clarification regarding tds under chapter xvii b on service tax component comprised of This article aims at addressing the amendments pertaining to rationalization of the provisions of sections 271AAB 271AAC and 271AAD of the Income tax Act 1961 Act

what is xvii b income tax

what is xvii b income tax

https://www.viralbake.com/wp-content/uploads/Income-Tax-1-1.jpg

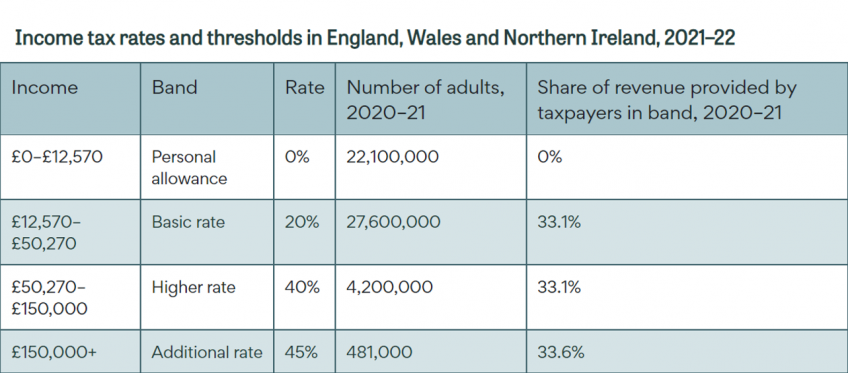

Income Tax Explained IFS Taxlab

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates and thresholds in England%2C Wales and Northern Ireland%2C 2021–22_0.png?itok=sAe2JxBC

Basic Concepts Of Income Tax MCQ 50 Free MCQs ScholarsZilla

https://scholarsclasses.com/blog/wp-content/uploads/2021/11/Basic-Concepts-of-Income-Tax-MCQ.jpg

2 Section 195 is contained in Chapter XVII B of the Income tax Act 1961 the Act which deals with deduction of tax at source 2 This chapter defines the methodology of payment of tax by Section 194Q Deduction of tax at source on payment of certain sum for purchase of goods Section 194R Deduction of tax on benefit or perquisite in respect of business or profession

This article is covering TDS compliance in Tax Audit Report i e 3D Report Applicability of Tax Audit TDS clauses under Form 3CD and its in depth analysis alongwith rate chart of TDS are covered in this article TDS means Tax Deducted at Source Collection of tax at the source from where an individual s income has originated The government practices TDS as an instrument to collect tax to minimize tax evasion by

More picture related to what is xvii b income tax

How To Check Income Tax Number Malaysia Jennifer Newman

https://global-uploads.webflow.com/5f783aea952b4abda8b9ff7e/60636aec79daefe7345c14ec_deductions-tax-relief.png

Income Tax Refunds Of Rs 1 71 Lakh Crore Released Till 14th Feb Daily

https://cdndailyexcelsior.b-cdn.net/wp-content/uploads/2022/02/Income-Tax.jpg

Top 3 Percent Of Tax Filers Pay 51 Percent Of Individual Income Taxes

https://fw-d7-freedomworks-org.s3.amazonaws.com/field/image/Taxes.jpeg

Law relating to Tax Collected at Source TCS is contained in chapter XVII BB of the Income tax Act 1961 in section 206C SECTION 206C 1 Sale of Alcohol Tendu Leaves Timber Any person paying interest or any other sum to a non resident is not liable to deduct tax if such sum is not chargeable to tax under the provisions of Income Tax Act

108 rowsWhether the assessee is required to deduct or collect tax as per the provisions of Chapter XVII B or Chapter XVII BB if yes please furnish details These sections broadly The Income Tax Act 1961 is the set of rules and regulations upon which the Income Tax Department levies administers collects and recovers taxes It contains 298

Ace Research And Development Income Statement We Charity Audited

https://i.pinimg.com/originals/85/bf/fc/85bffcbce80cbd8892e4ccf05fedeb48.jpg

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Astounding Gallery Of Eic Tax Table Concept Turtaras

https://www.thebalance.com/thmb/z7-q8IDYw8VYYtC0clAkfdpi_aE=/1428x786/filters:no_upscale():max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg

what is xvii b income tax - Section 194Q Deduction of tax at source on payment of certain sum for purchase of goods Section 194R Deduction of tax on benefit or perquisite in respect of business or profession