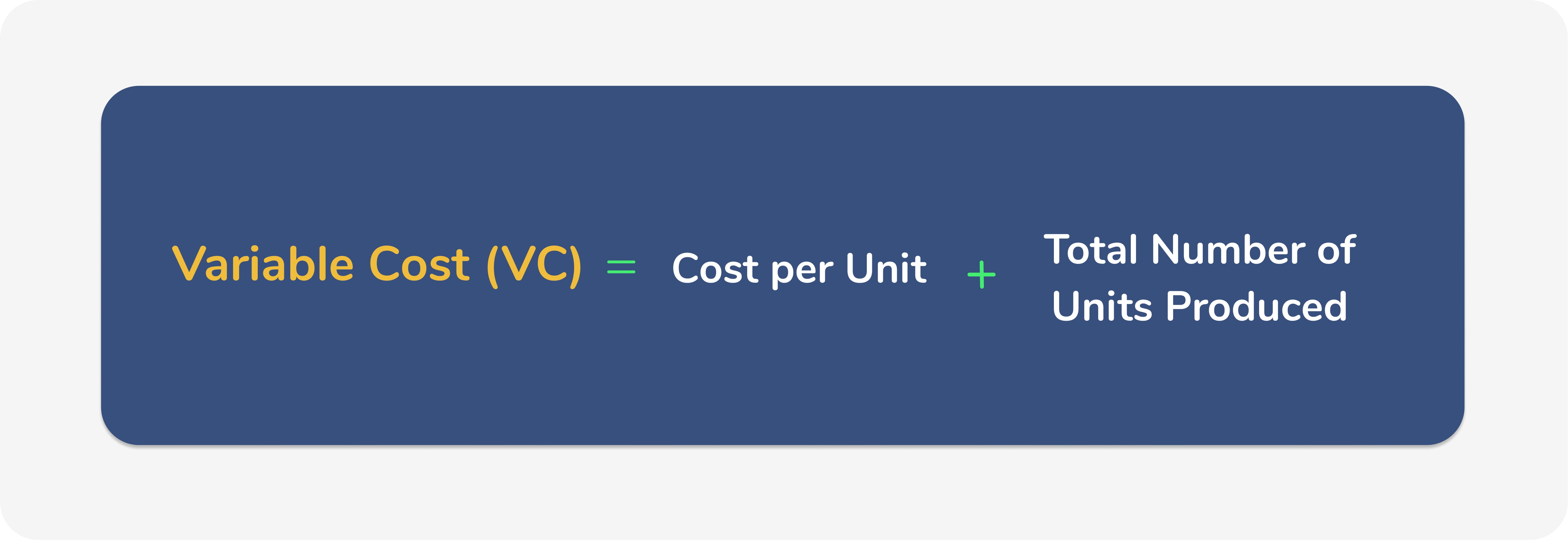

what is variable cost per unit with example What are Variable Costs Variable costs are expenses that vary in proportion to the volume of goods or services that a business produces In other words they are costs that vary depending on the volume of activity The costs increase as the volume of activities increases and decrease as the volume of activities decreases

Definition Variable cost per unit is the production cost for each unit produced that is affected by changes in a firm s output or activity level Unlike fixed costs these costs vary when production levels increase or decrease Examples of variable costs include a manufacturing company s costs of raw materials and packaging or a retail company s credit card transaction fees or shipping

what is variable cost per unit with example

what is variable cost per unit with example

https://wise.com/imaginary/d7675ef64e7aeccfb95497b86361d3e1.jpg

How To Calculate Average Unit Cost Haiper

https://www.double-entry-bookkeeping.com/wp-content/uploads/variable-cost-per-unit.png

