what is the difference between 1120s and 1120 c 1120 vs 1120 S What Are the Differences Both Form 1120 and Form 1120 S report required tax information for a specific type of business entity Because Form 1120 calculates a C Corp s tax liability any amount

This guide explains the differences between an S corp vs a C Corp the pros and cons of each of these entity types and how you can decide which is right for your business If the LLC is a corporation normal corporate tax rules will apply to the LLC and it should file a Form 1120 U S Corporation Income Tax Return The 1120 is the C corporation income tax

what is the difference between 1120s and 1120 c

what is the difference between 1120s and 1120 c

https://cdn.startupsavant.com/images/how-to-guides/s-corp/screenshot-1120s.jpg

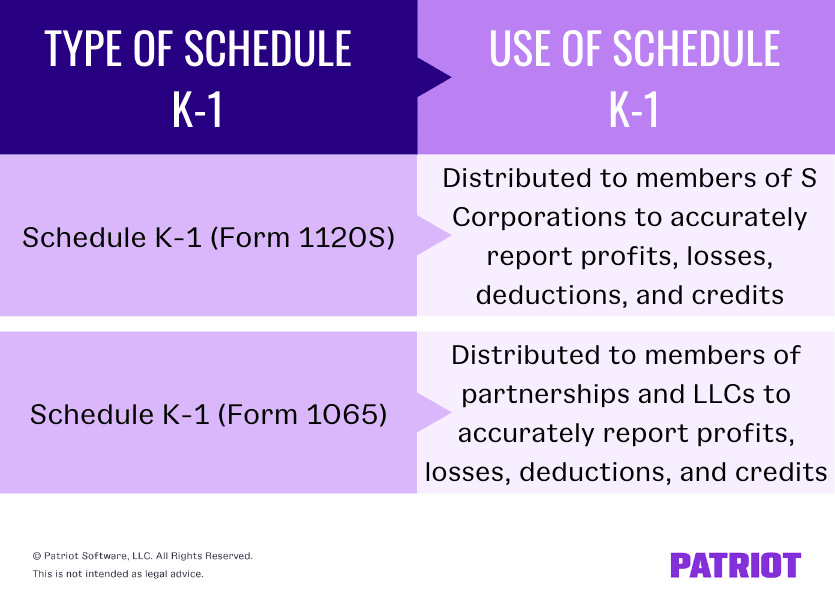

What Is Schedule K Form For Partners And Shareholders

https://www.patriotsoftware.com/wp-content/uploads/2021/08/Schedule-K-2.png

Key Differences Between Form 1120 H And 1120 DocHub

https://dochub.com/fifaplanet/mqNjP3BVWXy0vNw9yGzLkp/key-differences-between-form-1120-h-and-1120.jpg

Put simply Form 1120 S is considered the tax return of an S corporation The form must be filed by the 15th day of the 3rd month after the corporation s tax year Key Takeaways Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations

What s the Difference Between Form 1120 vs Form 1120 S Form 1120 is the US corporate income tax return for C corporations Form 1120 S on the other hand is the US income tax return for S corporations Information about Form 1120 C U S Income Tax Return for Cooperative Associations including recent updates related forms and instructions on how to file Corporations operating on a

More picture related to what is the difference between 1120s and 1120 c

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

Difference Between All Federal Tax Forms LoanBeam

https://hf-files-oregon.s3.amazonaws.com/hdpnylxsupport_kb_attachments/2022/04-26/a0b9c78f-bc8d-476c-b0a3-12ca16e0874d/image-20220426112019-7.png

I Need Help With Schedule K 1 Form 1120 S For John Parsons And

https://www.coursehero.com/qa/attachment/20108940/

Corporations use IRS Form 1120 to file their taxes S corporations use IRS Form 1120 S Profits and losses are passed through to the shareholders personal tax returns Form 1120S Depending on the number of members and elections made may file Schedule C Form 1065 Form 1120S or Form 1120 Owner salaries Owners are considered employees of

How does IRS Form 1120 differ from Form 1120S IRS Form 1120 is for regular C Corporations while Form 1120S is specifically for S Corporations The main difference between the two forms lies in their tax treatment Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax

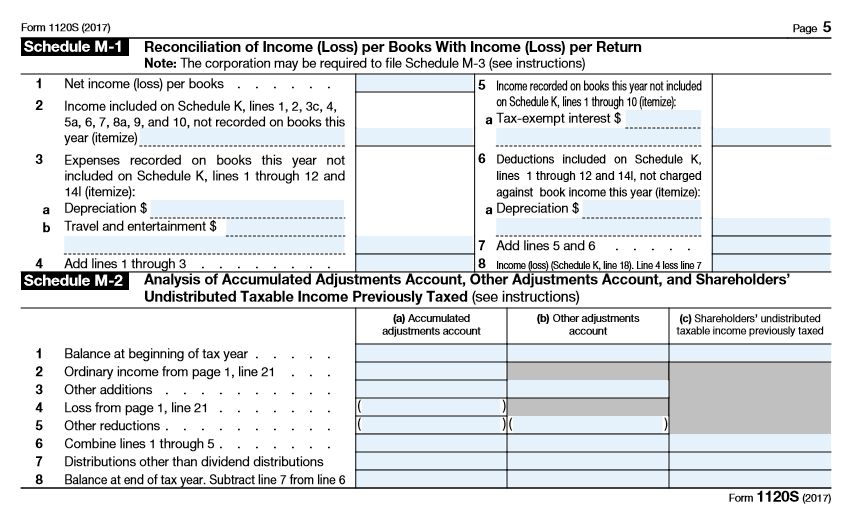

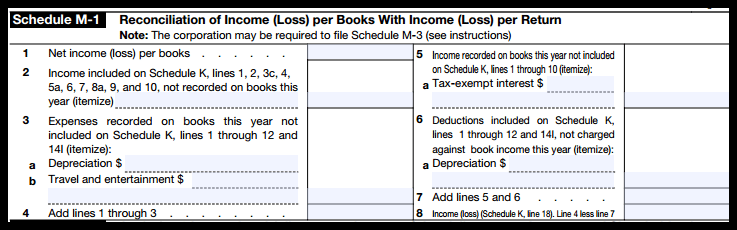

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

How To Complete Form 1120S Income Tax Return For An S Corp

http://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Reconciliation-of-Income-Loss-per-Books-with-Income-Loss-per-Return-Schedule-M-1.png

what is the difference between 1120s and 1120 c - What s the Difference Between Form 1120 vs Form 1120 S Form 1120 is the US corporate income tax return for C corporations Form 1120 S on the other hand is the US income tax return for S corporations