what is the highest legal interest rate on a payday loan Andrew Cook 4 years ago Imagine instead that a lender charged Sal 25 interest on a 1 year loan instead of a 2 week loan To find the APR we d take 1 25 1 which would be 1 25 If we didn t subtract 1 we would incorrectly conclude the APR is 125 The correct APR is 1 25 1 0 25 or 25

Updated January 14 2021 Reviewed by Eric Estevez What Is the Legal Rate of Interest The legal rate of interest is the highest rate of interest that can be legally charged on any type of Compare payday loan interest rates of 391 600 with the average rate for alternative choices like credit cards 15 30 debt management programs 8 10 personal loans 14 35 and online lending 10 35 Should payday loans even be considered an option Some states have cracked down on high interest rates to some

what is the highest legal interest rate on a payday loan

what is the highest legal interest rate on a payday loan

https://www.infocomm.ky/wp-content/uploads/2020/09/1600289544.jpeg

What Is The Maximum Interest Rate Chargeable In Ontario

https://www.hoyes.com/wp-content/uploads/2015/09/payday-loan-interest-rates-2.jpeg

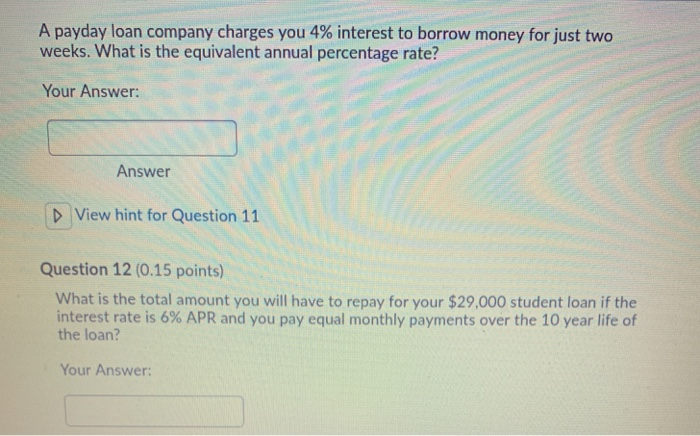

Solved A Payday Loan Company Charges You 4 Interest To Chegg

https://media.cheggcdn.com/study/aa7/aa7c42e7-2fcd-4612-8425-2757db39b10b/image.png

Texas has the highest payday loan rates in the U S The typical APR for a loan 664 is more than 40 times the average credit card interest rate of 16 12 A payday loan is a high cost short term loan for a small amount typically 500 or less that s meant to be repaid with the borrower s next paycheck Payday loans require only proof of

Espa ol Payday loans generally charge a percentage or dollar amount per 100 borrowed The amount of this fee might range from 10 to 30 for every 100 borrowed depending on your state law and the maximum amount your state permits you to borrow A fee of 15 per 100 is common KEY POINTS Payday loans are short term loans tendered at very high interest rates to borrowers As of 2022 data payday loan interest rates ranged from 28 to 1 950 compared

More picture related to what is the highest legal interest rate on a payday loan

This Map Shows The States With The Highest Payday Loan Rates

https://fm.cnbc.com/applications/cnbc.com/resources/img/editorial/2018/08/01/105368584-1533144099771paydayloaninterest.1910x1000.jpg

Payday Loans For Bad Credit Direct Lender Payday Loans Online Payday

https://i.pinimg.com/originals/71/af/e6/71afe6cedbfc623b36782d6683b8c14c.jpg

Best Payday Loans Online In 2020 Payday Best Payday Loans Payday

https://i.pinimg.com/originals/74/ac/37/74ac37f6707c44798013d17ed9820655.png

Payday loans tend to have small loan limits usually up to 500 and don t require a credit check Legal Services often due to high interest rates and fees These loans often need to be A typical two week payday loan with a 15 per 100 fee equates to an annual percentage rate APR of almost 400 percent By comparison APRs on credit cards can range from about 12 percent to about 30 percent In many states that permit payday lending the cost of the loan fees and the maximum loan amount are capped

A high interest loan is one with an annual percentage rate above 36 that can be tough to repay You may have cheaper options The findings captured in this interactive table show the level of consumer safeguards in place the most common payday loan product type average annual percentage rate charged and average cost to borrow 500 for four months

What Is A Good Interest Rate On A Credit Card

https://m.foolcdn.com/media/affiliates/images/Higher_interest_rates_ahead_sign.2e16d0ba.fill-4096x2048.jpg

How To Calculate The Interest Rate On A Loan Northstar

https://northstarbrokers.ca/wp-content/uploads/2021/01/percent-980x735.jpg

what is the highest legal interest rate on a payday loan - Payday lenders charge a fee per every 100 borrowed with 15 per every 100 being a common amount While that might not sound like much if you do the math that adds up to an annual interest