Variable Cost Definition Formula And Calculation Wise

https://wise.com/imaginary/bd717450864ae90a2dc39294ba5e53b5.jpg

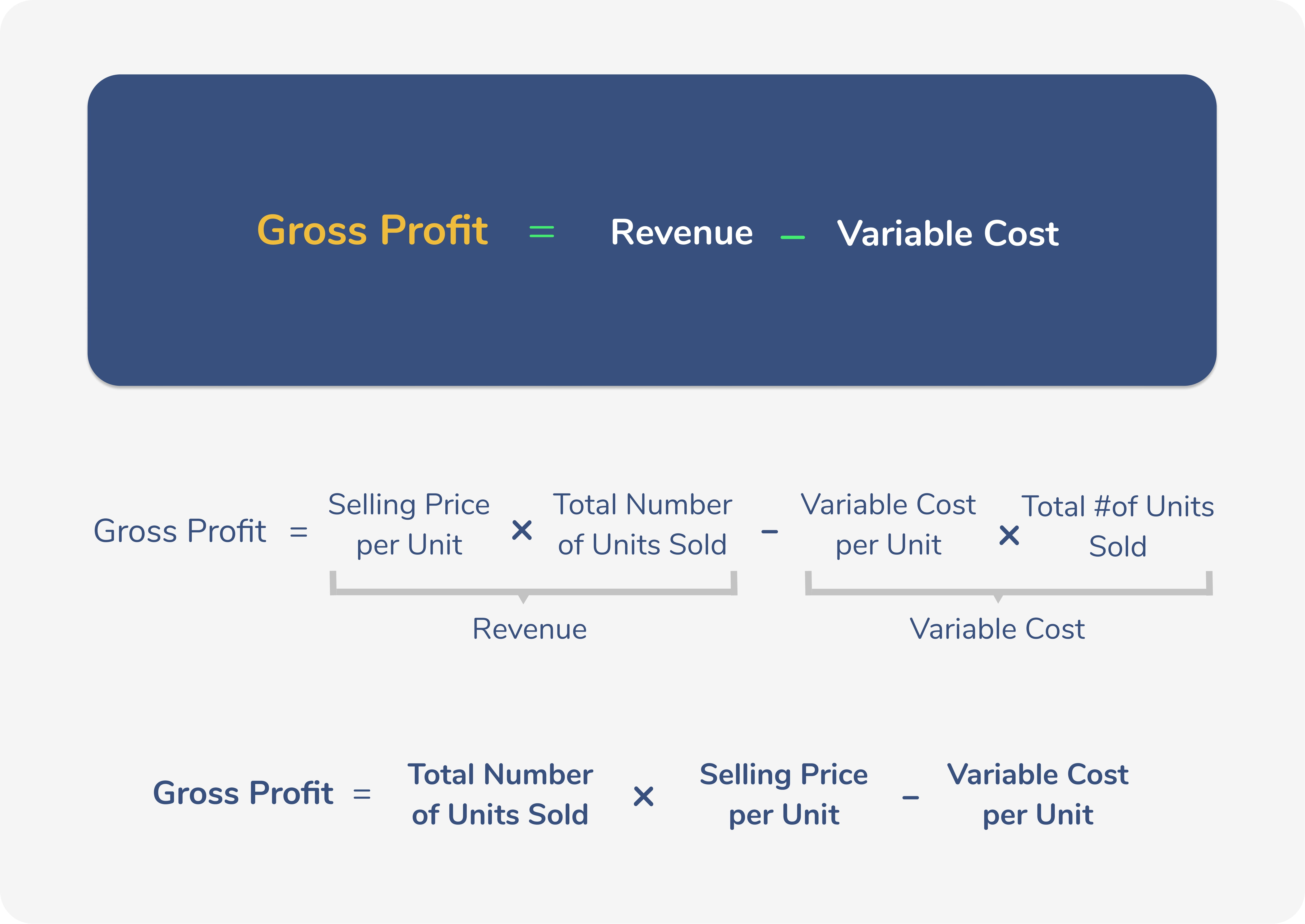

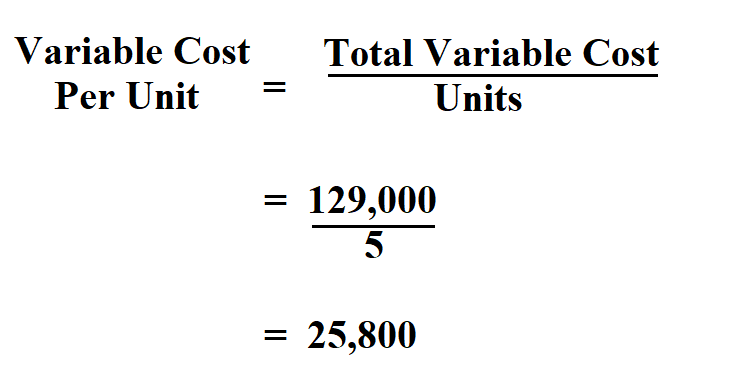

Variable costs are the costs incurred to create or deliver each unit of output So by definition they change according to the number of goods or services a business produces If the company produces more the cost increases proportionally For example Uber pays a driver for every ride they complete The average variable cost or variable cost per unit equals the total variable costs incurred by a company divided by the total output i e the number of units produced

