what is the purpose of the lower of cost or market method The lower of cost or market LCM rule is an accounting principle that requires businesses to write down the value of inventory on their balance sheets if the inventory s current market value is lower than its

The Lower of Cost or Market LCM Theory is an accounting model that states when determining the value of a product for financial reporting purposes it should be recorded at either cost or market price whichever is The lower of cost or market rule states that a business must record the cost of inventory at whichever cost is lower the original cost or its current market price This

what is the purpose of the lower of cost or market method

what is the purpose of the lower of cost or market method

https://i.ytimg.com/vi/6-yAWwhfenA/maxresdefault.jpg

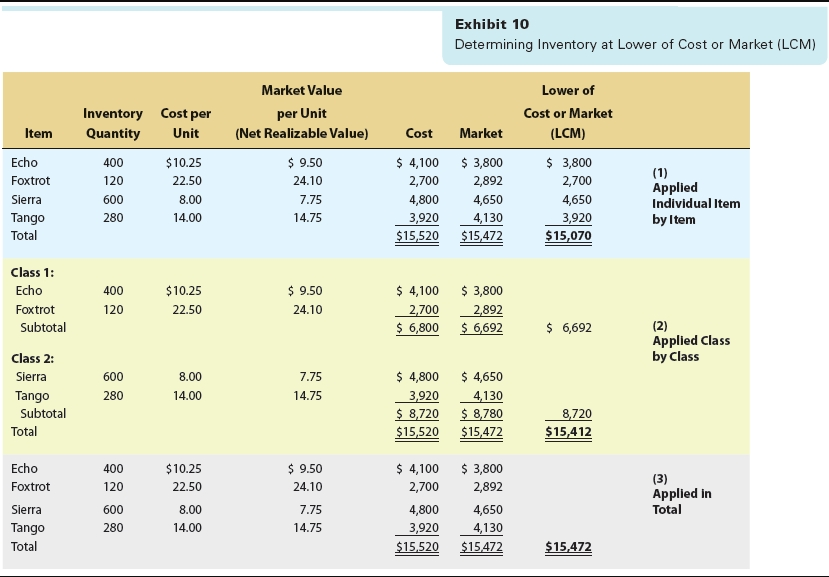

Accounting For Inventories Lower Of Cost Or Market Example YouTube

https://i.ytimg.com/vi/0voKzqtiP_s/maxresdefault.jpg

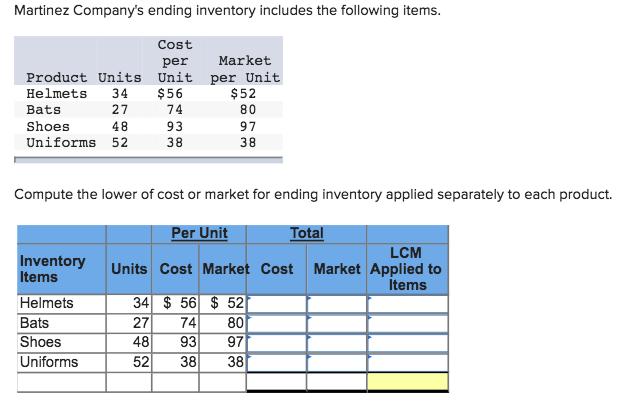

Solved Compute The Lower Of Cost Or Market For Ending Chegg

https://media.cheggcdn.com/media/5cc/5cc8d42c-90cb-4912-9e7e-c48e0495994f/phppoV4N1.png

Lower cost or market LCM is the conservative way through which the inventories are reported in the books of accounts which states that the inventory at the end of the reporting period is to be recorded at the original Definition Lower of cost or market often abbreviated LCM is an accounting method for valuing inventory It assigns a value to inventory at the lesser of the market replacement cost or the

What is the Lower of Cost or Market Method The lower of cost or market method refers to an inventory costing approach that values a company s stock on the balance sheet either at The lower of cost or market LCM is a term used to refer to the method by which inventory is valued and shown in the balance sheet of a business

More picture related to what is the purpose of the lower of cost or market method

