what is the federal tax rate for 18000 In 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income

The federal income tax system is progressive so the rate of taxation increases as income increases Marginal tax rates range from 10 to 37 Enter your financial details to calculate your taxes The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37

what is the federal tax rate for 18000

what is the federal tax rate for 18000

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

California Individual Tax Rate Table 2021 20 Brokeasshome

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

Which Matters Most Tax Rates Or Tax Brackets Retirement Income

https://www.smartfinancialplanning.com/wp-content/uploads/2017/05/Tax-History1.png

8 rowsUse our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax

Last updated March 28 2024 Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net This income tax calculation for an individual earning a 18 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare

More picture related to what is the federal tax rate for 18000

Data Driven Viewpoints A 99 YEAR HISTORY OF TAX RATES IN AMERICA

https://2.bp.blogspot.com/-NbAzw1SjuCk/TpO1gyZIJ9I/AAAAAAAAACU/q9Qhy04L1H8/s1600/Federal+Tax+Rates.jpg

2022 Tax Brackets Lashell Ahern

https://www.kitces.com/wp-content/uploads/2021/09/01-Ordinary-Income-Tax-Rates-Under-The-Proposed-Legislation-1.png

Annual Federal Withholding Calculator KerstinKeisha

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Edited by Patrick Villanova CEPF The federal income tax rates remain unchanged for the 2023 tax year at 10 12 22 24 32 35 and 37 The income thresholds for each bracket though Here are the 2023 Federal tax brackets Remember these aren t the amounts you file for your tax return but rather the amount of tax you re going to pay starting January 1 2023 to December 31 2023

Tax rates and brackets There are seven federal income tax rates 10 12 22 24 32 35 and 37 Your taxable income and filing status determine which tax brackets How much Federal Tax should I pay on 180 000 00 You will pay 32 738 50 in Federal Tax on a 180 000 00 salary in 2024 How did we calculate Federal Tax paid on

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

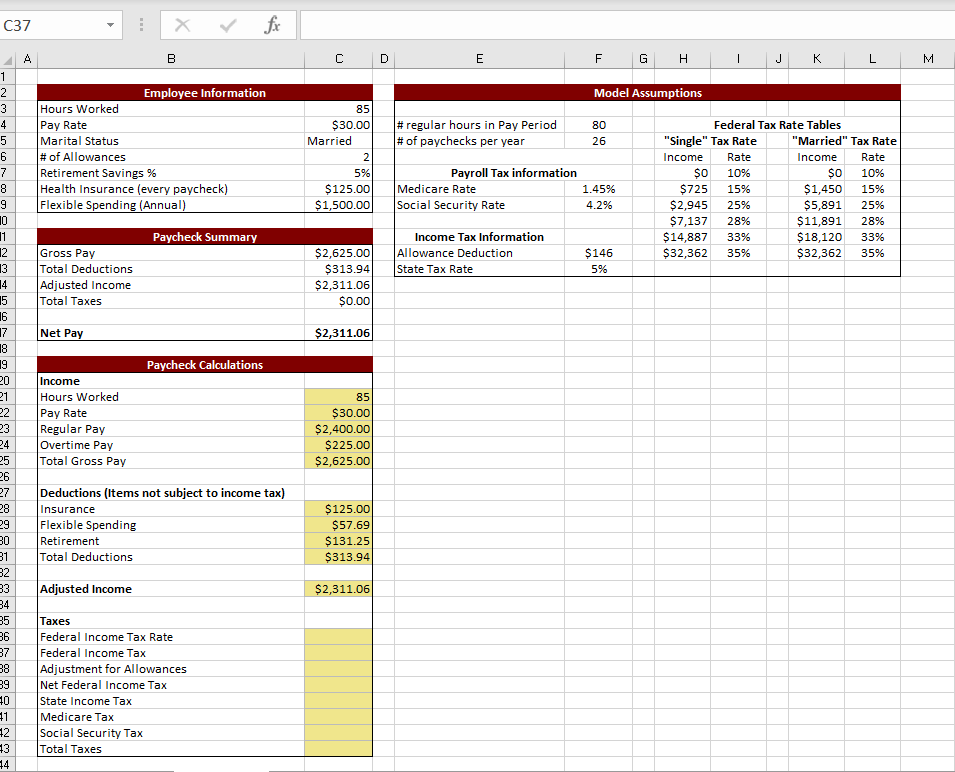

Use An IF Function To Calculate The Federal Income Chegg

https://media.cheggcdn.com/media/1eb/1eb07fb7-1dc4-42db-9969-aefa484d4ccc/phpvU0yyL

what is the federal tax rate for 18000 - Last updated March 28 2024 Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net