Factors like production volume cost per unit and economies of scale influence variable costs impacting profitability By understanding variable costs businesses can conduct cost volume profit analysis optimize pricing strategies and allocate resources efficiently What Is A Variable Cost Variable costs are the expenses that a business incurs and that vary based on the amount of goods and services it produces These costs are also known as unit level costs It is the opposite of a fixed cost which remains constant regardless of a change in production volume

More picture related to what is variable cost per unit with example

How To Calculate Variable Cost Guide Examples And Extra Tips

https://cdn2.avada.io/media/resources/YBZeMDZ.jpg

Variable Costing Formula Calculator Excel Template

https://www.educba.com/academy/wp-content/uploads/2019/01/Variable-Cost-Per-Unit-Example-1-2.png

How To Calculate Variable Cost Of Sales Haiper

https://www.educba.com/academy/wp-content/uploads/2019/01/Variable-Cost-Per-Unit-Example-1-3.png

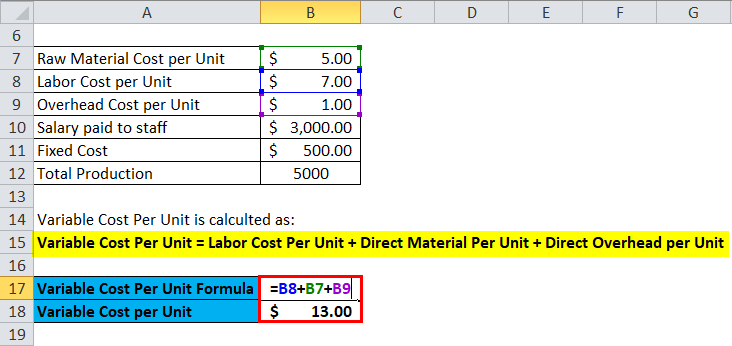

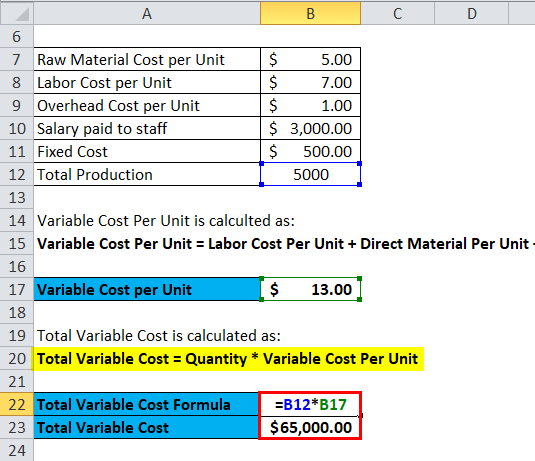

The variable cost per unit is calculated by dividing the total variable costs of the business by the number of units Variable Cost Per Unit Example To illustrate suppose a business has costs which are classified as shown below Direct Labor 40 000 variable Utilities 22 000 80 variable Materials 35 000 variable What is a variable cost A variable cost is the price of raw materials labor and distribution associated with each unit of product or service you sell That unit could be a Warren Buffet bobblehead or an hour of aromatherapy counselling Whatever you pay to create each unit falls under the heading of variable cost

Variable cost per unit refers to the total cost of producing a single unit of your business product It encompasses all necessary resources including labor materials marketing and anything else needed to sell the product What is a Variable Cost A Variable Cost is a corporate expense that changes in proportion with activity i e production levels or sales volume The opposite of that would be a Fixed Cost one that doesn t directly change with production or sales such as rent insurance utilities Some examples of common variable costs are Raw

How To Calculate Variable Cost Per Unit

https://www.learntocalculate.com/wp-content/uploads/2020/05/variable-cost-per-unit.-2.png

Variable Cost Explained In 200 Words How To Calculate It

https://blog.hubspot.com/hubfs/image-png-Jun-14-2021-02-37-23-12-PM.png

what is variable cost per unit with example - Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the product cost of production The method contrasts with absorption costing in which the fixed manufacturing overhead is allocated to products produced