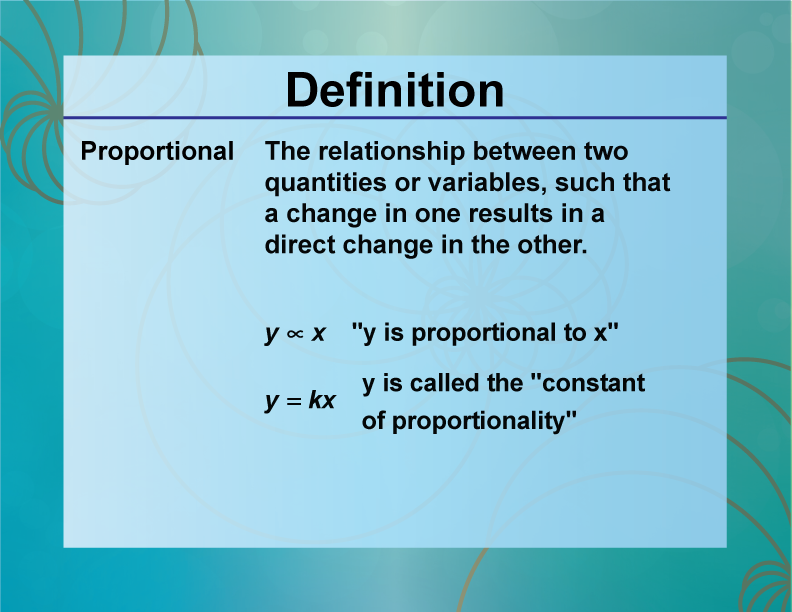

what is the definition of proportional tax A proportional tax is a type of tax where the tax rate is the same for all income levels It is a flat tax where everyone pays the same percentage of their income Proportional taxes are often used with other types of taxes such as sales property or income to generate government revenue

A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases The amount of the tax is in proportion to the amount subject to taxation 1 What is Proportional Tax A proportional tax is a single rated tax wherein all the incomes without considering the slabs or other criteria tax is levied at a flat fixed rate irrespective of the kind of person or kind of income thus eliminating the concept of higher and lower earnings

what is the definition of proportional tax

what is the definition of proportional tax

https://cdn.educba.com/academy/wp-content/uploads/2021/04/Proportional-Tax-768x427.jpg

Proportional Tax FundsNet

https://fundsnetservices.com/wp-content/uploads/what-is-proportional-tax-700x392.png

Proportional Tax Definition Effects Pros Cons How It Works

https://www.financestrategists.com/uploads/Advantages_and_Disadvantages_of_Proportional_Tax.png

Proportional tax also referred to as proportional taxation is a type of income tax in which all people share the same tax burden regardless of any outside factors such as their income A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases The amount of the tax is in proportion to the amount subject to taxation

A proportional or flat tax system assesses the same tax rate for everyone regardless of income or wealth This system is meant to create equality between marginal tax rates A proportional tax is a type of tax in which the tax rate remains constant and does not change with the increase in income of the taxpayer In a proportional tax system all individuals pay the same tax rate regardless of their income level

More picture related to what is the definition of proportional tax

Proportional Representation Of Diverse Populations

https://static.wixstatic.com/media/3bc2c3_8464e74a040f471e93ad1d35c73e9327~mv2.png/v1/fill/w_1000,h_511,al_c,q_90,usm_0.66_1.00_0.01/3bc2c3_8464e74a040f471e93ad1d35c73e9327~mv2.png

Disadvantages Of Proportional Tax PROPORTIONAL TAX Definition And

https://static.javatpoint.com/blog/images/advantages-and-disadvantages-of-sole-proprietorship.png

Definition Ratios Proportions And Percents Concepts Proportional

https://www.media4math.com/sites/default/files/library_asset/images/Definition--RatiosProportionsPercents--Proportional.png

Definition A proportional tax also called a flat tax is an income taxation system where every taxpayer is subject to the same tax rate regardless of income level or status A proportional tax is a type of tax that is applied uniformly to all taxpayers regardless of their income level That means the tax rate is the same for everyone and does not change with the amount of income This type of

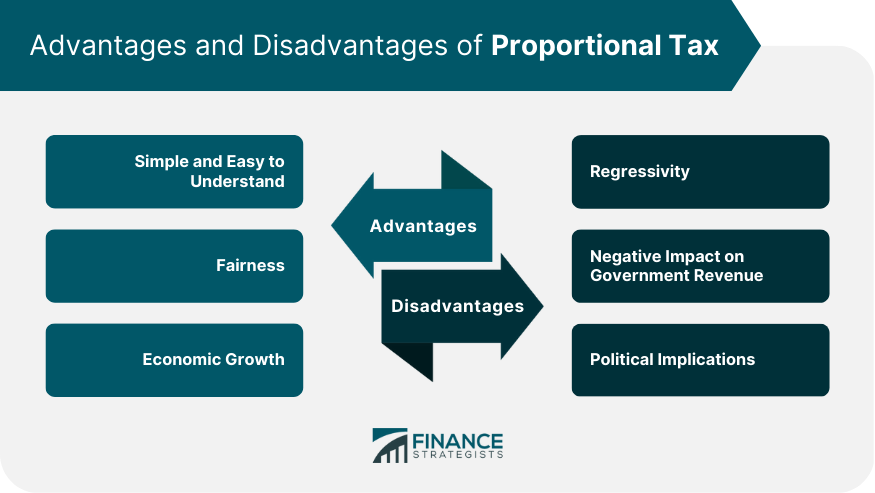

A proportional or flat tax is a system in which taxpayers all pay the same percentage of their income in taxes This applies regardless of what their income level is and whether they fall into the upper middle or lower class A proportional tax often referred to as a flat tax is a tax system that applies the same tax rate to all income levels This article delves into the intricacies of proportional taxation its advantages and disadvantages and how it compares to progressive tax systems

Proportional Tax Wealth How

https://pixfeeds.com/images/1/100985/1200-480353834-tax-concept.jpg

What Is Progressive Tax Definition And Meaning Market Business News

https://i0.wp.com/marketbusinessnews.com/wp-content/uploads/2017/02/Proportional-Tax.jpg?fit=603%2C677&ssl=1

what is the definition of proportional tax - A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases The amount of the tax is in proportion to the amount subject to taxation