Lower of Cost or Market Rule Financial Statements Marketing

https://i.pinimg.com/originals/10/d7/76/10d776641a3222c368bdfc3fd79bf31d.jpg

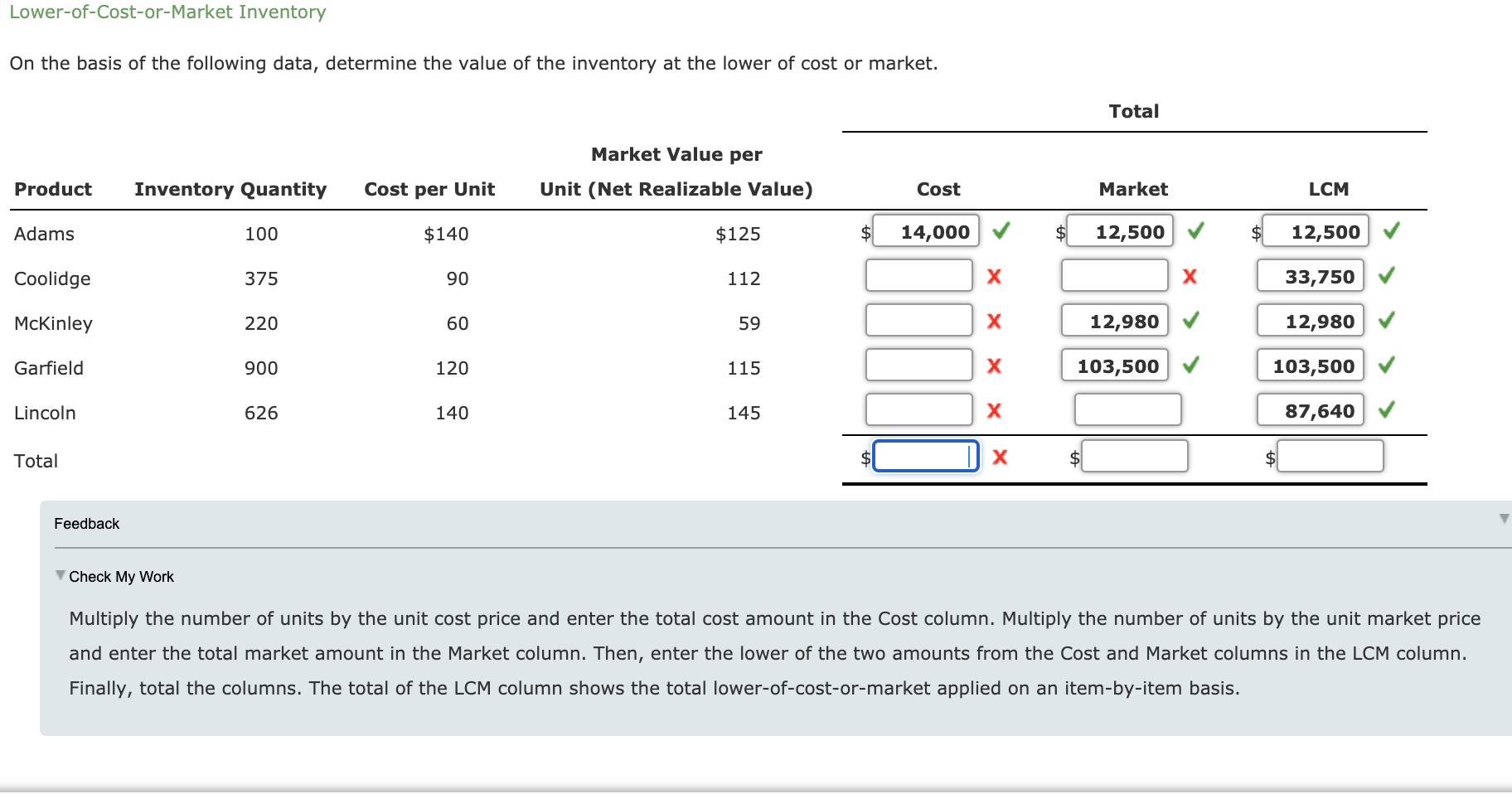

Solved On The Basis Of The Following Data Determine The Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/71b/71bb6fc2-c392-4ffc-beeb-cfa74583eadc/phpQeNMhu.png

Solved Lower of Cost or Market Inventory On The Basis Of The Chegg

https://media.cheggcdn.com/media/4af/4af33a61-f7aa-4b9e-98b2-1e9a23941737/phpQUIJg2

The lower of cost or market LCM method lets companies record losses by writing down the value of the affected inventory items The amount by which the inventory item was written down is recorded under cost In accounting lower of cost or market LCM or LOCOM is a conservative approach to valuing and reporting inventory Normally ending inventory is stated at historical cost However there

The lower Cost or Market method is useful for properly recording inventory USGAAP follows the method and helps to portray a true picture to the stakeholders Proper The purpose of the lower of cost or market method is to recognize a decline in value of inventory in the period it occurs Cost in the lower of cost or market formula is the original

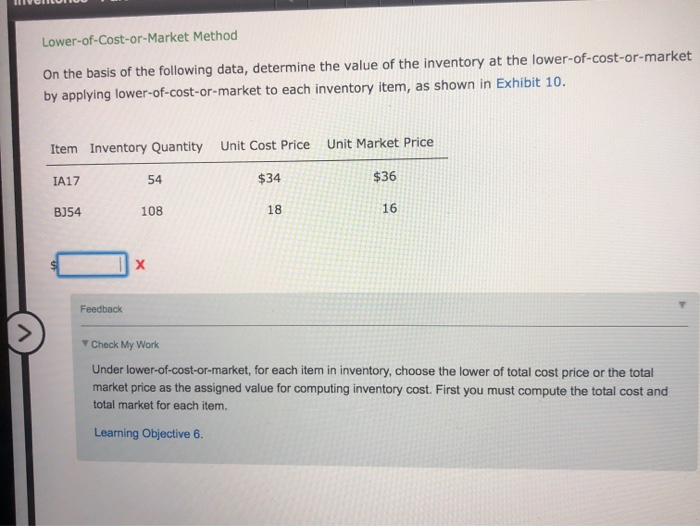

Solved Lower of Cost or Market Method On The Basis Of The Chegg

https://media.cheggcdn.com/media/c55/c554bbeb-0d16-4bab-8452-78ef04d65bad/phpy5ckVN

Solved Lower of Cost or Market Method On The Basis Of The Chegg

https://media.cheggcdn.com/media/c6e/c6e8f62c-d8a8-45d7-aaf3-db97a07d37ef/image.png

what is the purpose of the lower of cost or market method - Lower cost or market LCM is the conservative way through which the inventories are reported in the books of accounts which states that the inventory at the end of the reporting period is to be recorded at the original